The IRS says it issues most tax refunds within 21 days but many people get their refunds much sooner. The delays have already cost the agency billions in interest on late refunds.

Where Is Your Irs Refund Millions Of Tax Returns Are Waiting Wfmynews2 Com

Where Is Your Irs Refund Millions Of Tax Returns Are Waiting Wfmynews2 Com

Filing a paper tax return may delay your refund by.

Is the irs processing refunds. Has the most up to date information available about your refund. But that timeline could be delayed by a. The IRS processes tax returns as it receives them.

The IRS is having to manually review a lot of these returns a slow process that is delaying refunds for millions of low-income families after the agency has faced a decades worth of budget cuts. Miscalculating Credits or Deductions. IR-2021-16 January 15 2021.

The IRS said that 36 million refunds have gone out so far and that the agency is moving as fast as it can to get stimulus payments out in the coming days all while processing more returns. The IRS is already behind last years pace processing returns. Tax payers can still submit and file their return with their preferred provider we recommend Turbo Tax but the IRS wont begin processing and paying returns until after February 12th 2021.

A typical tax refund with no issues goes out in 21 days or less. WASHINGTON The Internal Revenue Service announced that the nations tax season will start on Friday February 12 2021 when the tax agency will begin accepting and processing 2020 tax year returns. The tool is updated daily so you dont need to check more often.

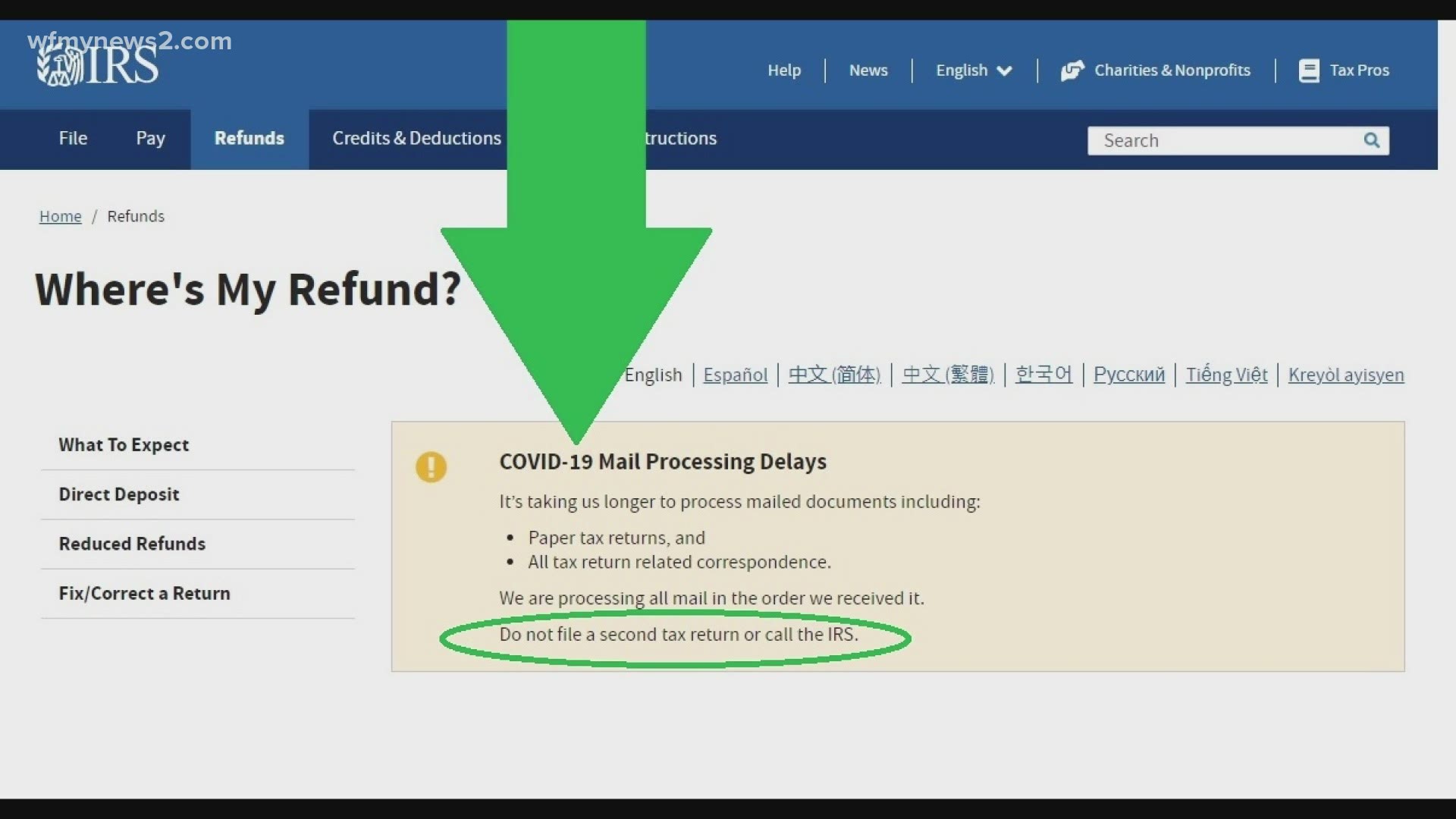

That backlog is delaying tax refunds for many Americans. You should count another week into your time estimate if you request your refund. If you mail in your return it can take three additional weeks the IRS has to manually enter your return into the system first.

Typically the IRS issues a refund within 21 days of accepting a tax return. If you file electronically the IRS can take up to three days to accept your return. But this year is complicated by a several issues including a.

The IRS says it issues most tax refunds within 21 days but many people get their refunds much sooner. For instance if there was a situation where you interchanged two digits the IRS will align the error made mathematically but this revision will lead to extra processing time and as a result your refund which is due will get delayed as well. How Long It Takes the IRS to Process a Tax Refund.

The estimated 2020-2021 refund processing schedule table below has been updated to reflect this including the extension to the season. The IRS is holding 29 million tax returns for manual processing meaning theyll require human review according to the National Taxpayer Advocate an independent arm of the tax agency that serves as a consumer watchdog. Typically nine out of 10 refunds filed electronically go out in this time frame.

The IRS maintains that most taxpayers will receive their refunds within 21 days if they file online and set up direct deposit for their bank accounts. The Internal Revenue Service is holding 29 million tax returns for manual processing contributing to more refund delays than are typical in a normal filing season due. If you feel like your 2020 tax refund is taking longer to arrive than usual youre not alone and you may well be right.

Typically the IRS sends most refunds within three weeks of taxpayers filing their return. The IRS issues more than 9 out of 10 refunds in less than 21 days. However this year the IRS is reportedly facing.

However its possible your tax return may require additional review and take longer. The refunds ranged from 2040 to as much as 12569. Their refund money typically should have shown up by early to mid-March given that the 2020 returns were filed electronically in February.

However this year the IRS is reportedly facing. IRS Commissioner Charles Rettig on Thursday said the millions of Americans whose tax returns have been caught in a processing backlog created by the pandemic which shut down the IRS for a time should see their refunds in the coming months. If you file your tax return electronically the IRS will generaly process direct deposit refunds within 7-10 days of receiving your tax return and process paper checks within about two weeks.

Through March 5 the IRS has issued.