You will have 2409mo left to spend. You can afford 1691mo Based on your income a rental at this price should fit comfortably within your budget.

Pay Rent How To Budget For An Apartment Get Roommates

Pay Rent How To Budget For An Apartment Get Roommates

So if you have a 35000-a-year job the maximum rent you can afford is 875 per month.

How much can i pay for rent. Enter the monthly rent and we will tell you what your Gross total income should be. If you use the additional options we deduct the rent from your income and subtract your debt expenses and savings from the remaining money depending on which fields you. The 30 threshold a trusted rule of thumb details that you should spend approximately 30 of your gross income on rent.

Use this slider to see how spending more or less on rent affects your budget. Gross annual income 000. Rental income tax breakdown Your rental earnings are 18000 You can claim 3600 as rental expenses.

That amount could be different from the price you originally paid for your home. Enter in your total Gross annual income below and click Calc Rent and we will tell you how much rent you can afford. Divide that number 12000 by 12 months.

For example if your gross monthly income is 5000 the maximum you should be paying for rent is 1500 30 of 5000 is 1500. Say you make 40000 a year multiply that by 30 or the equivalent of 03 to get how much you can spend on rent per year. Apartment communities look for an annual income that is 40 times your monthly rent.

Actual tax rates vary. 26 Zeilen Monthly Rent Applicant Minimum Salary Guarantor Minimum Salary. About the Rent Calculator.

The rule-of-thumb for renting is that your rent should be around 30 of your income. When youre trying to determine how much rent to charge there are a number of things youll need to think about. To calculate how much rent you can afford we multiply your gross monthly income by 20 30 or 40 based on how much you want to spend.

These necessities include expenses such as. Landlords can set the right rental price first time and tenants can check what theyre likely. One of the most important factors regarding rent is the actual rent amount and whether or not it is affordable.

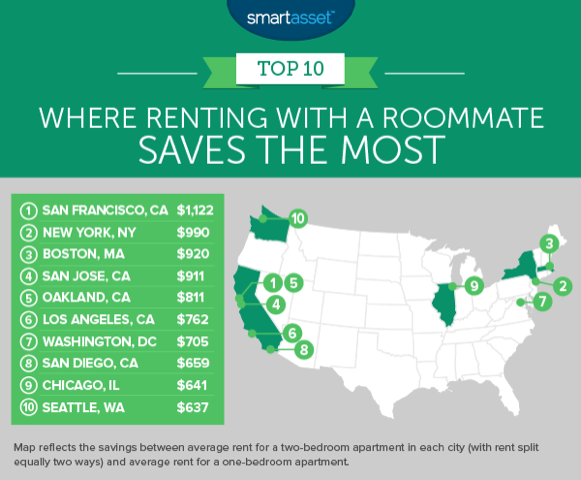

That means if you make 2000 a month you should spend up to 600 a month on rent. If you live in San Francisco where the average rent for a two-bedroom apartment is 4542 per month or New York City where the average is 3726 your rent will be outrageously expensive. Some people think a front-end debt-to-income ratio of 25 is considered affordable.

A good first step is figuring out what your homes currently worth in the market. Although this rule works for many renters its not necessarily the correct percentage for everyone. This may be higher or lower depending on the other expenses you have such as any debt payments you need to make.

As a general rule you should spend no more than 30 of your monthly income on rent. Affordable is a relative term and carries a different meaning for different people. You can use the slider to change the percentage of your income you want spend on housing.

To calculate how much you should spend on rent youd simply multiply your gross income by 30. Our team of data scientists have created the most advanced way to find how much rent to charge for any house or flat in the UK. If you make 6000 per month your rent should be no more than 1500 per month.

The general rule of thumb is to spend around 30 of your income on rent. On a 50000 a year salary your ideal rent price is 1250 On a 75000 a year salary your ideal rent price is 1875 On a 100000 a year salary your ideal rent price is 2500 As mentioned before the 30 rule should act as a rule of thumb. As a result your taxable rental income will be.

Determining how much you should spend on rent comes down to your monthly budget and income. How much rent can I afford. So to help you budget effectively we created this handy rent calculator.

Using a huge range of data points you can now find average rent by postcode in just a few seconds. You could use a website like Zillow to estimate your homes value. But it might be best to find a home.

The general rule is that your monthly apartment rent excluding utilities should not exceed 30 of your gross monthly income. When you want to calculate how much rent you can afford it is best to start with your net income. Use the formulas in this rent calculator to come up with an effective plan to see how much to spend on rent for your next apartment.

Others look for 30 of your monthly income but in reality these two methods are just two different mathematical ways to get to the same place. Calculate rent by taking 30 of your salary and start to check if that rent is realistic in your area. The cost of rent really depends on your location.

Be sure to include other costs like moving expenses broker. The cost of your groceries per month Your utility bills like your phone bill water and electricity The cost of renters insurance Drivers insurance Health dental insurance And of course how much you should spend on rent. There are many methods for determining what is considered affordable rent and the calculator is simply one method that may help.

