Three days before you close youll get a Closing Disclosure with final costs. A Wells Fargo FL closing costs.

Wells Fargo Mortgage Refinance Rates Today S 15 30 Year Wellsfargo Rates

Wells Fargo Mortgage Refinance Rates Today S 15 30 Year Wellsfargo Rates

The company estimates that the monthly payment will be.

Wells fargo refinance closing costs. If you plan to stay in your home that long refinancing may be. The buyer or person assuming the loan must meet credit and income qualifications and provide requested documentation. If you are a service member on active duty prior to seeking a refinance of your existing mortgage loan please consult with your legal advisor regarding the relief you may be eligible for under the Servicemembers Civil Relief Act or applicable state law.

PhotoFlickr Other considerations with a streamline refinance. Wells Fargo Will Let You Refinance For No Closing Costs Online 52009 333 PM EDT By Phil Villarreal mortgage online banking advice wells-fargo homes refinancing runaround. For example if you pay 2000 in closing costs and your new loan payment is 100 less youll need to be in your home at least 20 months to break even.

One of the best features of a Wells Fargo streamline refinance is the reduced paperwork and fees associated with a refinance. The terms for Wells Fargos fixed-rate loans are quite flexible from 10-30 years and it offers five different terms for its fixed-rate loans whereas most lenders only offer two. At closing the Bank of America loan includes 0611 discount points.

Learn about cash-out refinance mortgages and find out if accessing your home equity is right for you. If I have a Wells Fargo mortgage and want to refinance will I have to pay closing costs again. How to Get 100000 Credit Card Points with a New Home mortgage.

Knowing when to refinance is not an exact science however if you decide that this option suits your special monetary scenario there can be many benefits to re-financing your house. Were not positive were going to stay in this house for more than a couples years so it seemed like a good deal. Wells Fargo FL Mortgage Closing Costs Calculator estimator can help you estimate your total closing expenses.

Loan proceeds coupled with 71 million of new sponsor equity were used to refinance 450 million of debt as well as fund 37 million of upfront reserve and pay 85 million of closing costs. The rate is 125 higher than what we could get doing a regular refinance but then we would have to pay closing costs. This is how it was explained to me by Wells Fargo but I was wondering if there were any hidden costs.

They can include fees paid to third parties such as an appraiser the title company and other closing expenses. If I have a Wells Fargo mortgage and want to refinance will I have to pay closing costs again. Wells fargo mortgage refinance no closing costs Compare Our Low Home Loan Rates Versus Other Lenders This home loan re-finance calculator figures your month-to-month savings and also compares your primary balance in years with and without refinancing.

You can do this by dividing your total closing costs by your monthly savings. Credits can help reduce your closing costs to limit the amount you have to pay out of pocket. While refinancing can decrease payments it can also extend your payment period and wear down cost.

Wells Fargo also offers closing cost credits for certain home buyers using the yourFirst mortgage. So if you are considering a no cost refinance it might have higher interest rates. Learn more about refinance rates lowering your monthly payment or converting to a fixed-rate loan.

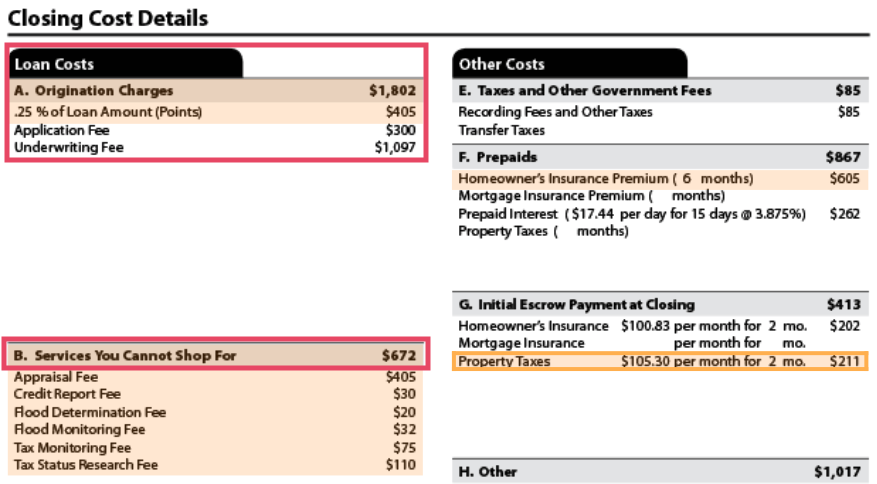

If you wind up refinancing say for 120000 you can now take the 20000 distinction in money and use it to pay for high-interest debt or for significant purchases house improvements and so on. There are fees to assume a loan including closing costs that must be paid separately from the mortgage. Typical mortgage closing costs covered in your Loan Estimate.

The Loan Estimate you receive after you apply is based on the information we have at the time and closing costs will vary with each loan. Check mortgage refinancing rates at Wells Fargo. FHA does not let lenders roll costs into the streamline loan.

There are costs related to processing any new loan application. Borrowers looking into Wells Fargo for their mortgage refinance should know that the bank will charge some fees for things such as mortgage insurance or a home appraisal though some of these may be waived. Wells Fargo offered an APR of 3458.

For more information or to determine eligibility call the Wells Fargo Assumption Department at 1-800-340-0570. They can include fees paid to third parties such as an appraiser the title company and other closing expenses. There are costs related to processing any new loan application.

Wells Fargo Home Mortgage is a division of Wells Fargo Bank NA. Refinance your mortgage with Wells Fargo. Wells Fargos underwritten loan-to-value LTV ratio of 491 percent indicates that the lender values the property at just under 927 million according to Fitch data.

Wells Fargo Mortgage Review For 2021 The Mortgage Reports

Wells Fargo Mortgage Review For 2021 The Mortgage Reports

How To Cover A Down Payment And Closing Costs In 2021 Benzinga

![]() Wells Fargo Mortgage Review 2020 Smartasset Com

Wells Fargo Mortgage Review 2020 Smartasset Com

Wells Fargo Mortgage Review For 2021 The Mortgage Reports

Wells Fargo Mortgage Review For 2021 The Mortgage Reports

Usaa Mortgage Review Smartasset Com

Usaa Mortgage Review Smartasset Com

Http Images Kw Com Docs 1 7 2 172761 1238518191245 Flyer Teachers Home Financing Program Pdf

Wells Fargo Mortgage Review 2020 Smartasset Com

Wells Fargo Mortgage Review 2020 Smartasset Com

The Hardest Mortgage Refinance Ever Key Takeaways

The Hardest Mortgage Refinance Ever Key Takeaways

Compare The Best Mortgage Rates Top 24 Lenders Ranked

Compare The Best Mortgage Rates Top 24 Lenders Ranked

Refinance Mega Thread Page 4 Bogleheads Org

Refinance Mega Thread Page 4 Bogleheads Org

Don T Get Stung By Mortgage Rate Lock Extension Fees Bankrate Com

Don T Get Stung By Mortgage Rate Lock Extension Fees Bankrate Com

Wells Fargo Personal Loans Are Competitive But Best For Customers

Compare The Best Mortgage Rates Top 24 Lenders Ranked

Compare The Best Mortgage Rates Top 24 Lenders Ranked

Mortgage Refinancing Wells Fargo

Mortgage Refinancing Wells Fargo

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.