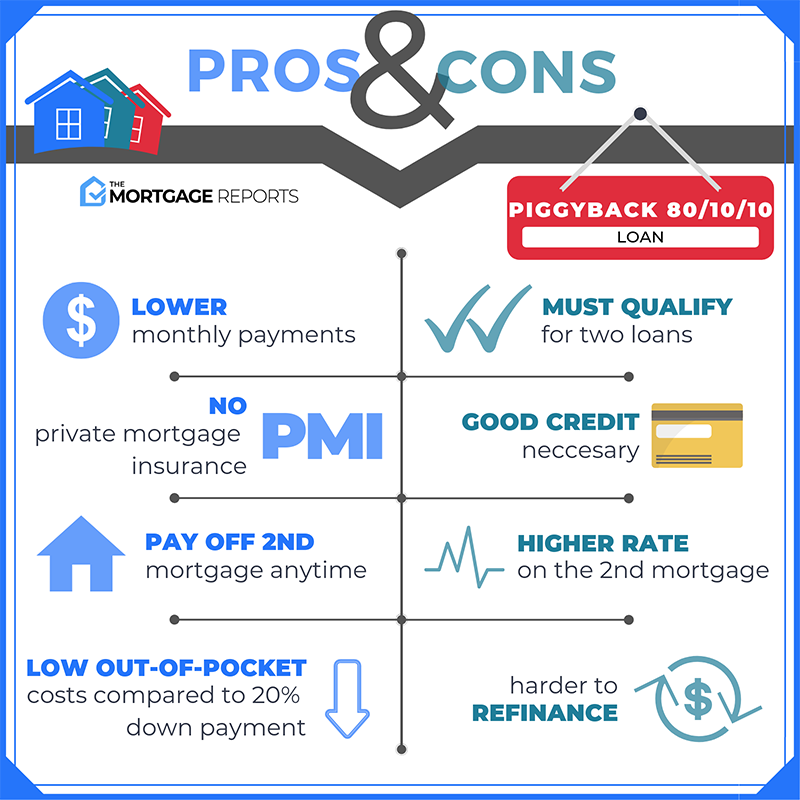

The first mortgage must be capped at 80 percent of the homes value to avoid PMI and a second mortgage will usually allow for another 10percent financing on top of this for a total of 90. If you do this you wont have mortgage insurance on any loan.

How To Avoid Pmi Know Your Options U S Mortgage Calculator

How To Avoid Pmi Know Your Options U S Mortgage Calculator

Another way to avoid PMI is to use a second mortgage.

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance1-f53f53e537a14a069144d763f621795b.png)

