For heads of household the threshold is 1616450 and for married people filing jointly it is 2155350. Find your gross income.

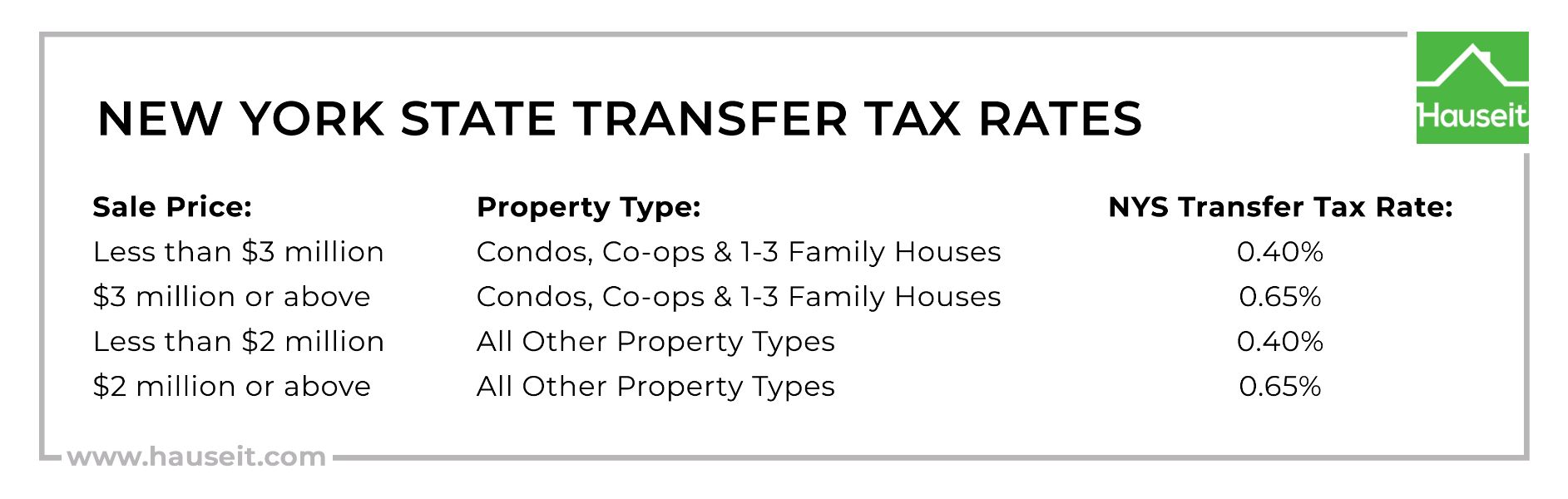

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Our calculator has recently been updated in order to include both the latest Federal Tax Rates along with the latest State Tax Rates.

New york state taxes 2020. 3525 plus corresponding subsidiary fund percent. The State of New York does not imply approval of the listed destinations warrant the accuracy of any information set out in those destinations or endorse any opinions expressed therein. Sales and use taxes.

The New York income tax has eight tax brackets with a maximum marginal income tax of 882 as. Note that special filing deadlines apply in certain instances. The lowest rate applies to single and married taxpayers who file separate returns on incomes of up to 12000 as of 2020.

Request for extension of time to file April 15 2021. In New York different tax brackets are applicable to different filing types. 3078 - 3876 in addition to state tax Sales tax.

Groceries prescription drugs and non-prescription drugs are exempt from the New York sales tax Counties and cities can charge an additional local sales tax of up to 4875 for a maximum possible combined sales tax of 8875. External web sites operate at the direction of their respective owners who should be contacted directly with questions regarding the content of these sites. 9 rows NYC income tax.

Collections for consumption and use taxes New York States second largest tax revenue source increased by 145 percent from 2016 to 2020. You are able to use our New York State Tax Calculator in to calculate your total tax costs in the tax year 202021. New York State Income Taxes for Tax Year 2020 January 1 - Dec.

Changes in the States top tax rate can have significant impacts in the overall level of State tax revenue. The top tax rate is one of the highest in the country though only individual taxpayers whose taxable income exceeds 1077550 pay that rate. The New York state sales tax rate is 4 and the average NY sales tax after local surtaxes is 848.

Rates kick in at different income levels depending on your filing status. The Budget Act amendments also extend the current personal income tax rates in New York City through 2023. The States top personal income tax rate of 882 percent is in effect until December 31 2024.

Each marginal rate only applies to earnings within the applicable marginal tax bracket. Filing due dates for your 2020 personal income tax return. How to Calculate 2020 New York State Income Tax by Using State Income Tax Table.

The latest deadline for e-filing New York State Tax Returns is. Find your pretax deductions including 401K flexible account contributions. New York Salary Tax Calculator for the Tax Year 202021.

Check the 2020 New York state tax rate and the rules to calculate state. For example the sales tax rate for New York City is 8875 while its 75 in Ontario County. If your 2020 income was 72000 or less youre eligible to use Free File income tax software.

075 totaling 36 for 2020. Major New York City and certain Yonkers taxes are also covered in detail--eg the business corporation tax the general corporation tax the tax on banking corporations the personal income tax on residents and the unincorporated business tax as well as property taxes listing of administrative agenciesdirectory and other miscellaneous state taxes eg motor fuels cigarettetobacco and public utilities taxes. New York City has four tax brackets ranging from 3078 to 3876.

Income tax return April 15 2021. To be sure you arent charged a fee access the Free File software thats right for you directly from our website. New York new employer rate.

31 2020 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and file a NY state return. The state charges a flat 4 rate but your actual rate can vary based on any local sales tax imposed by the city county or school district in which the sale occurs. 7 rows 2020 New York Tax Tables with 2021 Federal income tax rates medicare rate FICA and.

For more information see Free File your income tax return. New York has eight marginal tax brackets ranging from 4 the lowest New York tax bracket to 882 the highest New York tax bracket. Find your income exemptions.

Its our no-cost way to easily complete and file your federal and New York State income tax returns online. New Yorks income tax rates range from 4 to 882. Static Internal Revenue Code conformity as of March 1 2020 for New York State and New York City personal income tax purposes.