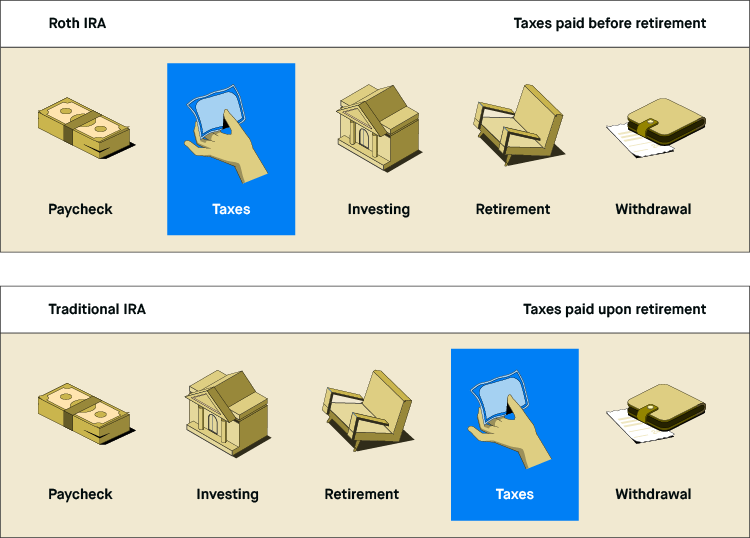

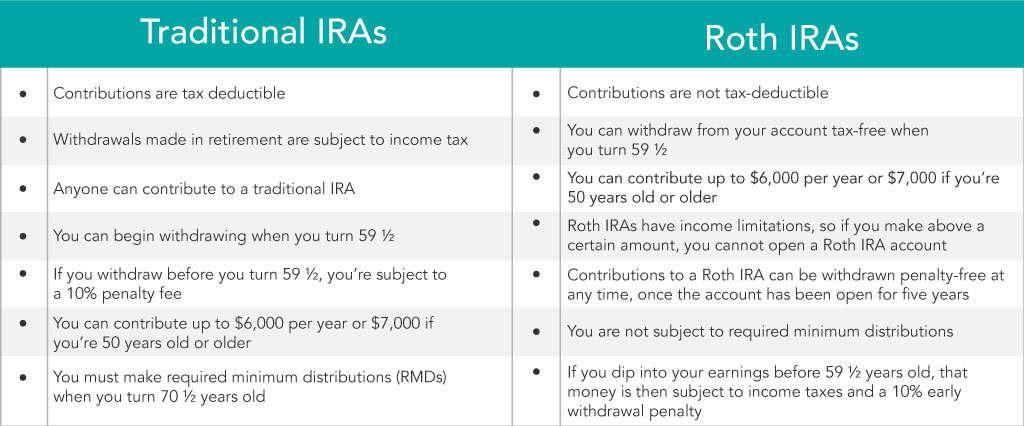

The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting a tax reduction for contributions to the retirement plan qualified withdrawals from the Roth IRA plan are tax-free. When choosing a brokerage to house an existing rollover or new IRA account it is important to consider the accounts costs available investments and other key features.

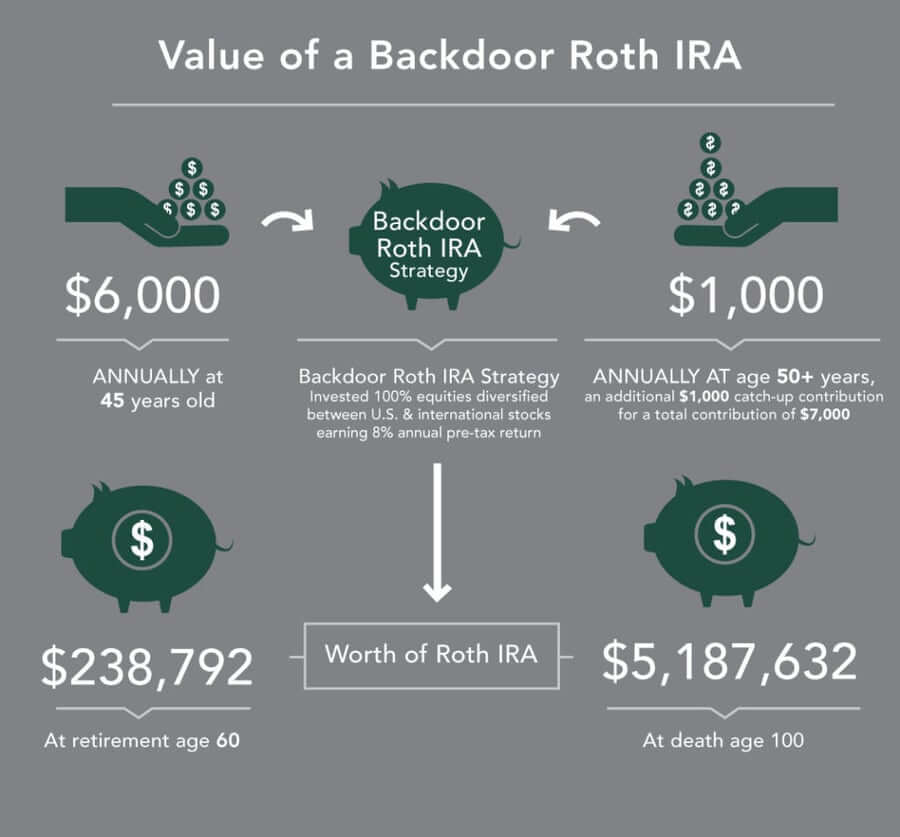

What You Should Know About Backdoor Roth Iras Vs Brokerage Accounts

What You Should Know About Backdoor Roth Iras Vs Brokerage Accounts

What is the difference between a Traditional and Roth IRA.

