New Hampshire Income Tax. Resident individuals partnerships and fiduciaries earning interest and dividend taxable income of more than 2400 annually 4800 for joint filers.

Understanding New Hampshire Taxes Free State Project

Understanding New Hampshire Taxes Free State Project

With rare exceptions if your small business has employees working in the United States youll need a.

Does new hampshire have income tax. Information is provided below about New Hampshire income tax. New Hampshire taxes only interest and dividend income. This includes everything from.

Do I need to file a New Hampshire state tax return. No not for wages earned. The federal corporate income tax by contrast has a marginal bracketed corporate income taxThere are a total of eleven states with higher marginal corporate income tax rates then New Hampshire.

New Hampshire collects a state income tax at a maximum marginal tax rate of spread across tax brackets. However despite the lack of a New Hampshire withholding tax employers will still need to withhold federal income tax. Note that while New Hampshire does not tax an individuals earned income there is a 5 tax on income derived.

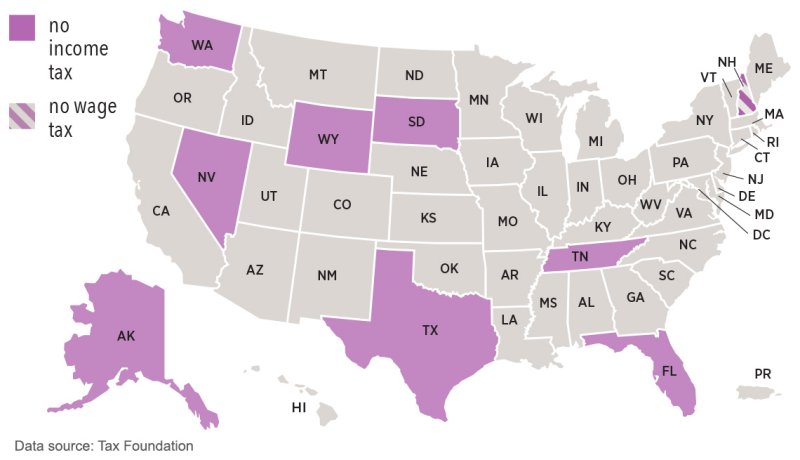

New Hampshire is the only state without either a sales tax or income tax except Alaska but Alaska gets a huge amount of revenue from the oil and extraction industries. New Hampshire does not tax individuals earned income so you are not required to file an individual New Hampshire tax return. However the state does tax income from dividends and interest.

The State of New Hampshire does not have an income tax on an individuals reported W-2 wages. If you are a small business owner this may sound more convenient than the alternativeyou do not have to withhold state income tax on employee wages. The state of New Hampshire has a flat 5 percent income tax rate on interest and dividends but not on general income such as wages.

As such there is no state tax withheld from individual workers W-2 forms. Have New Employees Complete Form W-4. Interest and Dividends Tax.

Additionally those claiming taxable income interests and dividends only of less than 2400 are not required to file tax returns. 11 - New Hampshire Business Tax. New Hampshire Income Tax Withholding Requirements Get an EIN.

Unlike the Federal Income Tax New Hampshires state income tax does not provide couples filing jointly with expanded income tax brackets. The state only taxes interest and dividends at 5 on residents and fiduciaries whose gross interest and dividends income from all sources. All new employees for your business must complete a federal Form W-4.

New Hampshire has a flat corporate income tax rate of 8500 of gross income. Unlike most other states New Hampshire does not have a personal income tax. Notably New Hampshire has the highest maximum marginal tax bracket in the United.

View solution in original post. New Hampshire does not impose an income tax on the taxpayers personal wages. So New Hampshires tax.