Apartment How Much Can I Afford Apartment Post

Apartment How Much Can I Afford Apartment Post

How Much Rent Can I Afford What To Consider Before Signing That Lease

How Much Rent Can I Afford What To Consider Before Signing That Lease

Money Finance Rent Blog Apartment Hunting Apartment Checklist Dream Apartment

Money Finance Rent Blog Apartment Hunting Apartment Checklist Dream Apartment

How Much Rent Can You Afford Ohmyapartment Apartmentratings

How Much Rent Can You Afford Ohmyapartment Apartmentratings

The 5 Most And Least Expensive States And Cities For Renters Earnest

The 5 Most And Least Expensive States And Cities For Renters Earnest

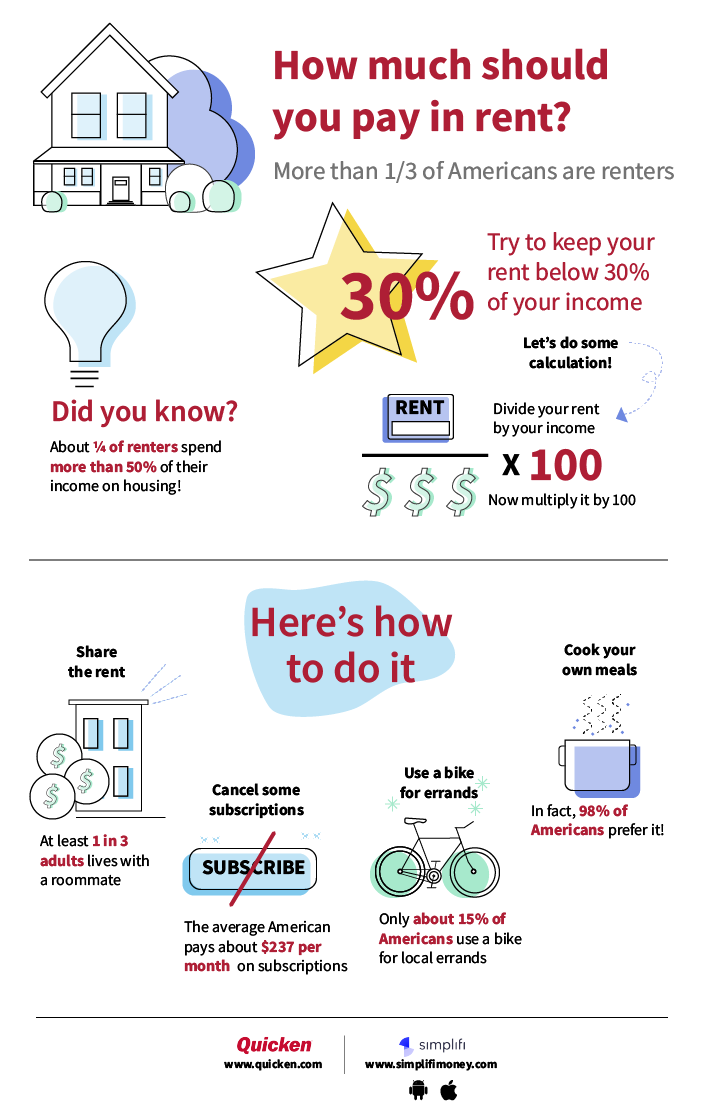

How Much Should You Spend On Rent Quicken

How Much Should You Spend On Rent Quicken

/how-much-will-section-8-pay-landlords-2124978-v2-5bc4bfd8c9e77c00528fe1f6.png) How Much Section 8 Will Pay A Landlord

How Much Section 8 Will Pay A Landlord

How Much Should I Spend On Rent Nerdwallet

How Much Should I Spend On Rent Nerdwallet

How Much Rent Can I Afford Rent Calculator

How Much Rent Can I Afford Rent Calculator

How Much Rent Can I Afford Rent Affordability Calculator Best Property Management Company San Jose I Intempus Realty Inc

How Much Rent Can I Afford Rent Affordability Calculator Best Property Management Company San Jose I Intempus Realty Inc

How Much Rent Can I Afford On My Hourly Pay My First Apartment

How Much Rent Can I Afford On My Hourly Pay My First Apartment

How Much Rent Can I Afford Renthop

How Much Rent Can I Afford Renthop

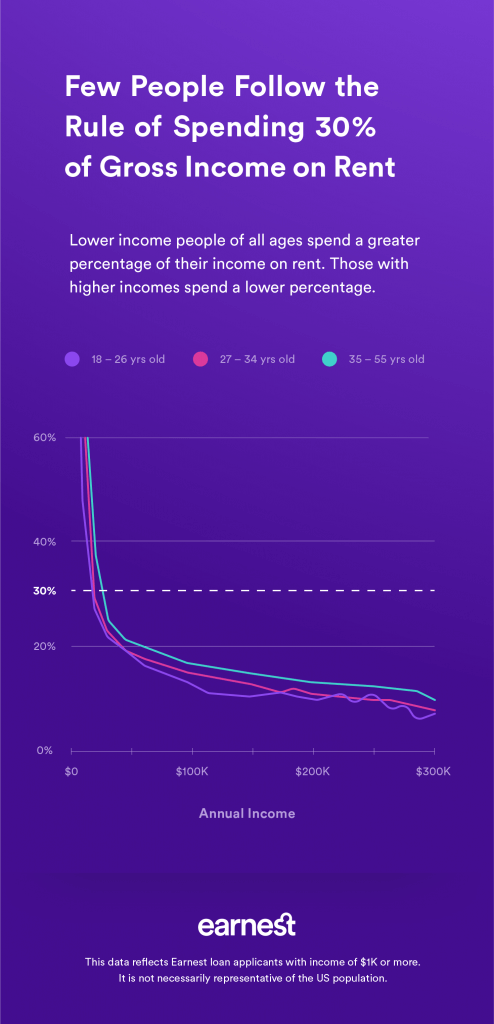

How Much Should I Spend On Rent Ignore The 30 Percent Rule Earnest

How Much Should I Spend On Rent Ignore The 30 Percent Rule Earnest

Here S How To Figure Out How Much Home You Can Afford

Here S How To Figure Out How Much Home You Can Afford

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.