What's an ira account. You can invest in almost anything using an IRA so its best to think of an IRA like a special. What is an Individual Retirement Account IRA. There are two main types of IRAs.

If one spouse works. An IRA is a type of investment account with tax benefits that can help you save for retirement. Its a magic bullet for savers who want to use money theyve already paid taxes on to.

An individual retirement account IRA allows you to save money for retirement in a tax-advantaged way. An IRA is an account set up at a financial institution that allows an individual to save for retirement with tax-free growth or on a tax-deferred basis. However the earnings within the account wont be taxed until they are withdrawn from the account.

The spousal IRA however is an exception to this rule. A lot of people mistakenly. The basic idea is that you place your own money into an IRA account and use the money later in life during retirement.

Generally you cant contribute to an individual retirement account IRA unless you earn an income in a given year. A nondeductible IRA contribution is not eligible for a tax deduction. The Roth IRA has often been called the holy grail of retirement accounts and there are good reasons why.

A Roth IRA is an individual retirement account IRA under United States law that is generally not taxed upon distribution provided certain conditions are met. An individual retirement account IRA is a tax-advantaged investment account individuals use for retirement savings. An IRA is a type of retirement savings account that lets you save money that you plan to use when you retire.

A Merrill financial advisor can help you establish retirement savings strategies designed to pursue your individual goals. An individual retirement account IRA is an investment vehicle to hold your investments. If your IRA is the vehicle then your investments are the passengers The IRA holds your investments and shelters them from taxes while providing other benefits.

IRA stands for Individual Retirement Account and its basically a savings account with big tax breaks making it an ideal way to sock away cash for your retirement. There are many types of IRAs including IRAs. Traditional and Roth IRAs.

An Individual Retirement Account IRA is a tax-advantaged account that can help you enhance your total financial picture and potentially build wealth for retirement. An Individual Retirement Account IRA is designed to help you save for retirement and take advantage of tax benefits. An IRA Individual Retirement Arrangement is a retirement account you can use if you have earned income that offers tax benefits.

Based on the features most important to the typical retirement investor we compared the 19 different brokers to find the best IRA accounts available today.

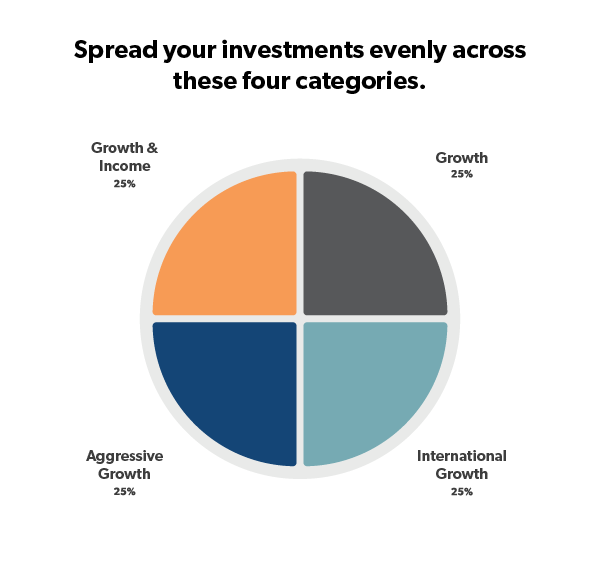

How To Start A Roth Ira Ramseysolutions Com

How To Start A Roth Ira Ramseysolutions Com

Roth Ira Or Traditional Ira Or 401 K Fidelity

Roth Ira Or Traditional Ira Or 401 K Fidelity

What Is 401k Ira Vs 401k Retirement Answers From Napkin Finance

What Is 401k Ira Vs 401k Retirement Answers From Napkin Finance

What Is An Ira An Ira Is An Individual Retirement Account Which Means That It S A Tax Deferred Retirement Account For An Individual That Wants To Set Ppt Download

What Is An Ira An Ira Is An Individual Retirement Account Which Means That It S A Tax Deferred Retirement Account For An Individual That Wants To Set Ppt Download

What Is An Individual Retirement Account Ira Robinhood

What Is An Individual Retirement Account Ira Robinhood

What Is An Ira Guide To Individual Retirement Accounts Mint

What Is An Ira Guide To Individual Retirement Accounts Mint

What Is An Individual Retirement Account Ira Nerdwallet

What Is An Individual Retirement Account Ira Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Investing In An Ira When Why And How Much Bankers Trust

Individual Retirement Account Open Ira Account Bbva

Individual Retirement Account Open Ira Account Bbva

Ira Basics Planmember Retirement Solutions

Ira Basics Planmember Retirement Solutions

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg) Roth Ira Withdrawals Read This First

Roth Ira Withdrawals Read This First

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.