For a Small Car like Maruti Swift Vxi - this all inclusive Tax Road Tax GST Cess is Rs 2 Lakh which is what valid for 15 years. These have lower tax rates to encourage car owners to choose greener vehicles.

A Guide To Company Car Tax For Electric Cars Clm

A Guide To Company Car Tax For Electric Cars Clm

How much car tax you pay depends on the cars level of CO2 emissions and how old it is.

How much tax do you pay on a car. If you win a 50000 car and owe 12000 in taxes plus other costs when you pick it up you can simply sell that 50000 car and pocket the money you have left over after youve paid it all off. Figure out how much youll owe using a sales tax calculator. Tax records are registered to the car itself and are easily recognisable by law enforcement.

You pay tax on the value to you of the company car which depends on things like how much it would cost to buy and the type of fuel it uses. While tax rates vary by location the auto sales tax rate typically ranges anywhere from two to six percent. Also note that in addition to these fees you must pay your standard DMV-related fees such as any title and registration fee as well as any state-mandated sales tax.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. It would only imply paying tax of Rs 16000 Annually on a Car and use in all Infrastructure Roads Transport System as build by Government. When you start earning more 20 tax is payed.

Altogether sales tax rates can be above 10 percent. Calculate Tax Over Lease Term. Multiply the base monthly payment by your local tax rate.

The prize tax on winning a car may seem daunting but it shouldnt stop you from entering contests. For example if your state sales tax rate is 4 you would multiply your net purchase price by 004. As for commercial vehicles 2000 is the maximum tax youll have to pay for vehicles over 26000 pounds.

Taxing a car the basics. Vehicle Excise Duty VED but commonly called car tax or road tax is a big running cost with cars. Remember to convert the sales tax percentage to decimal format.

At that lowest price point the provincial tax rate through a dealer is 7 per cent. Another major factor in how much company car tax you will pay is your personal income. It can be anything up to 1000 or more a year depending on how environmentally-friendly the car is.

This goes up to 8 per cent for the very narrow window of 55000 to 5599999 and then to 9 per cent from. Select city then click both city and county box. Youll pay less tax on newer petrol cars hybrids and electric vehicles.

Unfortunately this could raise your rate of tax if youre close to a tax threshold. This makes the total lease payment 74094. 2 county rate city rate total.

So the list price of the car plus your salary could push you into the next tax threshold. This value of the car is reduced if. With new vehicle testing coming in and a number of recent changes that will affect the amount of road tax you pay you could stand to make a significant saving by purchasing a vehicle before 1 April 2020 for private buyers and before 6 April 2020 for business usersThats when the new rates of Vehicle Excise Duty and Benefit-in-Kind on Company Car Tax come in.

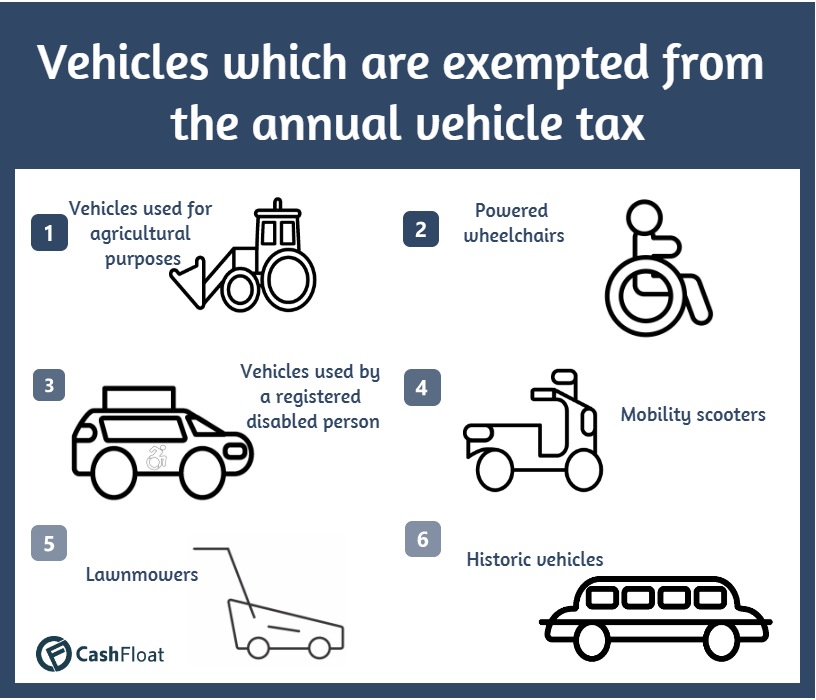

The documentation fee or doc fee is fairly straightforward. For a 35000 car that means paying a bill of 3500. Car owners exempt from car tax.

For example car buyers who live in Chicago will pay 625 for state sales tax 175 for county sales tax 125 for city sales tax and a 1 special tax totaling 1025 of the cost of the vehicle. You dont pay tax until youre earning over 10600. Select Community Details then click Economy to view sales tax rates.

Or you can use HMRCs company car and car fuel benefit calculator if it works in your browser. The vehicles CO2 emissions. For example if a lease on a Mercedes-Benz E-Class has a monthly price of 699 before tax and your sales tax rate is 6 the monthly lease tax is 4194 in addition to the 699 base payment.

To avoid this keep hold of any receipts just in case an officer asks to see them. You can calculate taxable value using commercial payroll software. Using the HMRC calculator.

If youre earning over 42385 however you will pay 40 tax. Car tax is higher for more polluting cars like older diesel cars. Multiply the net price of your vehicle by the sales tax percentage.

Add city plus county plus state car tax for total. 56 county city. Where Can I Get More Information about Car Registration.

Car Tax Rate Tools. But if the original purchase price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit. Double-check the tax records of a purchased car.

The amount of tax you pay depends on. If you do not pay after a year the increase goes up to 20 and if you do not pay at all then your car may be impounded.