Were so confident Better is the best lender out there were giving you the questions you need to test us. Refinancing should be a beneficial action on your part but you should make sure you have all the necessary information before you choose to work with a lender.

9 Questions To Ask Before Refinancing Your Mortgage

9 Questions To Ask Before Refinancing Your Mortgage

Know the right questions to ask when refinancing to help you choose a reliable lender.

Questions to ask when refinancing mortgage. What different refinancing options do you offer. Some of them may be listed on their. Here are the 5 most important questions to ask potential lenders before you refinance.

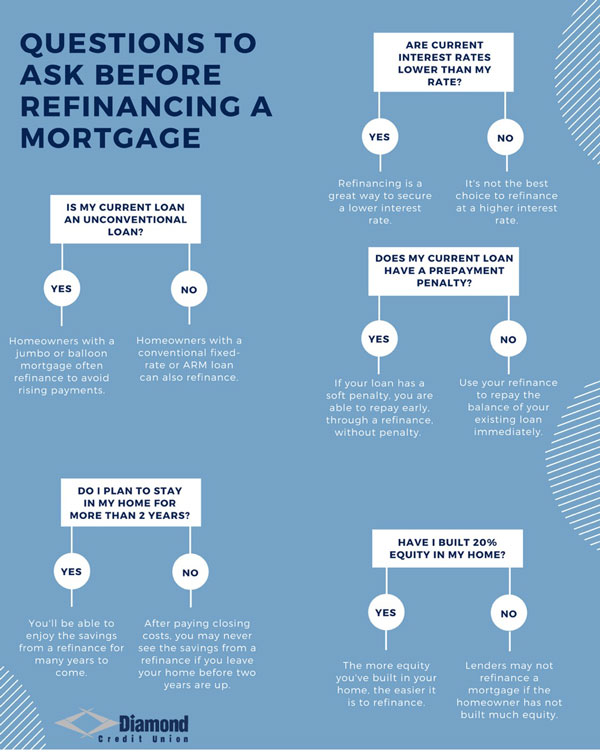

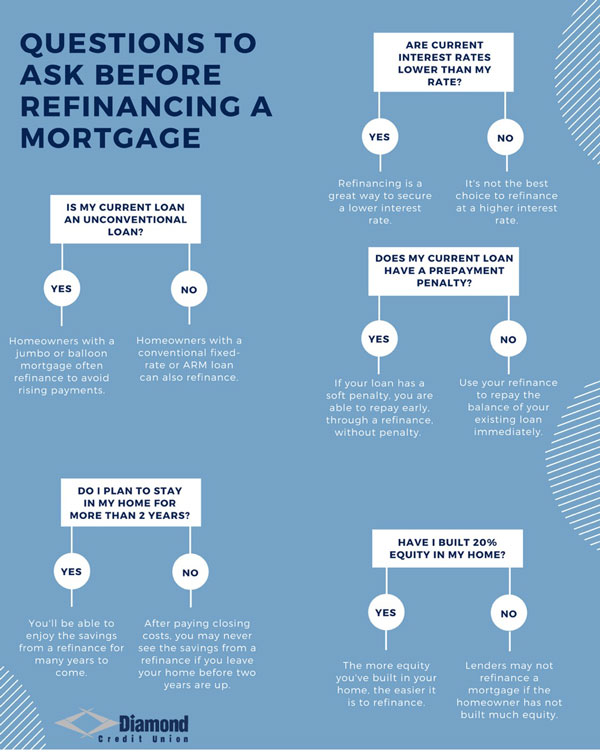

Do I have enough equity in my home. Once you get the information to them how soon should you expect updates. What happens when you refinance a mortgage.

4 key questions to ask now before you decide to refinance your mortgage Today borrowers can snag a 30-year mortgage for 381 and a 15-year loan for 316 compared to 446 and 391. When you are refinancing a mortgage loan it is important that you choose the right lender to take advantage of suitable products and the best interest rate available. Here are the answers to some of the most common mortgage refinancing questions.

Ask about the terms of the prepayment and if the prepayment penalty would apply if you refinanced through the same lender at a later date. Refinancing a mortgage is the equivalent of taking out a brand-new. Do you want to pay less interest or lower your monthly payment.

