An SR22 is a state filing that attaches onto an auto insurance policy. Plus rien à payer sur des prestations en optique dentaire et aides auditives.

6 California Sr22 Filing Faq S Mccormick Insurance

6 California Sr22 Filing Faq S Mccormick Insurance

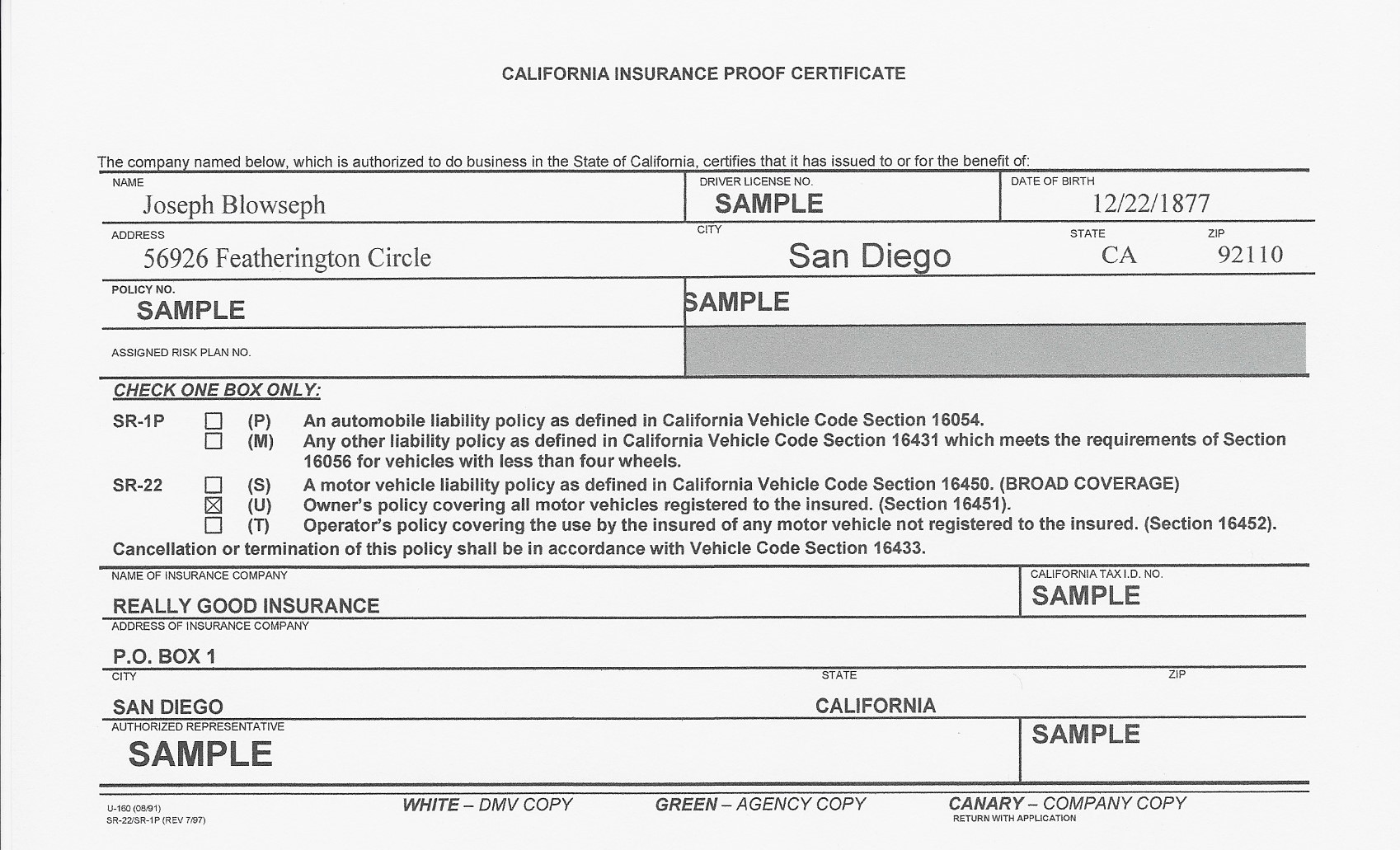

An SR-22 is a form that is filed with your state to show that you are meeting your states minimum auto liability insurance requirements.

