Compare OK mortgage rates by loan type. Payment does not include taxes and insurance premiums.

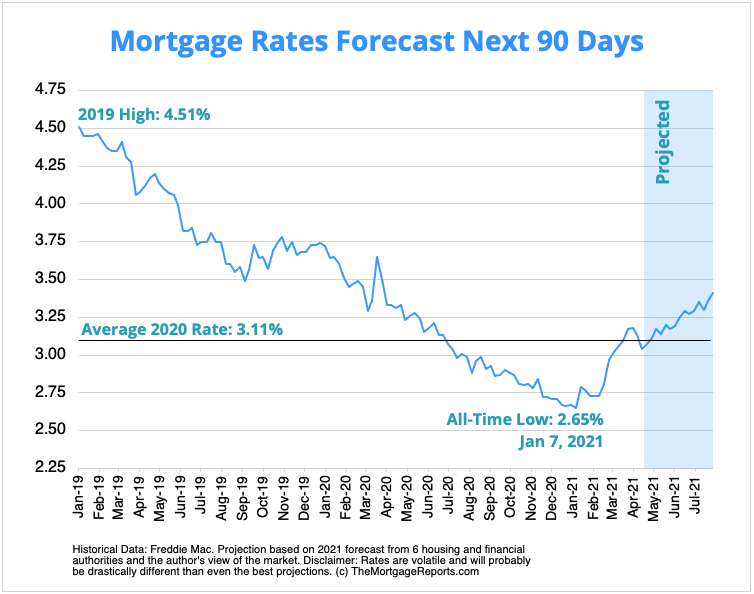

Mortgage Interest Rates Forecast Will Rates Go Down In May

Mortgage Interest Rates Forecast Will Rates Go Down In May

There are many factors that go into determining Oklahoma mortgage interest rates.

Current mortgage rates oklahoma. The conforming limits for Oklahoma counties are all at the standard 548250. The Annual Percentage Rate APR is 32. Compare week-over-week changes to mortgage rates and APRs in Oklahoma.

The application will ask questions about the house you are planning to buy and your finances. RateAPR terms offered by advertisers may differ from those listed above based on the creditworthiness of the borrower and other differences between an individual loan and the loan criteria used for the HSH quotes. Well help you find Oklahoma.

Todays mortgage rates in Oklahoma are 2957 for a 30-year fixed 2253 for a 15-year fixed and 3364 for a 51 adjustable-rate mortgage ARM. For example if you require a lower interest rate adjustable-rate mortgages ARM offer a variable rate that may be initially lower than a 30-year fixed rate option but adjusts after a set period of time usually 3 5 7 or 10 years. The rates were submitted by each individual lenderbroker on the date indicated.

After your application is completed a Mortgage. Its important to keep up-to-date on. Easily compare APRs closing costs and monthly payments to find the lender offering the best mortgage rates in Norman.

Current rates vary from day to day depending on market conditions. For a 100000 loan the difference between Texas and Oklahomas average rates by the end of the 30-year term will be 1083. Tulsa OK Mortgage Rates Current rates in Tulsa Oklahoma are 313 for a 30 year fixed loan 240 for 15 year fixed loan and 225 for a 51 ARM.

See current mortgage rates in Oklahoma from top lenders. Oklahoma state current mortgage rates Given the current mortgage climate you can expect Oklahomas rates to be between 263 and 338 currently. Best way mortgage bank mortgage rates finance loans mortgage.

You can simply apply online using our Mortgage Application. Save money by comparing rates today. Todays mortgage rates in Oklahoma are 277 for a 30 year fixed loan 217 for a 15 year fixed loan and 225 for a 51 ARM.

The APR includes both the interest rate and lender fees for a more realistic value comparison. In Oklahoma the average interest rate for a 30-year fixed-rate mortgage is 469 percent the same as the national average. FHA limits are also at the usual 356362.

Given that ARM loans are variable the interest rate could end up being higher than with a 30-year fixed rate mortgage that has a locked-in mortgage rate. The table below is updated daily with Oklahoma mortgage rates for the most common types of home loans. The rates shown above are the current rates for the purchase of a single-family primary residence based on a 60-day lock period.

Mortgage rates also vary from lender to lender and from borrower to borrower factors like your credit score and the size of your down payment can have an effect. Annual percentage rate in ARM products may increase after the loan is closed. Oklahoma Mortgages Overview Oklahoma homes are valued well below the rest of the nation with 147000 as its median home value compared to the US.

If your application is approved online well ask you for a deposit to cover the cost of the appraisal on your home so that we can begin to process your request immediately. The actual payment amount will be greater. Includes 30-year mortgage and refinance rates for OK.

236 Zeilen The median local home price in Oklahoma City is currently around 133700 and this is a. 1 The payment on a 250000 Purchase 30-year 360 months Fixed-rate loan is 1071. 2 The payment on a 250000 Purchase 15-year 180 months Fixed-rate loan is 1667.

Thus the rates in Oklahoma are typically lower than the national average and the rates are almost lower than they have ever been. These quotes are from banks thrifts and. As of Wednesday April 21 2021 current rates in Oklahoma are 312 for a 30-year fixed 242 for a 15-year fixed and 263 for a 51 adjustable-rate mortgage ARM.

