An annual percentage rate or APR is the price you pay for borrowing money stated as a yearly interest rate. This rate is applied each month that an outstanding balance is present.

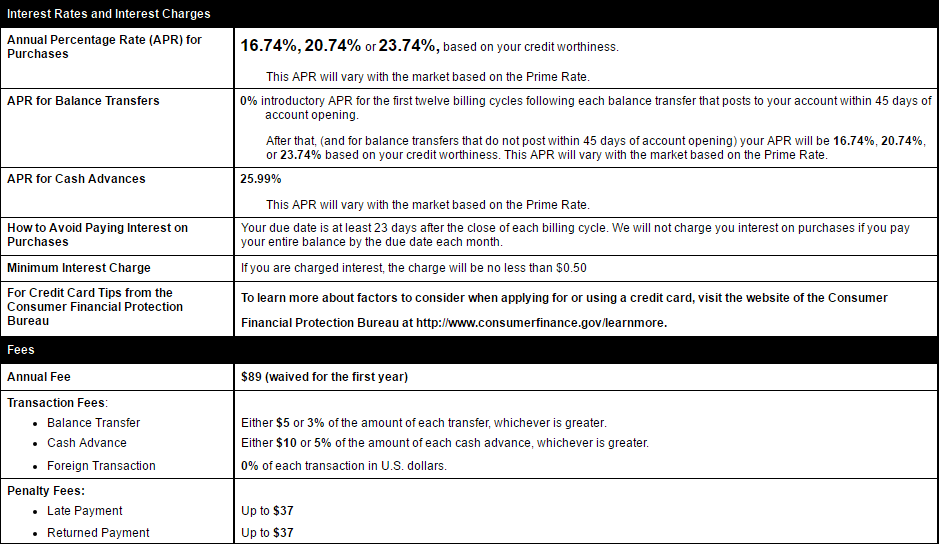

Youll find a list of all the APRs for a credit card in the credit card disclosure.

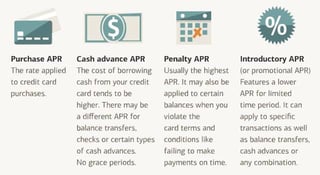

Annual percentage rate credit card. An annual percentage rate APR is the annual rate charged for borrowing or earned through an investment. Here are the most common types of interest rates youll find on credit cards. For credit cards interest rate and APR for purchases are essentially the same thing.

Annual percentage rate is significant because it is used to determine your daily interest rate which is what is used to calculate your interest payments. If you have an excellent credit profile penalty APRs can be more than 15 percentage points higher than what you were originally offered on your card. We would divide 20 by 365 the number of days in a year to convert this APR into a daily interest rate.

Knowing what an APR is how its calculated and how its applied can help you make more informed credit card decisions. It takes into account interest as well as other charges you may have to pay such as an annual fee. This is called the annual percentage rate APR.

With credit cards interest rates are calculated as a percentage of your balance and shown as an annual percentage rate APR. You may have seen the term APR or annual percentage rate used in reference to everything from mortgages and auto loans to credit cards. For example a card could have a purchase interest rate of 899 APR while a different card could have a purchase interest rate of 1999 APR.

Rates effective April 1 2021. The annual percentage rate APR is the interest rate charged on credit card balances expressed in a standardized annualized way. Types of credit card interest rates.

Calculate your APR annual percentage rate for each billing period by adding in all of the finance charges you paid that month including interest on all balances balance transfer fees and other transaction fees. A credit cards APR or annual percentage rate quantifies the cost of taking out credit. The credit card rate is expressed as an APR or annual percentage rate.

For credit cards the interest rates are typically stated as a yearly rate. The average credit card interest rate is 1615. For illustrative purposes lets take a 1000 balance and 20 APR scenario.

In this piece we look at credit card APRswhich youve probably seen listed on your monthly statements. Compare cards that offer an introductory 0 APR here. Credit card annual percentage rates commonly known as APRs determine how much youll pay in interest if you carry a balance on your credit card.

Visa Platinum III. Depending on how you manage your account your effective interest rate. Your cards APR can vary depending on a few.

A credit cards interest rate is the price you pay for borrowing money. Divide that dollar amount by the number of days in your billing cycle. As a result the national average card APR remained at a one-year high for the third straight week.

Financial institutions must disclose a financial instruments APR before any agreement is. The interest rate currently being applied to your balances is on your billing statement along with each balance. APR stands for Annual Percentage Rate and is the cost of borrowing money over a year on a credit card or loan.

Visa Platinum II. When youre looking at potential credit cards or loans you may see representative APR advertised. Given that lenders offer different.

On most cards you can avoid paying interest on purchases if you pay your balance in full each month by the due date. If your credit card has an annual percentage rate of say 18 that doesnt mean you get charged 18 interest once a year. This credit card program is no longer available to NEW applicants.

APR Annual Percentage Rate Visa Platinum I. The penalty or default interest rates are at least five percentage points higher than the worst APRs youd normally see on credit cards. For example if your credit card interest rate is 1299 percent per year your daily rate is 0356 percent.

In other words if you carry a balance beyond your credit cards grace period your APR will determine.

How To Calculate Annual Percentage Rate 12 Steps With Pictures

How To Calculate Annual Percentage Rate 12 Steps With Pictures

What Is Apr Annual Percentage Rate Guide For 2021

What Is Apr Annual Percentage Rate Guide For 2021

10 Things You Should Know About 0 Apr Credit Cards Seek Business Capital

10 Things You Should Know About 0 Apr Credit Cards Seek Business Capital

What Is Apr Understanding How Apr Is Calculated Apr Types

What Is Apr Understanding How Apr Is Calculated Apr Types

How To Calculate Apr On A Credit Card 3 Easy Steps Cardrates Com

How To Calculate Apr On A Credit Card 3 Easy Steps Cardrates Com

Credit Card Due Calculation How Interest On Credit Card Due Is Calculated

Credit Card Due Calculation How Interest On Credit Card Due Is Calculated

What Is Apr On A Credit Card 9 Best Low Interest 0 Apr Cards

What Is Apr On A Credit Card 9 Best Low Interest 0 Apr Cards

How Do 0 Apr Credit Cards Work Everything You Should Know Valuepenguin

What Is A Good Apr For A Credit Card Experian

What Is A Good Apr For A Credit Card Experian

Apr Vs Interest Rate Surprising Differences Between The Two Numbers

Apr Vs Interest Rate Surprising Differences Between The Two Numbers

Facts About Annual Percentage Rate Laws Com

Facts About Annual Percentage Rate Laws Com

What Is Apr Understanding How Apr Is Calculated Apr Types

How To Calculate Annual Percentage Rate Investing Percentage Calculator

How To Calculate Annual Percentage Rate Investing Percentage Calculator

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.