What does sr22 insurance cover. In these states SR-22 insurance covers the costs of the other drivers injuries or property damage if youre at fault in an accident. The minimum liability required by Ohio State gets full. It is not insurance itself but rather a form that indicates that you meet your states auto liability insurance coverage requirements.

An SR-22 may also be referred to as a certificate of financial responsibility or in Virginia and Florida an FR-44. Jusquà 200 Remboursés pour des consultations en dépassement dhonoraires. An SR22 filing is for drivers who have had their license suspended and are trying to get their license back.

SR22 also known as SR-22 SR 22 SR22 Form is a vehicle liability insurance document required by most state department of motor vehicles DMV offices for high-risk insurance policies. So if your car gets involved in an accident with another motorists parked vehicle this bond covers all costs. The purpose of a SR22 form is to prove you are insured enough to cover property damage or any other liability that arises from an accident.

Should I attach the SR22 to regular auto insurance or a financial responsibility bond. The SR22 Bond is required to facilitate in covering bodily injury 12500 for any 1 person injured and 25000 per accident when 2 or more people are injured and property damage 7500. What Does a Non-Owner SR22 Insurance Policy Cover.

A SR22 insurance form proves you carry auto liability insurance. Your original policy would be your primary and your SR-22 policy would allow you to get your required SR22 filed with the state -- but without switching your primary insurer. Many states only require liability insurance.

It will cover for the limit amounts you purchase so higher limits will give you greater assurance in case of expensive. A non-owner policy only covers a person for liability meaning for example if you cause an accident the policy will cover expenses to cover the other party such as vehicle damage and personal injury but NOT the vehicle you are driving. So when an a policy with an SR22 cancels your drivers license will be suspended until you either reinstate the policy or start a new policy that has the SR22 attached to it.

In the case of an accident where one party cannot purchase auto insurance cover the SR-22 provides succor. In other words by filing an SR22 form your insurer is guaranteeing to the state that you are maintaining coverage and that you will be financially responsible for any automotive accidents where you are deemed at-fault. Jusquà 200 Remboursés pour des consultations en dépassement dhonoraires.

What does SR22 Insurance in Colorado cover and what does SR22 Insurance NOT cover. In most states your BMVDMV will require you to carry an active SR22 filing for a certain period of time usually 3 years. Getting non-owner car insurance with a SR22 can save you money.

It is liability coverage for you as a driver when you are involved in an accident and you are at fault. Do I Need SR-22. How does the SR22 Bond Insurance work.

Plus rien à payer sur des prestations en optique dentaire et aides auditives. Your non-owner policy would not cover. Because of this in common parlance SR22 insurance is a plan under which your insurance carrier is willing and able to file paperwork with the state notifying them of your coverage.

If the court or state tells you that you need SR-22 insurance certification your minimum coverage requirements are still the same as for any other resident. An SR22 is a state filing that requires the insurance company to notify the Ohio BMV if the policy ever cancels lapses. The insurance company will also keep the state update on your car insurance policy renewals and cancellations.

People may mistakenly refer to it as SR-22 insurance An SR-22 is not insurance its simply a document provided by your insurance company. SR-22 coverage means that you meet states auto insurance minimum requirements for driving and is NOT auto insurance itself. What Does an Ohio SR22 Bond Cover.

If you need a SR22 insurance and your current insurer doesnt offer it then sometimes you can buy a SR22 non-owner policy with a second company. SR-22 insurance covers the minimum protection required by state law. An SR-22 bond covers property damage expenses another driver sustains in a car crash.