It never makes sense to buy an index fund with a sales charge which can come in the form of a front-load paid when buying shares or a back-load paid when selling shares. Find out who made it to the top of this years list and open a trading account with them.

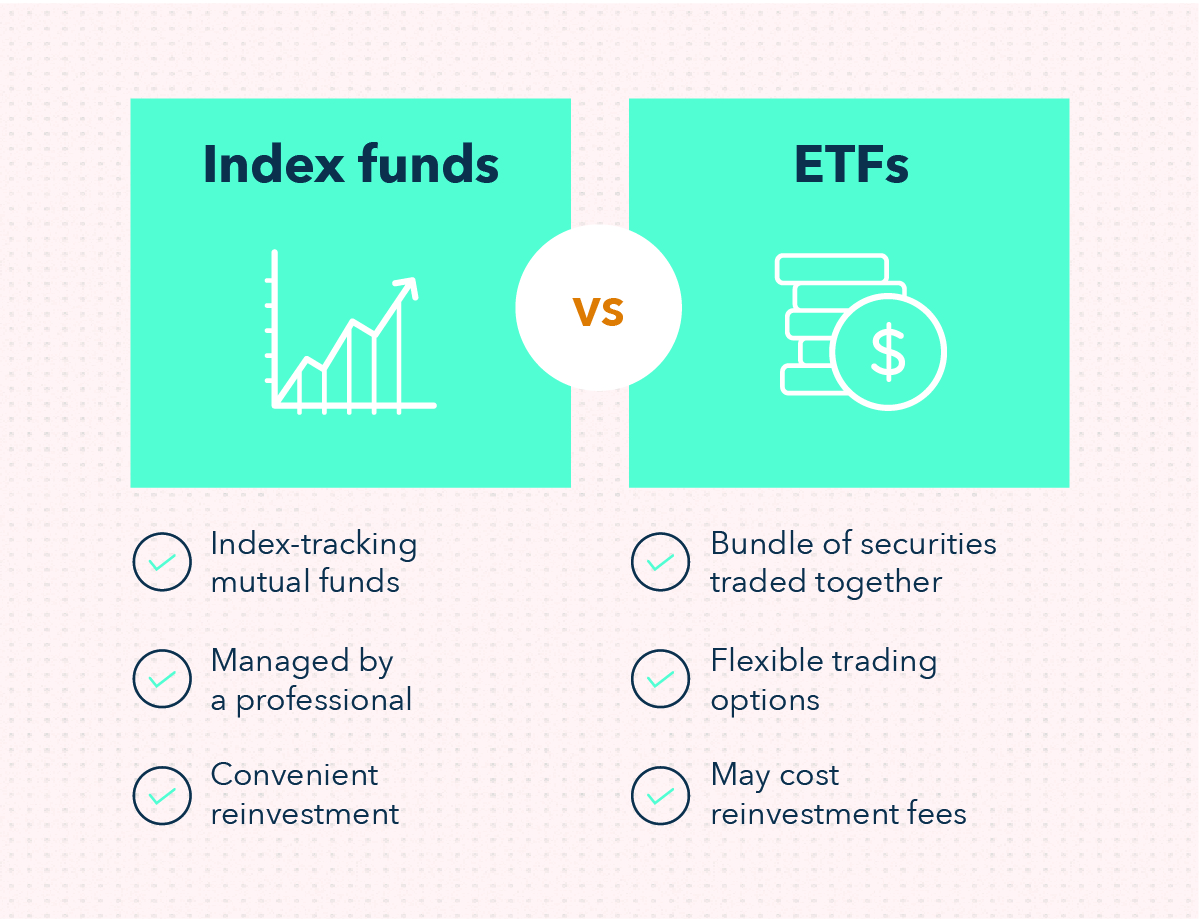

What Is The Difference Between Etfs And Index Funds Personal Budget

What Is The Difference Between Etfs And Index Funds Personal Budget

The beauty of index funds is that.

Buy index funds. This index may be created by the fund manager. Index futures are used to speculate on the direction of price movement for. Index futures are futures contracts where a trader can buy or sell a financial index today to be settled at a future date.

Annonce Looking for a List of the Best Safest and Low Fee Online Brokers. If youre looking for a low-cost low-risk investment option index funds are the way to go. Open a Brokerage Account.

Once you know the SP index fund you want to buy and how much youre able to invest go to your brokers website and set up the trade. Others charge you for every trade and dont offer index funds with low expense ratios. Find out who made it to the top of this years list and open a trading account with them.

However before investing carefully research possible index funds or ETF buys as theyre not all alike. Choosing the right one can save you. Buy the index fund.

Among index funds FMETF has the least management fee of 050. Youll need an investment account to buy index funds. Mid- and Long-Term Goals.

When you buy an index fund you get a. Since index funds track the performance of a stock index such as the SP 500 or NASDAQ theyre. Many mutual fund companies will have a selection of.

Part of learning how to index invest is knowing where to buy index funds. An index fund creates a portfolio of stocks that mirror the collection of companies and performance of a market index such as the SP 500. We talked about ETF vs stock before and index funds can be an ETF like VTI which tracks the total US stock market.

Check this article that compares index funds. Not all online brokerage accounts are created equal when it comes to buying index funds and ETFs. And you could buy index funds yourself.

The lesser the fee the better your long-term returns would be. But then you wouldnt be able to take advantage of dividend reinvesting or have access to expert financial advice or have your portfolio balanced by experts when it becomes prudent to do so. Yes go for an investment with the least fees.

Annonce Looking for a List of the Best Safest and Low Fee Online Brokers. An index fund is a type of mutual fund or ETF portfolio that tracks a broad segment of the US. ETFs if you recall are traded like stock shares.

Some online brokers offer rock bottom fees and a wide variety of index funds to choose from. With index funds and a little homework on your end you dont need advice or active management. Buying stocks and investing in index funds will ultimately depend on your game-plan.

Some investors can find their own answers and others may need the help of a financial advisor. Over the past 10 years index funds ETFs and mutual funds have consistently outperformed actively managed funds. What are your goals that are tied to your stock and index fund investments.

You can buy index funds through your brokerage account or directly from an index-fund provider such as BlackRock or Vanguard. How To Buy Index Funds 1. Some may say you could just buy index funds yourself rather than start investing with a robo-advisor.

Your index fund investment strategy takes into account your overall. Purchasing Index Funds Download Article 1. An index fund is an investment fund either a mutual fund or an exchange-traded fund ETF that is based on a preset basket of stocks or index.

Buy from mutual fund companies who offer a range of index funds. It is no secret that I love index funds and practically live by them mainly the SP 500 based index funds like VOO and SPY. A learning moment.

Index funds arent a specific type of investment that you can actually purchase like a stock or bond. Decide on Your Index Fund investment Strategy. Sales charges only make sense when youre getting valuable advice and top-notch active management.

In general index funds can be a very good investment.