When you make an appointment to talk to a mortgage lender the more information you can provide the better advice we can give you. Knowing what questions to ask a mortgage lender when refinancing mortgage can make the refinancing process faster and reduce unexpected costs. One of the first refi questions a borrower should ask is what products are available to me Lenders offer a wide-variety of refinance programs to their potential borrowers.

The short answer to this question is A lot In the summer of 2020 as COVID-19 led to a sharp downturn in the US. In addition a refinance may not make sense financially particularly for borrowers who plan to sell their homes in the next few years. Mortgage Refi Questions To Ask Your Lender.

Questions To Ask When Refinancing Your Mortgage. How much can I lower my mortgage interest rate with a refi. First ask each lender what types of loans they offer the types of refinance options available and how to qualify for each.

What Is My Credit Score. What rates can you offer for a no-cost refinance. Underwriters review loans then issue conditions before approving or rejecting them.

Its time to find the right lender. It is important to ask these 10 questions as you may be able to get a better rate and will have more information on the real cost of the refinance and if it makes sense for you. Here are the most important questions to bring up with your lender.

Before taking the leap homeowners should ask themselves the following key questions to help determine if a refinance makes financial sense. Does my quote include taxes and insurance When applying for a loan a lender will provide an estimate that gives a. With the average interest rate as of early March sitting at just over 3 for a 30-year fixed-rate mortgage theres obviously a major savings to be had by refinancing.

Perhaps your financial standing is solid and you can afford to pay a slightly higher monthly mortgage payment. Before deciding whether or not to refinance ask yourself these five questions. Here are some good questions to ask prospective lenders.

Is the Lender Equipped to Approve Loans In-House. Before taking the leap and opting to refinance homeowners. 5 Questions to Ask Your Mortgage Lender Before Refinancing Your Home 1.

How much money do I need to bring to closing On average homeowners can anticipate paying 2 to 3 of. We recommend that you make sure to ask your lender any and all questions. Then test your lenders knowledge by asking about the difference between the interest rate and APR how your monthly payment will change and whats on your Closing Disclosure.

What Is Your Average Loan Processing Time. In this case refinancing to a shorter term loan is an excellent opportunity to build equity faster while saving substantial interest money. The key is not to waste time.

Can I Build Equity And Pay Off My Mortgage Faster. In general 760 or above is an optimal credit score. Ask the lender about the best method of communication and how best to get them important follow-up information.

Ask the lender what their average loan processing time is. The higher your credit score the better your interest rate will be. What is the purpose of the refinance.

Before jumping into refinancing ask yourself these four questions to decide if it makes sense for you.

Questions To Ask When Refinancing A Home Mathis Title Company

Questions To Ask When Refinancing A Home Mathis Title Company

4 Key Questions To Ask Now Before You Refinance Your Mortgage

4 Key Questions To Ask Now Before You Refinance Your Mortgage

8 Questions You Should Ask Before Refinancing Your Mortgage Youtube

8 Questions You Should Ask Before Refinancing Your Mortgage Youtube

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Should You Refinance Your Mortgage Yes Or No Diamond Cu

Should You Refinance Your Mortgage Yes Or No Diamond Cu

Ask These 5 Questions Before Refinancing Your Mortgage Fox Business

Ask These 5 Questions Before Refinancing Your Mortgage Fox Business

10 Questions To Ask When Refinancing Rocket Mortgage

10 Questions To Ask When Refinancing Rocket Mortgage

6 Crucial Questions To Ask When Refinancing Your Home Loan Complete Controller

6 Crucial Questions To Ask When Refinancing Your Home Loan Complete Controller

17 Questions To Ask Your Mortgage Lender Mintlife Blog

17 Questions To Ask Your Mortgage Lender Mintlife Blog

Questions To Ask Before Refinancing Your Mortgage Bankrate

Questions To Ask Before Refinancing Your Mortgage Bankrate

Mortgage Refinance Checklist Everything You Need To Refinance Your Home Pdf Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Refinance Checklist Everything You Need To Refinance Your Home Pdf Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Questions To Ask Before Refinancing

Questions To Ask Before Refinancing

5 Questions To Ask Before You Refinance Your Mortgage Christian Community Credit Union

5 Questions To Ask Before You Refinance Your Mortgage Christian Community Credit Union

Refinancing Questions To Ask Your Mortgage Broker Mortgage Corp

Refinancing Questions To Ask Your Mortgage Broker Mortgage Corp

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.