State And Local Individual Income Tax Collections Per Capita Tax Foundation

State And Local Individual Income Tax Collections Per Capita Tax Foundation

A Taxing Issue Some Background On N H S Business Taxes New Hampshire Public Radio

A Taxing Issue Some Background On N H S Business Taxes New Hampshire Public Radio

New Hampshire Retirement Tax Friendliness Smartasset

New Hampshire Retirement Tax Friendliness Smartasset

/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png) States That Do Not Tax Earned Income

States That Do Not Tax Earned Income

9 States That Don T Have An Income Tax

9 States That Don T Have An Income Tax

Why New Hampshire Is Suing Massachusetts The Boston Globe

Why New Hampshire Is Suing Massachusetts The Boston Globe

7 States Without Income Tax Mintlife Blog

7 States Without Income Tax Mintlife Blog

You Asked We Answered Why Is New Hampshire So Against Having An Income Tax New Hampshire Public Radio

You Asked We Answered Why Is New Hampshire So Against Having An Income Tax New Hampshire Public Radio

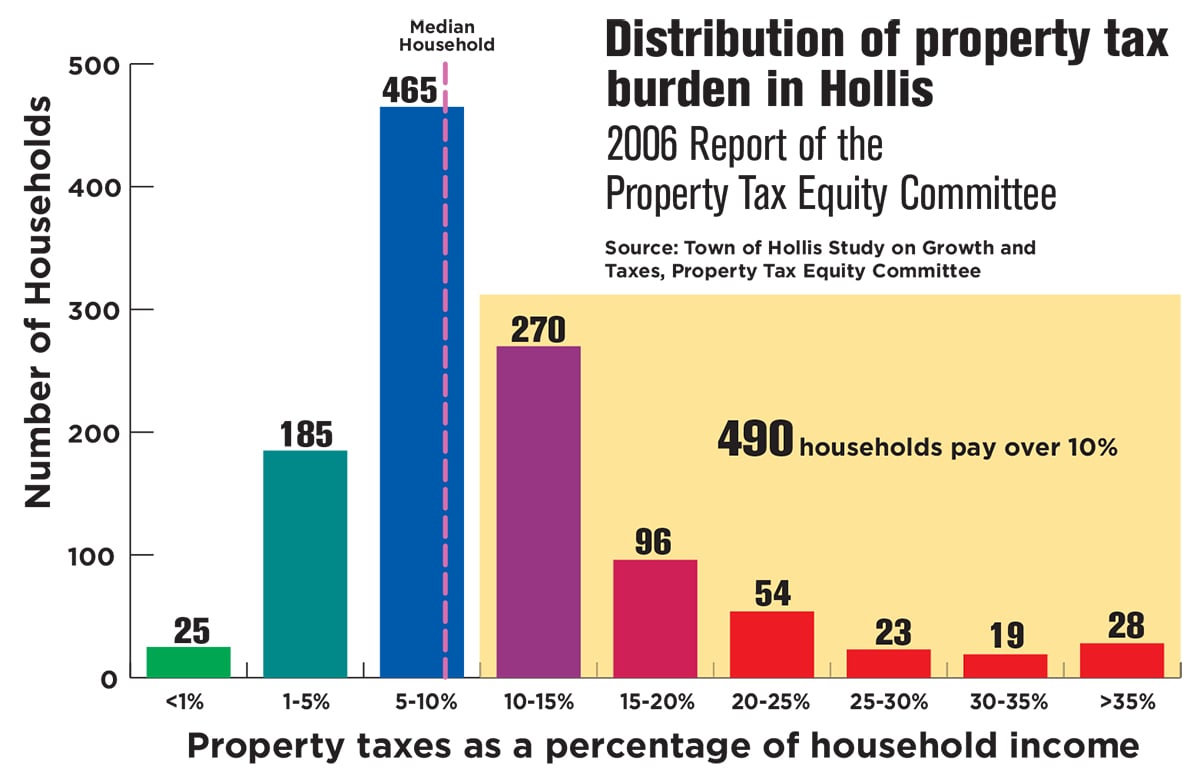

Does New Hampshire Love The Property Tax Nh Business Review

Does New Hampshire Love The Property Tax Nh Business Review

Is New Hampshire Really As Anti Tax As It S Cracked Up To Be Stateimpact New Hampshire

Historical New Hampshire Tax Policy Information Ballotpedia

Historical New Hampshire Tax Policy Information Ballotpedia

New Hampshire Could Become The Ninth Income Tax Free State Tax Foundation

New Hampshire Could Become The Ninth Income Tax Free State Tax Foundation

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.