In general the IRS notes that it issues most refunds within 21 days of receiving your tax filing forms. But that deadline was pushed back in March to Wednesday July 15.

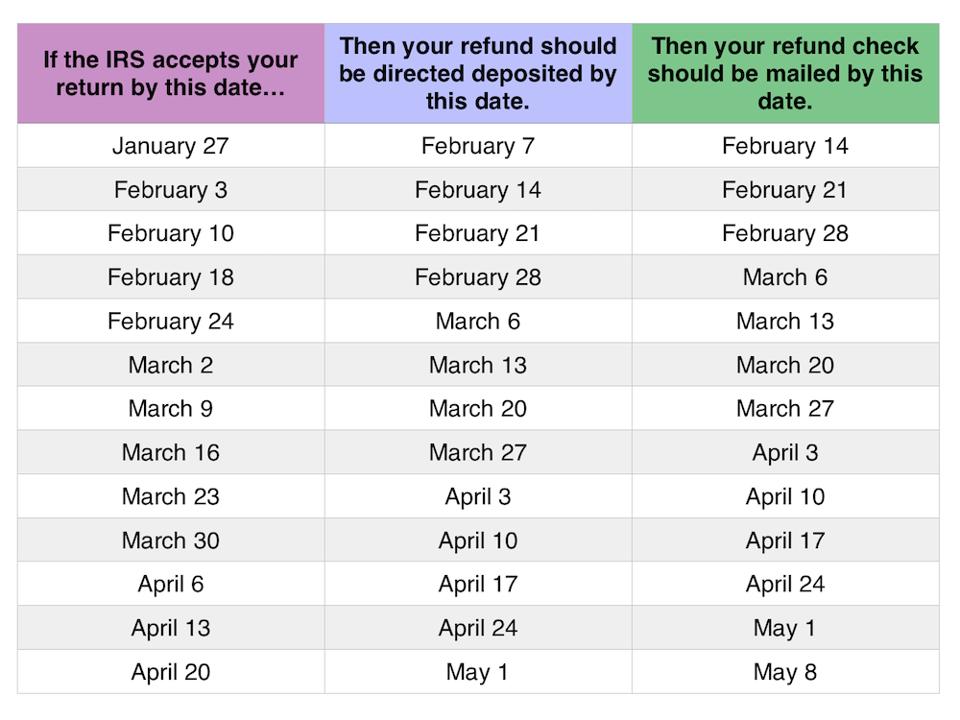

2020 Tax Refund Chart Can Help You Guess When You Ll Receive Your Money

2020 Tax Refund Chart Can Help You Guess When You Ll Receive Your Money

Most tax refunds associated with e-filed returns are issued within 21 days.

Estimated tax return date. Taxes must be paid as taxpayers earn or receive income during the year either through withholding or estimated tax payments. Extended due dates for furnishing 2020 Forms 1095-B and 1095-C. Taxes must be paid as taxpayers earn or receive income during the year either through withholding or.

At first the deadline for filing your taxes was Wednesday April 15. Enter the actual or estimated IRS tax return acceptance date - the acceptance date is the date the IRS acknowledged your. If youre self-employed or have other income that requires you to pay quarterly estimated taxes get your Form 1040-ES postmarked by this date.

The due dates for providing certain information returns related to health insurance coverage has been extended. The IRS officially opened the 2020 income tax season on Monday January 27 when it started accepting tax returns. The due date for providing the 2020 Form 1095-B and 2020 Form 1095-C has been extended from February 1 2021 to March 2 2021.

Lets get started with the DATEucator tool below. The IRS has announced that the 2021 tax filing season will start on February 12 2021. These payments are still due on April 15.

Anzeige Trust The Experts At HR Block To Guide You Step By Step Through Your Expat Taxes. They will provide an actual refund date as soon as the IRS processes your tax return and approves your refund. Estimated tax payments for the 2020 tax year IRS Form 1040.

Estimated Taxes Due April 15 While the deadlines to file and pay certain taxes have been extended to May 17 the first quarter estimated tax payments for individuals are still due on April 15. Get A 100 Accuracy Guarantee With HR Block for your US. Individual tax returns due for tax.

Call the IRS at 800-829-1954 The tool will get you personalized refund information based on the processing of your tax return. 11 2021 and up to June 15 2021 can now be paid on or before June 15 2021. Anzeige Trust The Experts At HR Block To Guide You Step By Step Through Your Expat Taxes.

This relief does not apply to estimated tax payments that are due on April 15 2021. Heres When You Can Look Forward to Your 2020 Tax Refund The Internal Revenue Service began accepting returns on Monday January 27. These payments are still due on April 15.

Learn who must pay make estimated taxes how to determine your tax payments and when to make them. Well it depends on when and how you file your taxes. For 2020 these were due on July 15 and Sept.

The IRS has announced that the 2021 tax filing season will start on February 12 2021. Most refunds will be issued in less than 21 days. Estimated tax payments due on or after Feb.

Get A 100 Accuracy Guarantee With HR Block for your US. Estimated tax payment due April 15 Notice 2021-21 issued today does not alter the April 15 2021 deadline for estimated tax payments. Select or click your preferred tax refund transfer method.

4 The 2020 federal tax.