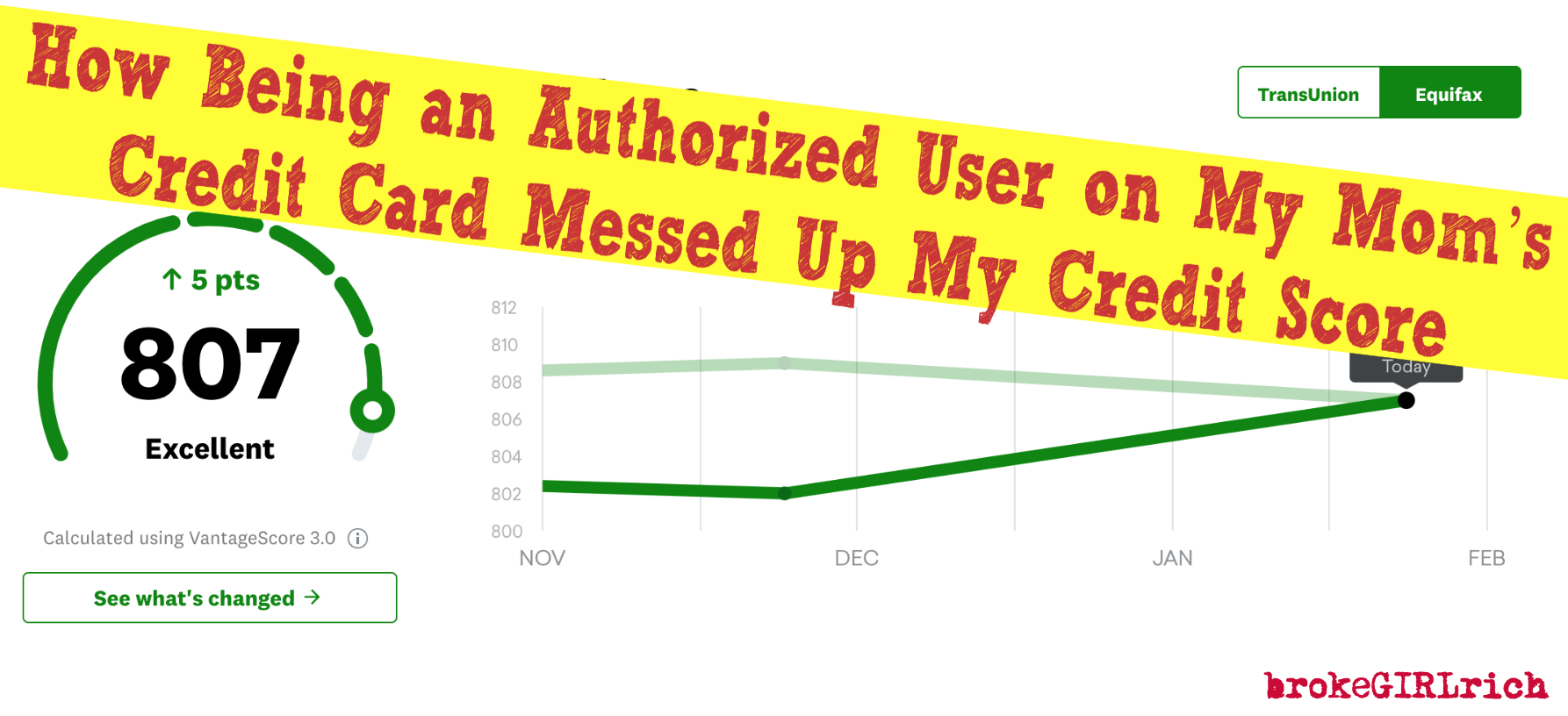

If they have a good income and long credit history that means you may have a credit limit as high as 20000 or more. And your credit score takes a hit because credit utilization accounts for about a third of your credit rating.

How Being An Authorized User Affects Your Credit Score Creditrepair Com

How Being An Authorized User Affects Your Credit Score Creditrepair Com

One of the fastest ways to boost your credit score is to be added as an authorized user by someone with excellent credit.

How much can being an authorized user help your credit. There is no pre-qualification for an authorized user status on a credit card. After adding my brother and now with this new experience Im convinced how beneficial it can be to add authorized users to old cards with a high limit. Authorized user status can help someone establish credit if the account is managed well.

Can help your score with low credit utilization balancelimit percentage or lower it by as much as 45 points if maxed-out. If you cannot qualify for a credit card on your own being an authorized user can help you beef up your credit history and can help with credit age a. FWIW it was the same on Credit Karma too.

When you are added as an authorized user you typically have access to the primary users entire credit line. Just continue to grow your own credit. Your scores will climb quite a bit on their own if you get them paid down.

And therefore youre not responsible for bill payments. Becoming an authorized user can help your credit. Right now you are using two-thirds or about 66 of your credit.

In other words it means that you can add 8 to 9 authorized users to your credit card and those authorized users can benefit from your positive credit history. For instance for those with bad credit a credit score below 550 becoming an authorized user improved their. Depending on the credit card youre added to it may cost nothing to be added as an authorized user.

However the credit cards history will be reported on the authorized users credit report as long as the authorized user is related to the account holder. Just as joining a responsible credit users account can help you linking yourself with a less reliable cardholder can hurt you. What Are the Risks of Being an Authorized User.

Take away that card where youre an authorized user and your utilization goes up to 100. Some credit reporting agencies including Experian do not include negative payment history in an authorized users credit. When you are added as.

If the cardholder misses a payment or maxes out their card your credit could be negatively affected. Therefore to ensure you are doing more good than harm to your score by taking on this card get answers to the following questions before becoming an authorized user. You can figure out your utilization rate by dividing your total credit card balances by your total credit card limits.

Youll receive a card in your name and can use that card as you will. His new score according to Credit Sesame is now 732 89 points more than it was this time last month. Being added as an authorized user is a good way to jumpstart your credit history if youre new to credit or you have a troubled credit history.

Thats because if the card issuer reports to major credit bureaus the account merges with your own credit appearing as a new account. The individual with the authorized user account will receive a credit card with their name on it and can use it to make charges. As you can see becoming an authorized user is a great way to quickly improve your credit score especially if youre starting out with credit that is well less than great.

Full payment history is often reported to the three major. However some credit cards charge a fee. Your utilization wouldnt go down that much to change your scores if you are at 80 utilization.

However you get all credit benefits of the account which if done right can help boost your credit score and credit. Additionally if the accounts credit utilization rate is low this can also be good for your credit. The positive account history from being an authorized user can help you qualify for credit on your own.

Based on your info above it wont help you much to be added if you did live with them. Lower utilization percentages are best with the ideal proportion ranging between 1 and 9 percent. If you have little or no credit history becoming an authorized user on someone elses credit card can help build credit history and improve your credit.

Your oldest account is only 1 year less than theirs. If the primary account holder has a strong history of on-time payments this can have a positive impact on your credit. Amounts owed 30 percent of your score.

Being an authorized user means the account is yours to use but you wont be listed as the primary account holder. For instance most of the major credit cards allow up to 9 authorized users each month. The number of authorized users on a credit card can vary a lot depending on the issuer.

The person who applied for a credit card and was approved is considered to be the primary credit account holder and he or she is able to add authorized users to the account usually at no extra cost. And why its so important to have a couple of cards with NO annual fees in your wallet.