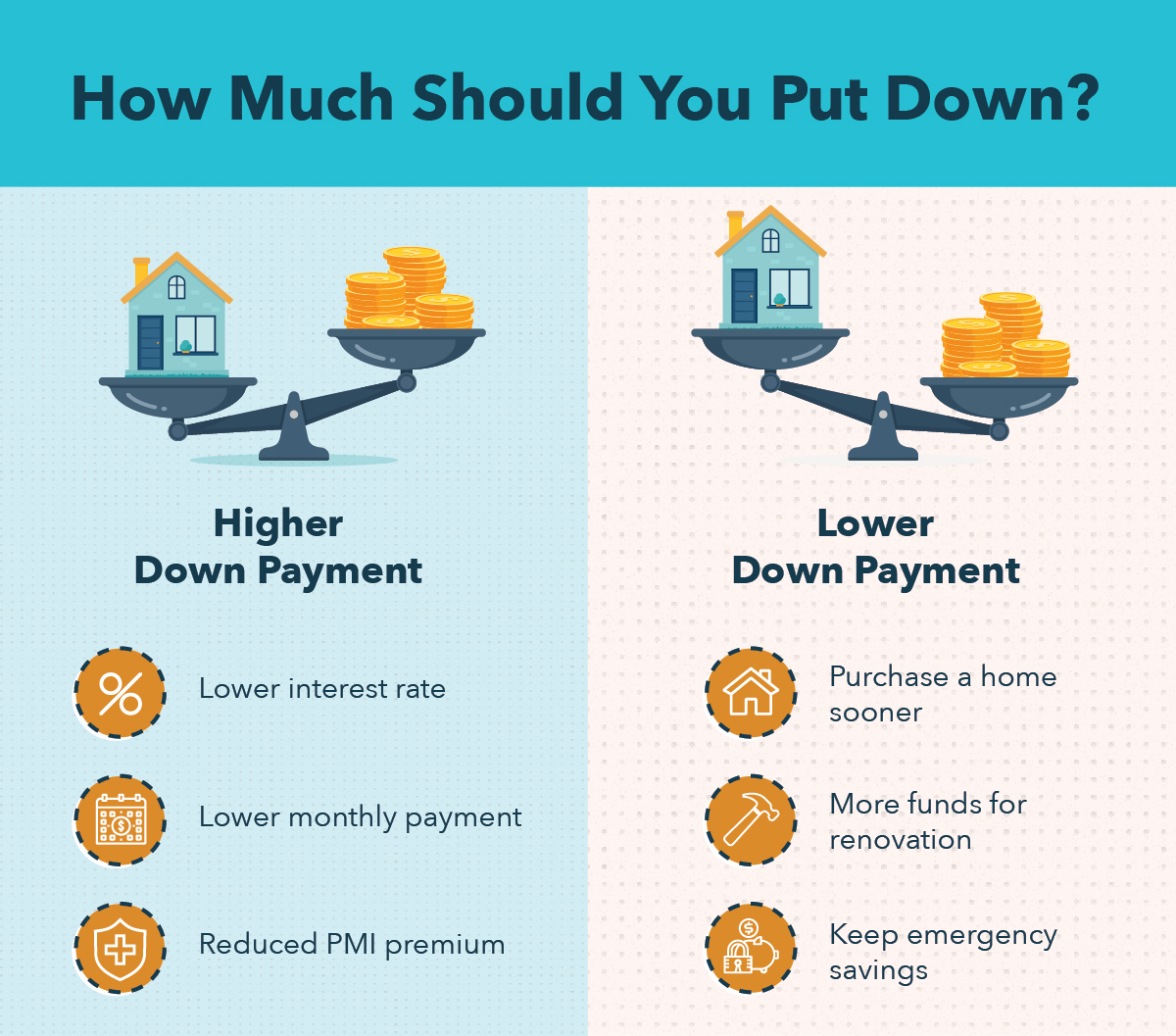

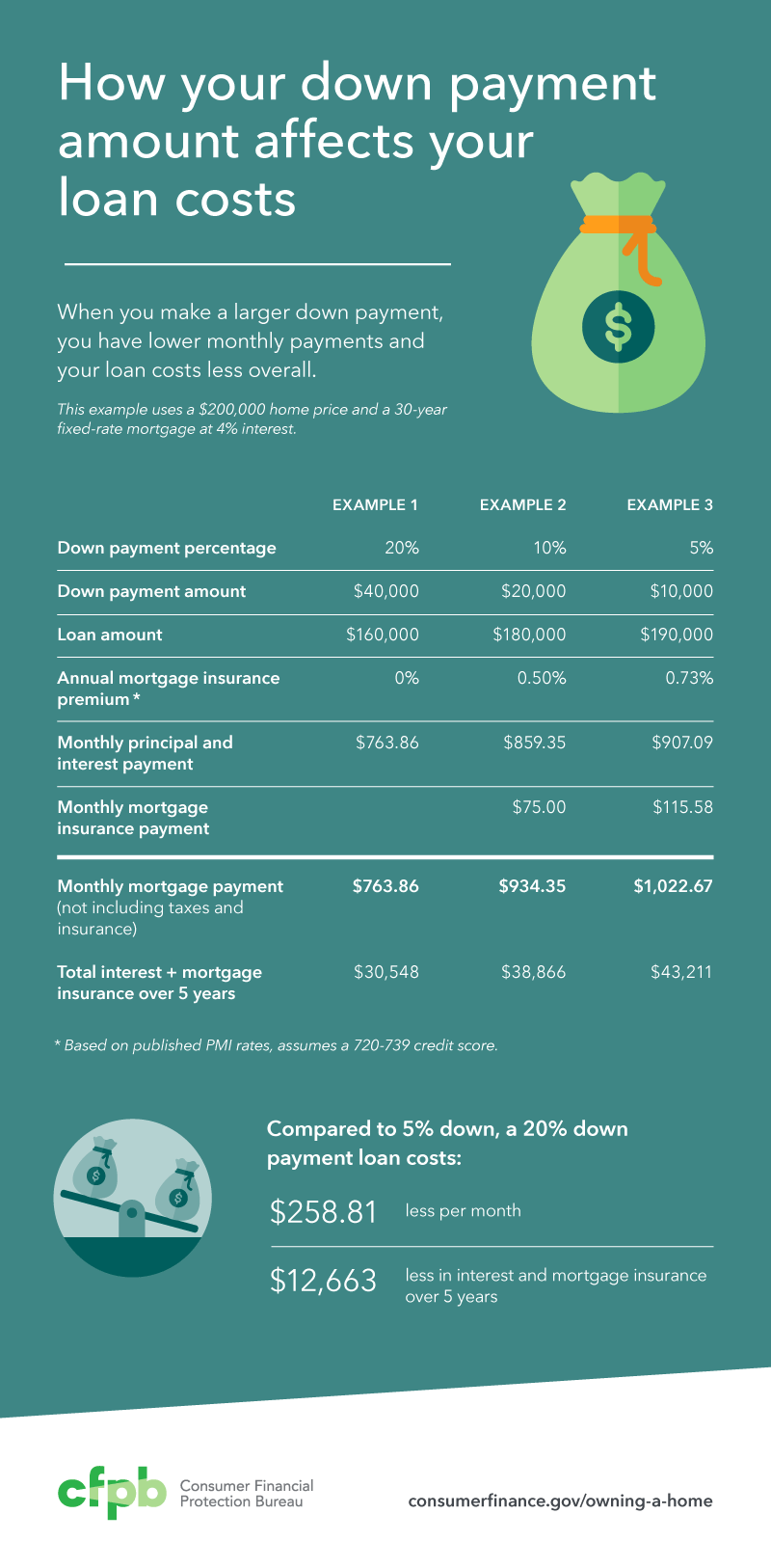

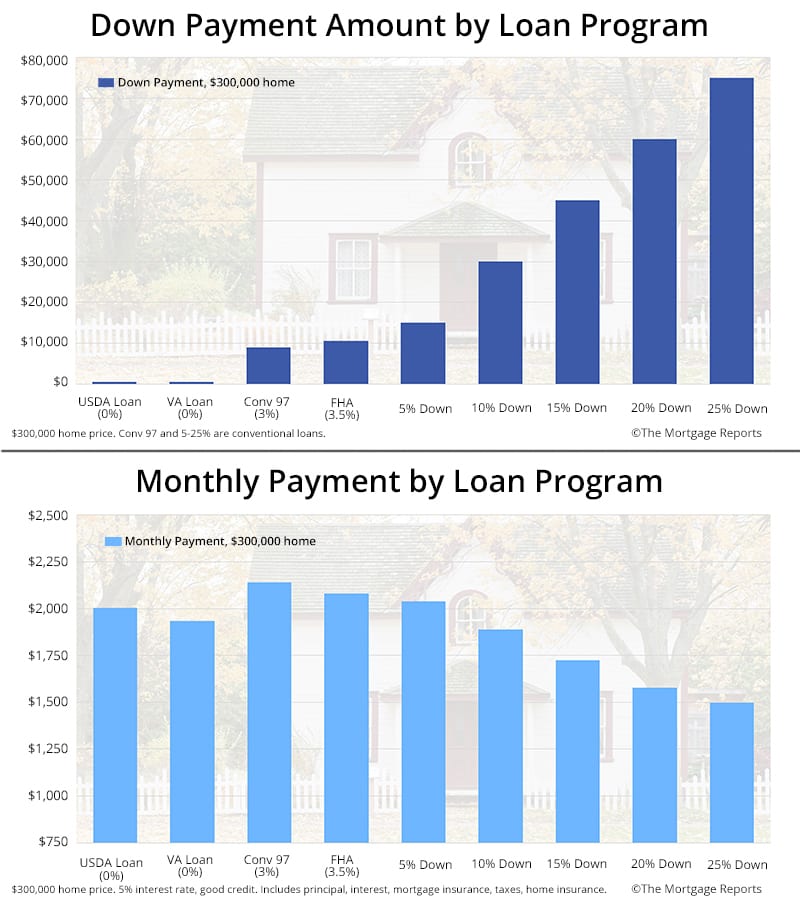

How much down payment to avoid pmi. For conventional loans making a 20 percent downpayment will remove the necessity for PMIBut people really need to examine their own finances and see whether unloading all of their savings into a down payment is a smart move compared to putting down a. 15 more than the buyer who chose PMI. Despite the pandemic and the financial risks it poses many banks and other lenders are still offering loan programs with minimal down payment requirementsranging from 3 to 10 typically.

