Read about tax situations that apply specifically to senior citizens and retirees. Social Security benefits include monthly retirement survivor and disability benefits.

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg) Are Social Security Benefits Taxable After Age 62

Are Social Security Benefits Taxable After Age 62

Is Social Security taxable in New Mexico.

Do seniors on social security have to file taxes. Compare those numbers to just 25972101 taxpayers over the age of 65 who filed in 2018 according to the most recent IRS data available. As a senior citizen you may be eligible to claim a refundable credit on your personal state income tax return. The simplest answer is yes.

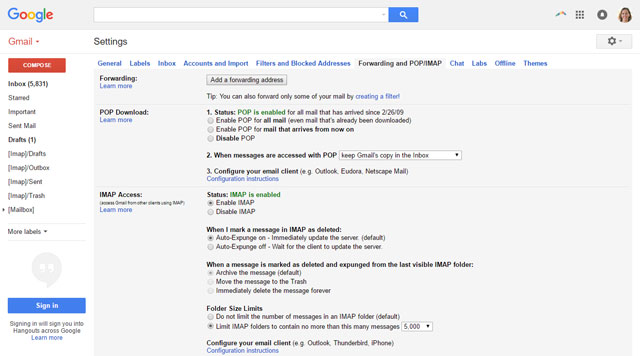

When You Must File Taxes If you are over the age of 65 and live alone without any dependents on an income of more than 11 850 you must file an income tax return. If you are under age 65 are single and have Social Security income below 12200 you generally dont have to file a federal tax return. Hopefully this answer is what you need to know about filing taxes with just Social Security income.

The maximum credit amount for tax year 2020 is 1150. If social security benefits are the only source of income for the senior then there is no need of filing a tax return. If the money received from this program constitutes the seniors sole earnings one need not file a tax return.

If you are older than 65 the amount goes up to 13850 before you must file a federal tax return. Of course Social Security is only one income source you may get taxed on during retirement. Heres how to tell if your Social Security.

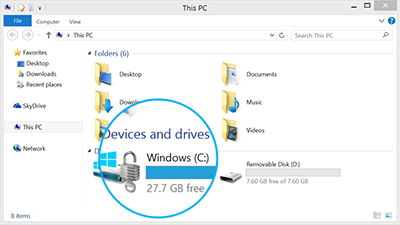

Individual Retirement Arrangements IRAs. Review the tax rules. Even some people with taxable sources of.

Determine if these benefits are taxable. They dont include supplemental security income payments which arent taxable. Taxes on social security benefits depend on the retirees pay.

Request your Social Security benefit statement. The Circuit Breaker tax credit is based on the actual real estate taxes paid on the Massachusetts residential property you own or rent and occupy as your principal residence. If part of your income comes from Social Security you do not need to include this in the gross amount.

The Internal Revenue Service reversed a decision that would have required Social Security recipients and many senior citizens to file a tax return this year even if theyre not required to do. Retirees whose only source of income is Social Security generally will not owe any federal taxes and therefore dont need to file a return with the IRS. The exemption is 2500 for taxpayers under the age of 65.

Those only receiving Social Security benefits do not have to pay federal income taxes. Tax Tip 2020-76 June 25 2020 Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Determine if Your Retirement Income is Taxable Social Security and Railroad Retirement Benefits.

Social Security recipients who typically dont file do not need to file a tax return to get their stimulus check Social Security recipients do not have to file a tax return to get their third payment. Social Security retirement benefits are taxable in New Mexico but they are also partially deductible. The federal government taxes up to 85 of Social Security payments for seniors who earn more than a specific threshold but never taxes the full benefit.

Sales taxes are 783 on average but exemptions for food and prescription drugs should help seniors lower their overall sales tax bill. Social Security benefits may or may not be taxed after 62 depending in large part on other income earned. Social Security income is generally taxable at the federal level though whether or not you have to pay taxes on your Social Security benefits depends on.

As of 2017 retirees without spouses and have attained the required 65 years should file an income tax return if the gross earnings are more than 11850. If you have savings in a traditional IRA or 401 k withdrawals from that plan will be.