Unless otherwise stated the due dates provided are for 30 June balancers only. The Tax Deadline to e-File 2020 Taxes is April 15 2021.

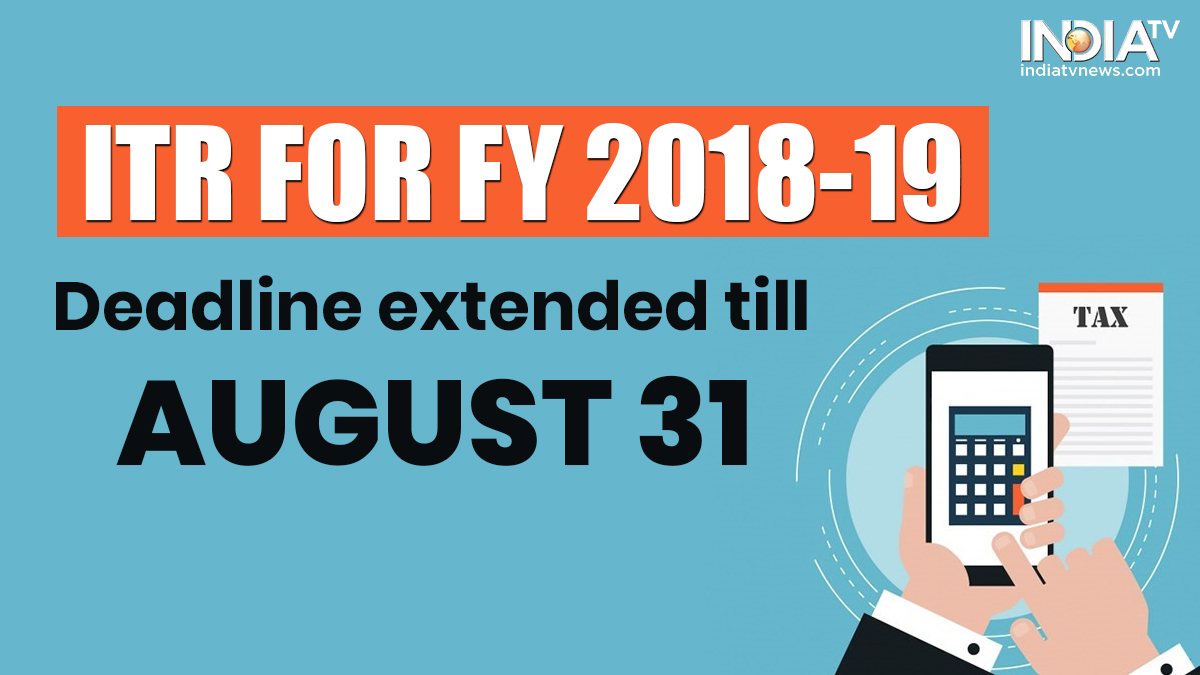

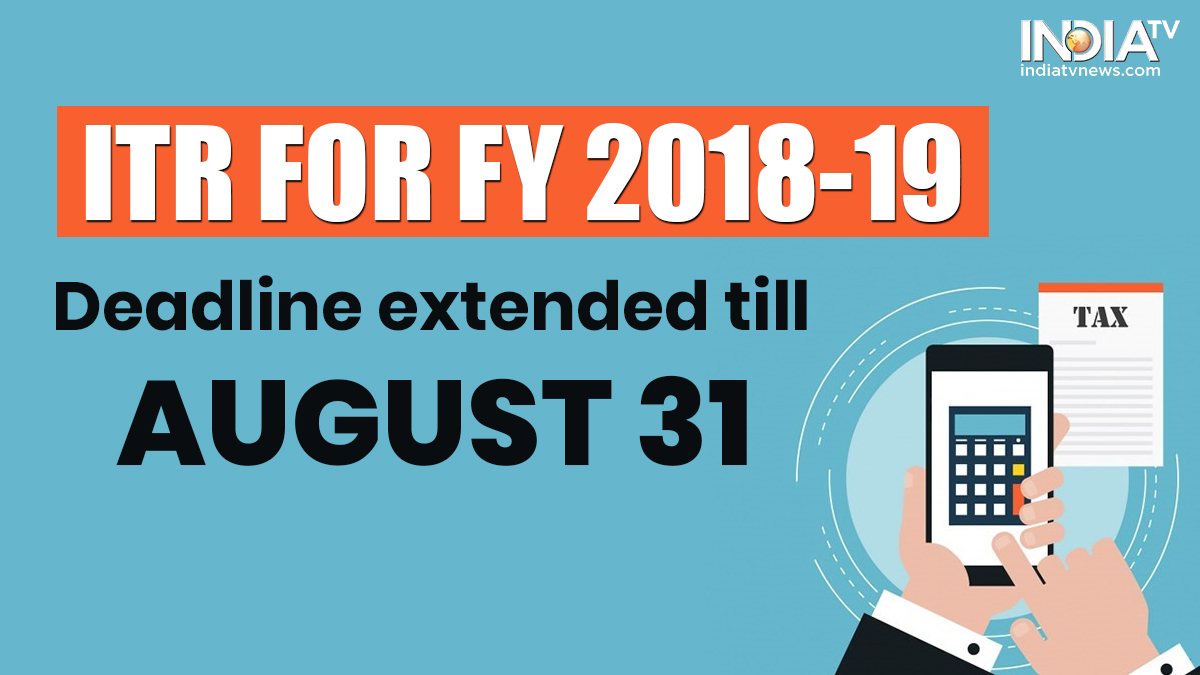

Itr Filing 2019 Govt Extends Income Tax Return Filing Deadline Till August 31 Business News India Tv

Itr Filing 2019 Govt Extends Income Tax Return Filing Deadline Till August 31 Business News India Tv

However if you receive notice from HMRC that you must file a tax return after 31 July 2019 youll need to send back the completed form within three months of the date of issue on the notice.

What is the last date for tax return 2019. After that date your refund will. 31 October 2019. The payment due dates for a tax return are determined by client type the lodgment due date and when the return is lodged.

If youre an individual and used a registered tax agent to help lodge your annual tax return for the fiscal year 2020 1 July 2019 30 June 2020 this is typically the deadline they will adhere to for the submission of your return. When a due date falls on a Saturday Sunday or public holiday you can lodge or pay on the next business day. Last day to contribute to an Individual Retirement or Health Savings Account IRAHSA and have it considered retroactive to 2019.

Last Date of Tax Audit For FY 2019-20. 2019 Return refund is April 15 2023. What if I made a mistake and need to refile my taxes.

Taxpayers in that area who extended their 2019 tax returns to October 15 2020 now have until January 15 2021 to file those returns. The last tax year started on 6 April 2020 and ended on 5 April 2021. Though the last date of filing Income Tax returns for FY 2019-20 is over for individual filers as well as for companies March 31 2021 is the final deadline to file ITR as well as.

If you miss this date you have until October 15 2021. Its year-end is December 31 and the tax return due date is the same as the individualsnormally April 15 except its May 17 in 2021. HM Revenue and Customs HMRC must receive your tax return and any money you owe by the deadline.