Some require no down payment at all. The buyer chose to avoid PMI. One way to avoid paying PMI is to make a down payment that is equal to at least one-fifth of the purchase price of the home.

Before buying a home you should ideally save enough money for a 20 down payment. In that event if you can only put up 5 percent down for your mortgage you take out a second piggyback mortgage for 15 percent of the loan balance and combine them for your 20 percent. Increase Your Down Payment.

Instead he or she opts for a 20 down payment. In mortgage-speak the mortgages loan-to-value LTV ratio is 80. PMI was created to allow home buyers to get loans even if their down payment was below the 20 threshold.

The combined mortgages only have a payment advantage of 85 for 12 months. So the simplest way to avoid PMI is to put 20 percent down when purchasing a home. If your new home costs 180000 for example you would need to put down at least 36000 to avoid paying PMI.

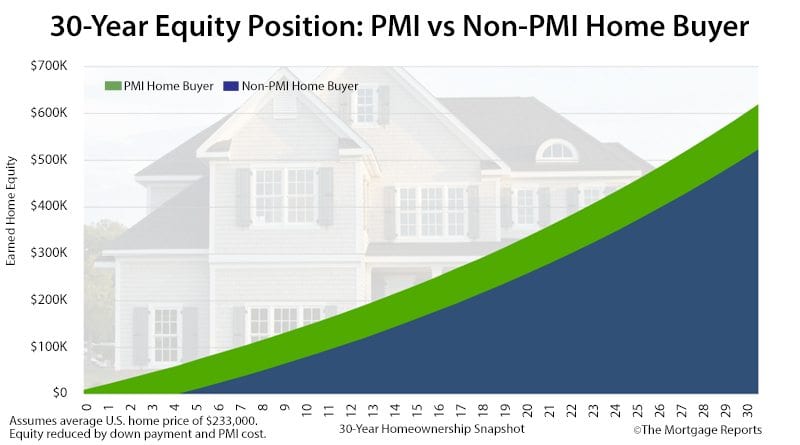

If a borrower gets an FHA loan and puts 5 down they would be required to pay PMI. In my native San Francisco the San Francisco Federal Credit Union has a program they call POPPYloan which enables VERY high earning households to finance up to 100 of their home purchase up to 2 million. The appeal to avoiding PMI payments is monthly payments will be lower.

