Knowing how rates. When youre searching for.

Historical Mortgage Rates Uk Where Are We Now Pure Property Finance

Historical Mortgage Rates Uk Where Are We Now Pure Property Finance

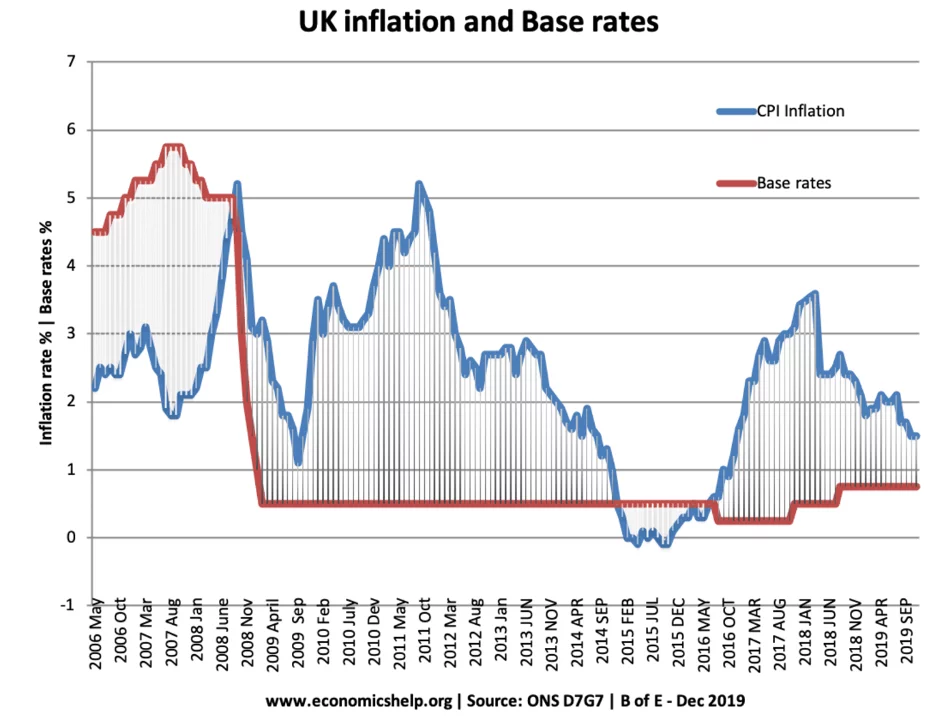

There are several reasons interest rates have been on a wild ride.

Mortgage rates timeline. A timeline of key events and data relating to historical interest rates in the UK 1979-2017. The first half of the 20th century was a similar picture with rates fluctuating. Mortgage Rates at Historic Lows Freddie Macs PMMS dates back to April 1971.

Inflation-adjusted average home sales price. Usually mortgage rates fall when the economy is struggling but this particular economic downturn has been anything but usual. With your pre-approval letter in hand you can start looking at homes.

Moving into the 19th century there was more volatility with interest rates shifting between 4 and 10 per cent. The data would help give policymakers economists and everyday Americans a deeper understanding of the. Finding a HomeNo Timeline.

HSHs Fixed-Rate Mortgage Indicator FRMI averages 30-year mortgages of all sizes including conforming expanded conforming and jumbo. The FRMI has been published as a continuous series since the early 1980s. The Feds moves arent totally irrelevant though.

Freddie Mac began keeping track of 30-year fixed-rate mortgage rates in 1971. History of the housing market 1971 1975. Rate Pts Rate Pts Rate Pts Rate Pts Rate Pts.

Moving into the 19th century there was more volatility with interest rates shifting between 4 and 10 per cent. But if you follow mortgage rates you will see that most of the time the rates fall very slowly if at all. Historical antecedents Interest rates were very stable in the UK during the 18th century staying put at between 4 and 5 per cent.

If your house hunting takes longer simply request a new pre-approval from your mortgage loan officer. They tend to have a delayed and indirect impact on home loan rates. 177412 1 compared to previous year Housing starts.

With 30-year fixed rates dipping below 27 in 2020 even a steep increase of 1 would leave rates well short of the 5 to 6 average rates we saw just 15 years ago. The annual average rate of inflation began rising in 1974 and continued through 1981 to a rate of 95. At todays average rate youd pay 553 per month in principal and interest.

For those history buffs among you the rate on a 30-year fixed-rate mortgage on April 2 1971 was 733. View data of the average interest rate calculated weekly of fixed-rate mortgages with a 30-year repayment term. Scroll down the page to see the FRMIs 15-year companion as well as.

Historically when the Feds have dramatically cut rates mortgage rates remain almost identical to the rates established months before the cut as they do months after the cut. Weekly average rates and points on 30-year fixed 15-year fixed and 1-year adjustable rate mortgages 1992-present. The average 20-year mortgage rate today is 2964 up 0028 from yesterdays average of 2936.

The average 15-year fixed mortgage rate is 2350 with an APR of 2620. 1971 to 2020 In 1971 the same year when Freddie Mac started surveying lenders 30-year fixed-rate mortgages hovered between 729 to 773. Separate statistical series for conforming and jumbo loans have long been available to HSH clients.

Historical graph for mortgage rates. Mortgage Rate Watch Mortgage Rates Back Near Lowest Levels in Weeks Mortgage rates hit their lowest levels in more than a month last Thursday but reversed course later that afternoon. A timeline of key events and data relating to historical interest rates in the UK 1979-2017.

Each mortgage will have its own timeline but from start to finish the process may stretch from about three to five months. 20-year mortgage rates. The first half of the 20th century was a similar picture with rates.

To help you make sense of everything weve put together a timeline of where interest rates have been over the last several months. Historical antecedents Interest rates were very stable in the UK during the 18th century staying put at between 4 and 5 per cent. Historical mortgage rates.

Since youre not yet racing the mortgage clock you can afford. Because mortgage rates change daily your pre-approval letter is valid only for a limited time usually 45 to 60 days. For today Tuesday April 27 2021 the benchmark 30-year fixed mortgage rate is 3070 with an APR of 3280.

12 24 million units.