Try to use as much free money as you can before you borrow. The federal student loan gives students much more flexibility and stability through multiple repayments reductions and.

Should Anyone Be Eligible For Student Loans Wsj

Should Anyone Be Eligible For Student Loans Wsj

There is no one-size-fits-all with how we advise people with student loans because of how complicated it can get says Scott Snider a certified financial planner and partner at Paragon Wealth Strategies in Jacksonville Fla.

Should i get a student loan. Student loans dont go on your credit report. And there is a loan for living costs too. You can also get a forbearance with federal student loans though the government will not pay the interest on your loans during forbearance.

3 Reasons Why You Should Get Student Loans for College. Typically courts will deny requests to discharge either federal or private student loans in bankruptcy. That being said any time you take out a student loan youre taking a blind risk on something that has potentially serious repercussions for your future.

While an educational loan represents an investment in your future a loan is a loan. Heres just a few reasons why student loans are a better system of borrowing than commercial debt. If youre getting ready to apply to college and dont have the funds to pay for your entire education you might think that taking out student loans is.

Since you will be borrowing the money you will have to repay it. But as usual your best option really depends on your own unique situation. Updated February 12 2020.

If you can get into a top their business school but cant pay for it. There is a grace period of six months after a student graduates for federal student loans. However the degree you get with the loan needs to be able to pay you back and then some.

Of course you dont have to take the loans you could pay the tuition fees directly. If you are looking to get a private student loan it is most likely that you have already heard of Sallie Mae. Student loan repayments are proportionate to income.

Its all about the payback period. With interest rates at record lows it is a great time for borrowers with existing federal loans to consider refinancing. You can accept all some or none of the federal student loans youre offered.

For example if you can get into an Ivy League school but cant pay for it. Taking out loans gives students a reality check even if the loans are small. Although federal student loans are often the most affordable way to borrow they may not be enough to cover all of your college costs.

Even though the average amount of debt owed by college students is just shy. Full-time students only need to start repaying these loans at the earliest in the April AFTER they graduate or leave no matter how long their course is. Student loan borrowers should be aware that president Joe Biden and his administration have proposed numerous policies that address the student loan.

Federal Student Aid. If you expect to earn an annual salary of 50000 your student loan payments shouldnt be over 279 a month which means you can borrow about 26000 at. If you need to pay for college taking out a student loan may be unavoidable.

Its important to know that youre under no obligation to accept all the federal student loan money made available to you. Sallie Mae offers competitive private student loan interest rates as well as consolidation options for graduates. Student loans are a blind risk.

While every students situation will vary all students should really consider taking out a federal loan first before taking out private loans. However if you apply for a mortgage lenders may. Borrowers with private student loans should refinance if they can qualify for a lower interest rate says Kantrowitz.

However as a servicer reviews are generally below average and focus on the lack of. In addition to a lower monthly payment it also means less interest paid at the end of the loan. Private student loans on the other hand are much harder to discharge than other consumer debts.

If you lose your job or take time off so youve no income you dont need to repay student loans. The filer must appeal the denial and prove undue hardship to. Your award letter may also include scholarships or grants which is genuinely free money you never have to pay back.

This means they will need. Student loans are different from other types of borrowing because they do not appear on your credit file and your credit rating is not affected. Private student loans as well as grants and work-study.

Yet as Ill explain thats often a bad idea. Unsubsidized federal student loans are.