Even if private mortgage insurance is required to. This equals a total savings of 1020. In the Tale of Three Mortgages increasing the down payment from 3 percent to 10 percent saves the borrower.

With rapid home price appreciation PMI can be eliminated relatively quickly. Larger down payments bring several advantages. One way to avoid paying PMI is to make a down payment that is equal to at least one-fifth of the purchase price of the home.

The buyer has some saving. Is PMI required by law. The easiest way to avoid PMI is by making a down payment of 20 percent or more.

You can reduce or eliminate your PMI costs save on mortgage interest because youre financing less and reduce your mortgage costs because a lower loan-to-value ratio makes you a more desirable borrower. Typically youll need to make a 20 down payment to avoid PMI on a conventional mortgage. You can avoid paying for private mortgage insurance or PMI by making at least a 20 down payment on a conventional home loan.

If youre looking for ways to avoid PMI on your first home purchase there are a variety of methods out there but beware that many of these might actually cost you more in the long run. How to Avoid Paying PMI. In June 2010 the median home price in the Bay Area was 465000 meaning the median down payment needed to avoid.

The traditional way to avoid paying PMI on a mortgage is to take out a piggyback loan. In mortgage-speak the mortgages loan-to-value LTV ratio is 80. If waiting almost five-years sounds crazy a low-down-payment program like the Mirandas used might be the answer.

Unlike the continental US adjustments to the cost of premiums based on loan amount begin at 625000 instead of 417000 in Alaska and Hawaii. The mortgage industry holds the 20 percent down payment as the standard for a home loan that can be approved without the backing of a government program or the payment of private mortgage. 4 Zeilen Piggyback loans are a little-known type of mortgage that can be a great way to avoid PMI with.

The easiest way to avoid PMI is by using a lender that doesnt require it for down payments below 20. If you cant its a safe bet that your lender will force you to.

Down Payments Explained How Much Should You Pay Mint

Down Payments Explained How Much Should You Pay Mint

How To Avoid Pmi With Less Than 20 Down Jvm Lending

How To Avoid Pmi With Less Than 20 Down Jvm Lending

How To Avoid Pmi When Buying A Home Nerdwallet

How To Avoid Pmi When Buying A Home Nerdwallet

Mortgage Insurance Cost Versus Benefits Should You Pay For Pmi Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Insurance Cost Versus Benefits Should You Pay For Pmi Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How To Decide How Much To Spend On Your Down Payment Consumer Financial Protection Bureau

How To Decide How Much To Spend On Your Down Payment Consumer Financial Protection Bureau

/choosing-a-down-payment-315602-Final-21f6f43a49084466afd65a24f1d288b9.png) Down Payments How They Work How Much To Pay

Down Payments How They Work How Much To Pay

Reasons To Use A Piggyback Loan 80 10 10 Loan Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Reasons To Use A Piggyback Loan 80 10 10 Loan Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Understanding Pmi Private Mortgage Insurance We Sell Oklahoma

Understanding Pmi Private Mortgage Insurance We Sell Oklahoma

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance1-f53f53e537a14a069144d763f621795b.png) How To Outsmart Private Mortgage Insurance

How To Outsmart Private Mortgage Insurance

How Much Should You Put Down On A House Not 20

How Much Should You Put Down On A House Not 20

How Big A Down Payment Do You Need To Avoid Pmi Money

How Big A Down Payment Do You Need To Avoid Pmi Money

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance4-032e9dfa86f4428395ca45cbb2628baf.png) How To Outsmart Private Mortgage Insurance

How To Outsmart Private Mortgage Insurance

What Is Pmi And How Can I Get Rid Of It

What Is Pmi And How Can I Get Rid Of It

/whatisprivatemortgageinsurance-38fc97c7df3f4d9a9f5bad519ed8c5f5.png) Private Mortgage Insurance Pmi What Is It

Private Mortgage Insurance Pmi What Is It

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.