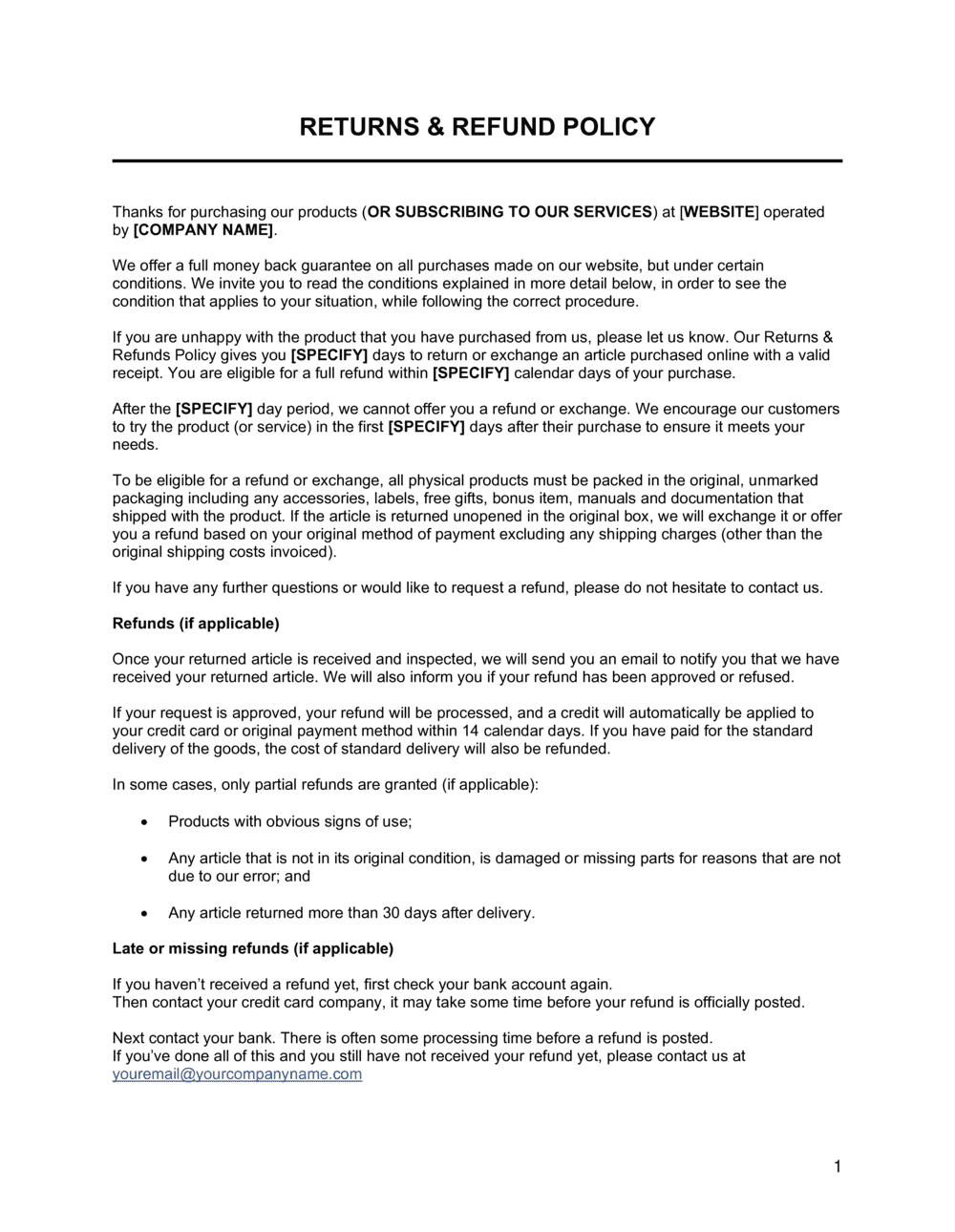

A return policy is a set of rules that merchants establish to manage how customers return or exchange unwanted or defective products that theyve previously purchased or received as a gift. A returns policy is an outline where you inform customers about your return and refund process.

Return Refund Policy Template By Business In A Box

Return Refund Policy Template By Business In A Box

What is a return policy.

Article return policy. If you dont post a Return Policy some laws require you to provide a minimum timeframe to accept all returns. For the most accurate information please read our COVID-19 update. If your item is defective or flawed and its been less than 60 days since your purchase simply choose one of the options above to return the item.

If the order has already been shipped you are eligible to return it without giving any reason within 60 days after the delivery if you are outside of this period check out our article on Warranty for more information However shipped goods have to be returned to. All personal care items including lingerie swimwear etc are final sale. If its been more than 60 days since your purchase please contact us to return the item.

Briefly describe the article. Due to hygiene issues there are no returnsexchanges. To ship your items back with your own label select any carrier and fill out our ReturnExchange Form.

You can improve the accuracy of search results by including phrases that your customers use to describe this issue or topic. Create a ReturnRefund Policy. Start the return process within 30 days of receiving your item.

Our operations are limited during COVID-19. Learn more about Wayfairs Return Policy and. There are two main benefits to having a Return Policy.

If an item isnt the perfect match you can return it for a refund within 30 days of delivery in the original condition and packaging. Send the items back to the address below. We do recommend getting a tracking number for your return.

Wiley will reimburse the cost of shipping for returns of any item sent in error. It also states an approximate timeframe for their return or refund to be handled. It clearly tells your customer what they can and cant return and for what reasons.

If you are not completely satisfied with a product purchased from John Wiley Sons Inc return it within 30 days of receipt for a replacement copy or a full refund with the exceptions noted below. A clear returns refunds and exchanges policy shows that you the ecommerce business owner stand by your product and pride yourself on a stellar customer service experience. Providing a comprehensive policy for returns and exchanges instills confidence in.

You can improve the accuracy of search results by including phrases that your customers use to describe this issue or topic. We stand behind all of our shoes and gear. The product must be in new or unused condition with all original product inserts and accessories.

The summary is used in search results to help users find relevant articles. All customized items do not qualify for return or exchange and neither do gifts. We inspect all returned items.

This return and exchange policy defines the length of time a customer has to make a return 30 days points out that shipping charges will not be refunded and states that customers should plan on 5-7 days before they see their credit arrive. All returned items must be in their original condition - unworn unwashed unaltered undamaged and no smell of perfume. Electronics without data storage capabilities photos books magazines and gas-powered equipment must be returned.

Secondly you will gain the confidence of potential customers and convert more sales. Briefly describe the article. Exceptions to this return policy include.

The summary is used in search results to help users find relevant articles. You are welcome to return anything that was purchased from Patagoniaboth new and sale items. For all returns by mail 795 will be deducted from the refund amount for using our return label.

First you will be able to control your return terms.