21819 Marine View Dr S. 1206 PM PDT April 20 2020.

Wa Gov Inslee S New Healthy Washington Reopening Plan The Olympian

800 AM - 500 PM Monday - Friday Closed Weekends State Holidays.

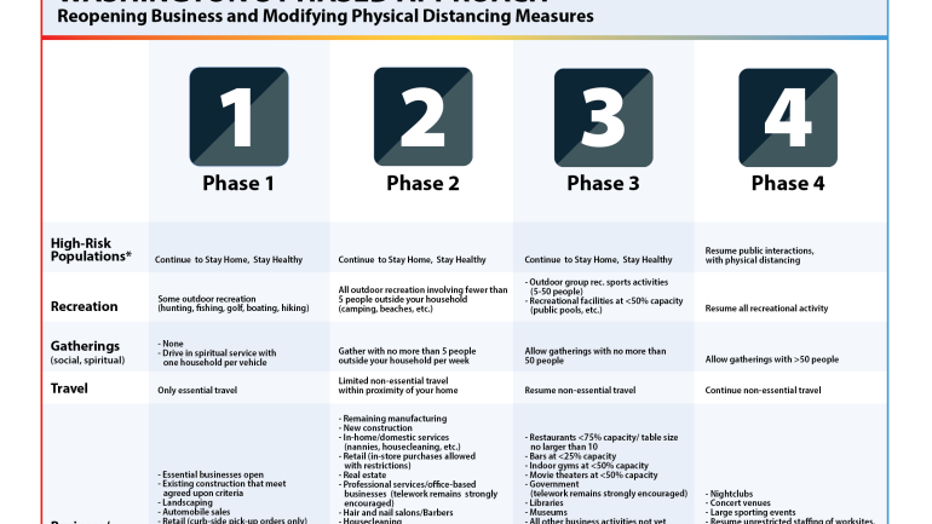

When do gyms open in washington state. It closes indoor activities at restaurants bars dance halls clubs theaters health and fitness clubs and other similar indoor social or recreational venues until March 31. 10 instead of the current requirement of six feet of distance between patrons gyms and facilities in counties in Phase 2 and 3 of the states COVID-19 economic reopening plan. As early as May 1 churches and retail stores could open with some restrictions.

The orders come. 655 PM PDT April 27 2020. On March 11 2021 Gov.

WASHINGTON Gyms will be closing across the state of Washington by the direction of Governor Jay Inslee amid the coronavirus outbreak. 2620 Williamson Pl NW 253 267-5425. Jay Inslee announced that the Healthy Washington.

Near the end of May restaurants salons and gyms would be added to the list. The full Healthy Washington. Districts have been expected to continue.

Phase 2 will also bring back restaurants bars retailers and manufacturers. Roadmap to Recovery will be transitioning from a regional approach to a county-by-county evaluation process. KAPP-KVEW spoke with staff at Planet Fitness in Yakima who tell us they are preparing to.

Reopening phases in Washington state. COVID-19 Reopening Guidance for Businesses and Workers. Washington state sues gyms for remaining open despite order By GENE JOHNSON May 19 2020 GMT SEATTLE AP Washington Attorney General Bob Ferguson said Tuesday hes suing two gyms that have continued to operate in violation of the governors anti-COVID stay-home order but hes giving them a last chance to avoid a fine.

When you can get a haircut go to the gym or eat at restaurants as coronavirus lockdowns are lifted May 22 2020 at 600 am Updated June 3 2020 at 545 pm. 22824 100th Ave West. More detailed information can be found in this article from the Governors Office.

10 2020 at 904 am. 24 Hour Fitness is committed to reopening our gyms safely and responsibly and will update this page with open locations and projected reopening dates as we know them. New guidelines for fitness centers and gyms will go into effect Monday in Washington state.

On March 11 2021 Governor Inslee announced the Healthy Washington - Roadmap to Recovery plan will be transitioning from a regional approach to a county-by-county evaluation process. 3 W Crawford St 509 276-5880. Fall 2020 Inslee announced earlier this month K-12 public and private schools would remain closed for the rest of the academic year.

The rest of the state is expected to enter Phase 2 by June 1. Gyms and fitness centers must allow customers to cancel memberships any. Pool facilities are open in Washington state.

By Associated Press Wire Service Content Aug. 1125 Washington St SE PO Box 40100 Olympia WA 98504 360 753-6200 OFFICE HOURS. Find a 24 Hour Fitness Gym Open Near You.

Fitness studios independent sports and fitness training group fitness gyms and multi-use indoor fitness facilities providing private instruction and access to personal fitness training andor specialized equipment including but not limited to weight and resistance training. 2305 W Dolarway Rd 509 925-5445. Heres why Heres why According to Governor Jay Inslees proclamation from Nov.

3 Shouweiler Rd 360 861-8340. By Monica Petruzzelli. In early June larger gatherings.

The governor also announced that a new third phase of the Roadmap has been added. All dates and locations are subject to change - please check back for the latest information and be sure to refer to our health page for. 16 pool facilities are not included in the closure of indoor.