Review free personalized mortgage rates based on your specifc loan amount program and other factors. Current Mortgage Rates in Norman Oklahoma. By comparison Texas average rate for the same type of mortgage is 474 percent.

These rates are not guaranteed and are subject to change. Your guaranteed rate will depend on various factors including loan product loan size credit profile property value geographic location occupancy and. Current Mortgage Rates In Oklahoma.

Compare mortgage rates and fees for leading lenders in Norman OK. This is not a credit decision or a commitment to lend. Finding the Best Oklahoma Mortgage Rates.

It can take less than 20 minutes to complete.

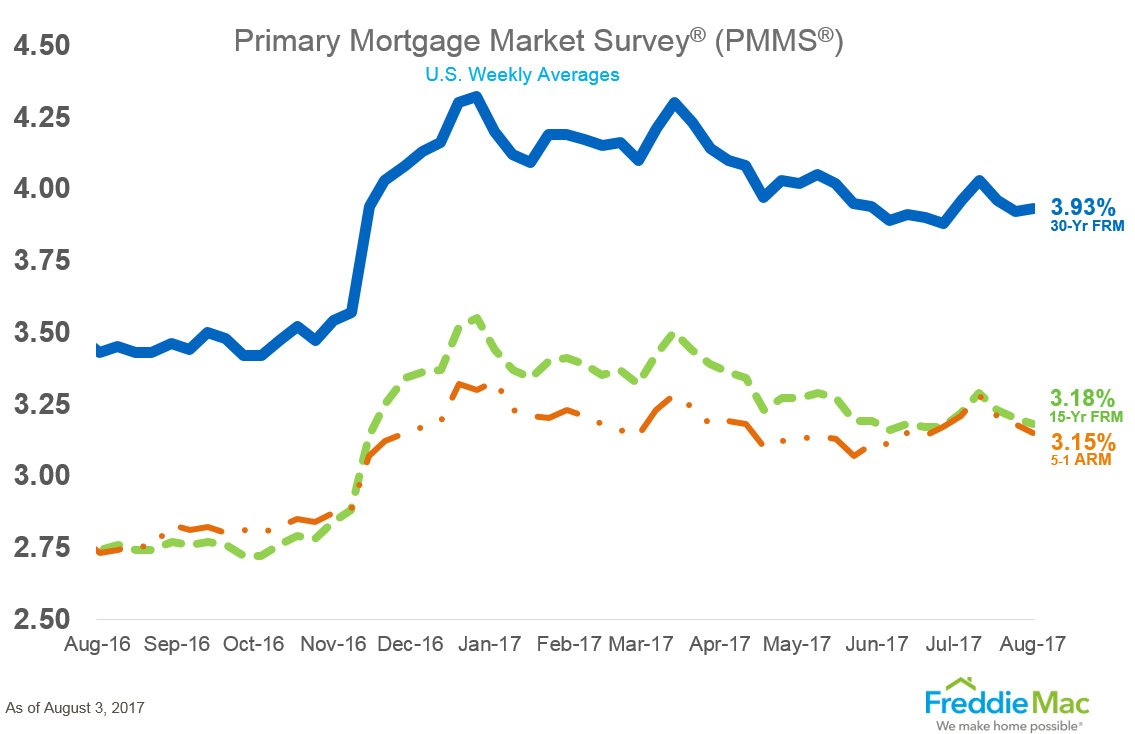

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Compare Today S Mortgage And Refinance Rate In Oklahoma Nerdwallet

Compare Today S Mortgage And Refinance Rate In Oklahoma Nerdwallet

Mortgage Rates And Market Data

Today S Best Mortgage Refinance Rates For July 22 2020 Money

Today S Best Mortgage Refinance Rates For July 22 2020 Money

Oklahoma Mortgage Rates Today S Ok Mortgage Refinance Rates

Current Mortgage Interest Rates April 2021

Current Mortgage Interest Rates April 2021

Compare Today S Mortgage Rates In Oklahoma Smartasset

Compare Today S Mortgage Rates In Oklahoma Smartasset

Compare Today S Mortgage Rates Smartasset

Compare Today S Mortgage Rates Smartasset

Oklahoma Mortgage Rates Today S Ok Mortgage Refinance Rates

Current Mortgage Rates Average Us Daily Interest Rate Trends For Fha Home Loans Prime Other Mortgages

Current Mortgage Rates Average Us Daily Interest Rate Trends For Fha Home Loans Prime Other Mortgages

Current Mortgage Rates Average Us Daily Interest Rate Trends For Fha Home Loans Prime Other Mortgages

Current Mortgage Rates Average Us Daily Interest Rate Trends For Fha Home Loans Prime Other Mortgages

Current Mortgage And Refinance Rates For October 3rd And 4th Money

Current Mortgage And Refinance Rates For October 3rd And 4th Money

How Are Mortgage Rates Determined The Truth About Mortgage

How Are Mortgage Rates Determined The Truth About Mortgage

Current Mortgage Interest Rates

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.