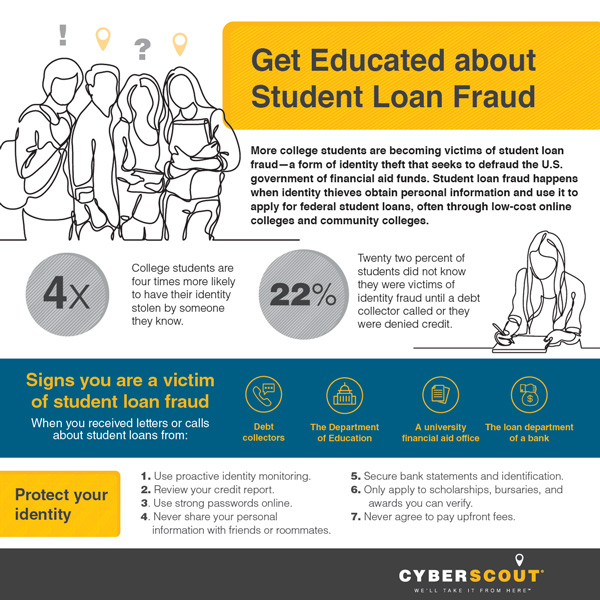

Student Loan Fraud Fraud Report Diamond Cu

Student Loan Fraud Fraud Report Diamond Cu

8 Common Student Loan Mistakes Ed Gov Blog

8 Common Student Loan Mistakes Ed Gov Blog

Should I Pay Off Student Loans Or Save Money For The Future Cccu

Should I Pay Off Student Loans Or Save Money For The Future Cccu

Student Loans Ftc Consumer Information

Student Loans Ftc Consumer Information

Why Biden Should Forgive Student Loan Debt Fourth Estate

Should I Refinance My Student Loans

Should I Refinance My Student Loans

5 Things To Do Before Making Your First Student Loan Payment Ed Gov Blog

5 Things To Do Before Making Your First Student Loan Payment Ed Gov Blog

Should You Save Or Pay Off Student Loans Early

Should You Save Or Pay Off Student Loans Early

3 Options To Consider If You Can T Afford Your Student Loan Payment Ed Gov Blog

3 Options To Consider If You Can T Afford Your Student Loan Payment Ed Gov Blog

Should Anyone Be Eligible For Student Loans Wsj

Should Anyone Be Eligible For Student Loans Wsj

How To Pay Off Your Student Loans After Graduating Cccu

How To Pay Off Your Student Loans After Graduating Cccu

Five Things To Know About Your Student Loans Ed Gov Blog

Five Things To Know About Your Student Loans Ed Gov Blog

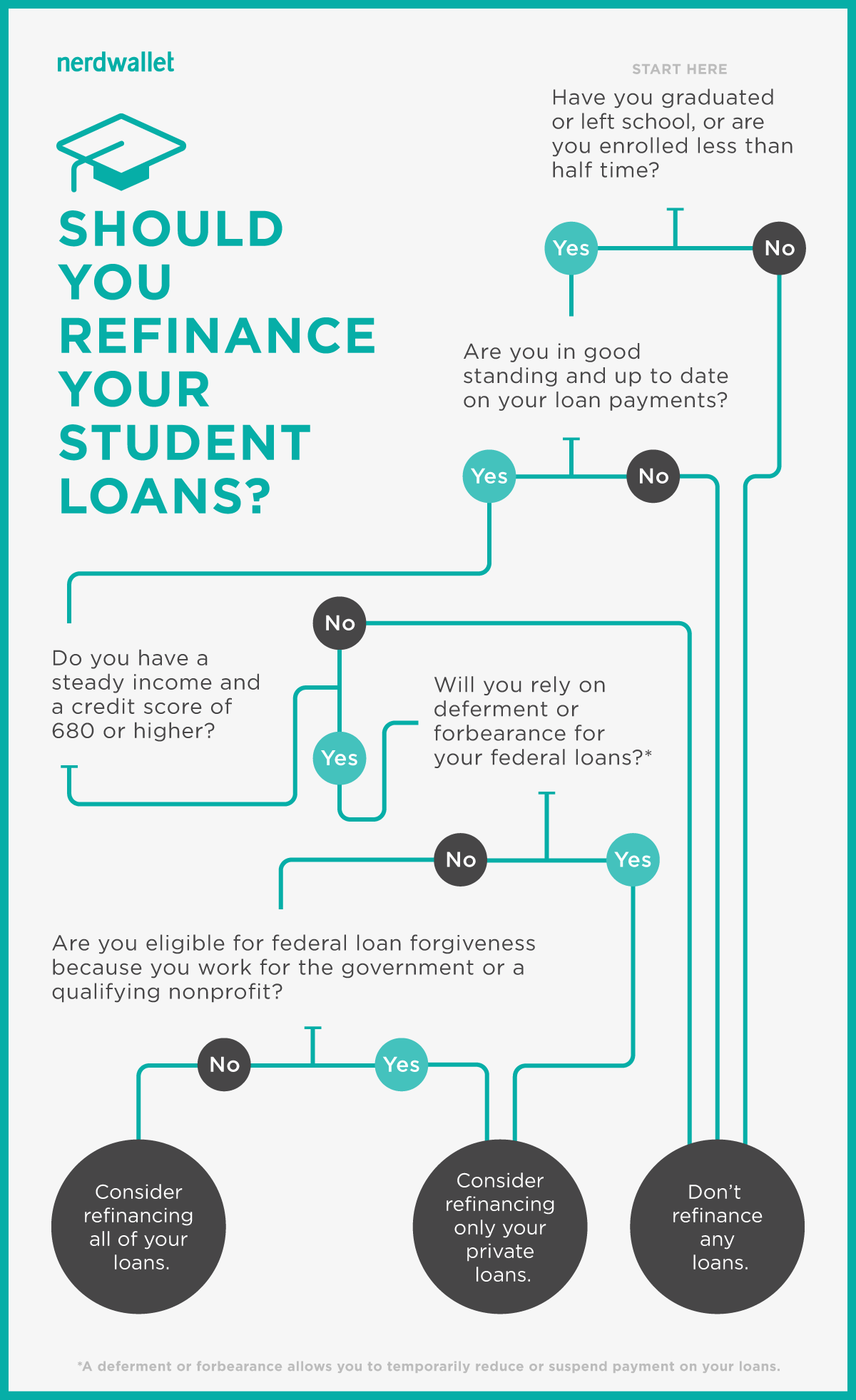

Infographic Should You Refinance Your Student Loans

Infographic Should You Refinance Your Student Loans

When Student Loan Debt Can Be Good

When Student Loan Debt Can Be Good

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.