Keep in mind if you owe taxes and dont file an extension you might be subject to Tax Penalties. Paper tax returns due This is the deadline for filing a paper tax return. The 2018 Return refund deadline is April 15 2022.

If the ITR is filed before the expiry of deadline then a penalty will be levied on late filing of ITR for upto Rs 10000. In order to provide more time to taxpayers for furnishing of Income Tax Returns it has been decided to further extend the due date for furnishing of Income-Tax Returns and consequently the date for furnishing of various audit reports under the Act including tax audit report and report in respect of internationalspecified domestic transaction has also. File a 2020 income tax return Form 1040-SR and pay any tax due.

Last date to file income tax rate is 31st march for fy 2019-20 An income tax return ITR is basically a document that is filed as per the provisions of the Income Tax Act reporting ones income profits and losses and other deductions as well as details about tax refund or tax liability. The last date for filing ITR. Now individuals may file the ITR till January 10 2021.

Sole proprietors file Schedule C with their personal tax returns to arrive at their net taxable business incomes. 01 Jul 2020 QC 34594. Last day to file an original or amended tax return from 2017 and claim a rebate unless you have an extension then this is October 15 2021.

However owing to the coronavirus pandemic many of use were unable to claim the ITR following the central government extended the last date of filing a belated or revised return. 15 2021 you can no longer e-File IRS or State Income back taxes prior to Tax Year 2020. The last date to file income tax return ITR for the financial year 2019-2020 FY20 has again been extended.

Among other measures Due date of all income-tax return for FY 2019-20 will be extended from 31st July 2020 31st October 2020 to 30th November 2020 and Tax audit from 30th September 2020 to 31st October 2020. For the financial year 2019-20 the income tax return deadline has been extended to December 31 2020 from the usual deadline of July 31. If you have not filed your 2017 IRS Tax Return and expect a tax refund you have until 04152021 to submit the return on paper and to claim your refund.