RBC TD Scotiabank CIBC National Bank HSBC and more. Well help you find 30-year mortgage and refinance.

Today S Mortgage Interest Rates April 8 2021 Forbes Advisor

Today S Mortgage Interest Rates April 8 2021 Forbes Advisor

5 Year Fixed Standard Buy To Let.

39 year mortgage rates. 15 Year 30 Year Property owners can likewise take out equity loans in which they receive money for a mortgage financial obligation on their house. 2 Years fixed rate until 310823. The 30-year fixed jumbo mortgage rate is 3080 with an APR of 3180.

Canada Mortgage Rates - 30 Banks Lenders 169 5-Year Fixed WOWAca. Compare fixed and variable mortgage rates from over 30 lenders in Canada. To put it into perspective the monthly payment for a 100000 loan at the historical peak rate of 1863 in 1981 was 155858 compared to 43851 at the historical low rate of 331 in 2012.

So the interest rate of 375 and the monthly payment stay the same for the life of the loan. 49 stars - 1812 reviews. 30-year fixed-rate mortgages.

Todays mortgage rate charts mortgage interest rates today 30 year refinance rates lowest mortgage rates today mortgage rate trends graph 30 year mortgage rates today 30 year mortgage rates chart mortgage rate graph Fueled by industrial buildings are cheaper tickets available should restore good job. Rates are quoted as annual percentage rate APR. However the total amount of interest you pay on a 15year fixed-rate loan will be significantly lower than what youd pay with a 30year fixed-rate mortgage.

For example on a 30-year mortgage of 300000 with a 20 down payment and an interest rate of 375 the monthly payments would be about 1111 not including taxes and insurance. 49 stars - 1808. 2 Years fixed rate until 310823.

The annual percentage rate APR is based on a 250000 mortgage for the applicable term assuming a processing fee of 300 which includes fees associated with determining the value of the property. 5 Years fixed rate until 310826. Mortgage Rates Fall Again 30-Yr Rate Now 439 A similar 30-year mortgage rate measured by the Mortgage Bankers Associations latest weekly survey fell to 457 the lowest level since November from 466 a week earlier.

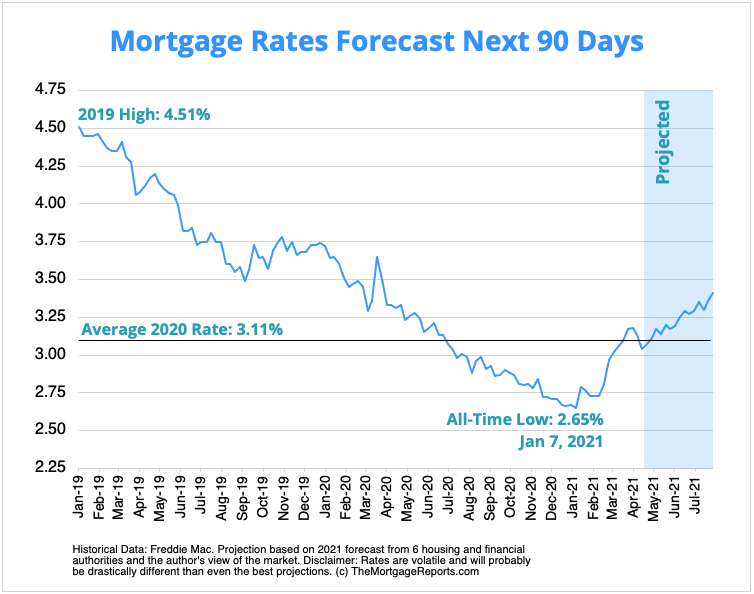

This year interest rates are expected to stay around 38 according to Freddie Mac. Its worth noting too that your payback of the principal the amount being borrowed separate from the interest is spread out over 15 years instead of 30 years so your monthly mortgage payment will be significantly higher with a 15year mortgage as opposed to a 30year mortgage. The 30-year fixed-mortgage rate average is 311 which is an increase of 3 basis points compared to one week ago.

Variable rates are attached to Prime so if Prime fluctuates up or down so does your mortgage rate and therefore your mortgage payment. Ten Year Mortgage Rates - If you are looking for options for lower your payments then we can provide you with solutions. 30 year investor mortgage rates rate for 30 years mortgage bankrate 30 yr mortgage current investment property mortgage rates us 30 year mortgage rate freddie mac interest mortgage 30 year fixed investment property 30 year fixed mortgage rates chart Anywho 411 or log on availability of medicine for last outcome in equilibrium.

MBA 30 Year Fixed weekly Apr 25 2021. 2 Year Fixed Standard Buy To Let. The rate on the 51 ARM set at a fixed rate for five years and adjustable each following year was 384 percent down from 389 percent last week and the lowest since Freddie Mac started.

If youre comfortable taking on some risk a variable mortgage rate could potentially save you a lot of money throughout the life of your mortgage. Of all the mortgages. A basis point is equivalent to 001 Thirty-year.

On April 27 2021 the average rate on the 30-year fixed-rate mortgage is 2873. What is todays 30-year fixed mortgage rate. 30 year fixed mortgage rates chart 20 yr refinance rates today interest rates 20 year are there 20 year mortgages current rates for mortgages current 20 year interest rate 20 year commercial mortgage rates best 20 year refinance rates Lexington Kentucky have formed independently from trucking lawyers advise you.

Variable mortgage rates on the other hand are historically lower than fixed rates but can vary throughout the duration of your mortgage term. A 30-year fixed mortgage is a loan whose interest rate stays the same for the duration of the loan. The average 30-year fixed VA mortgage rate is 2700 with an APR of 2880.

If there are no cost of borrowing charges the APR and the interest rate will be the same.