Annual Percentage Yield APY as of April 24 2021. Lets dive deeper into the current high-yield CD rates at Marcus by Goldman Sachs.

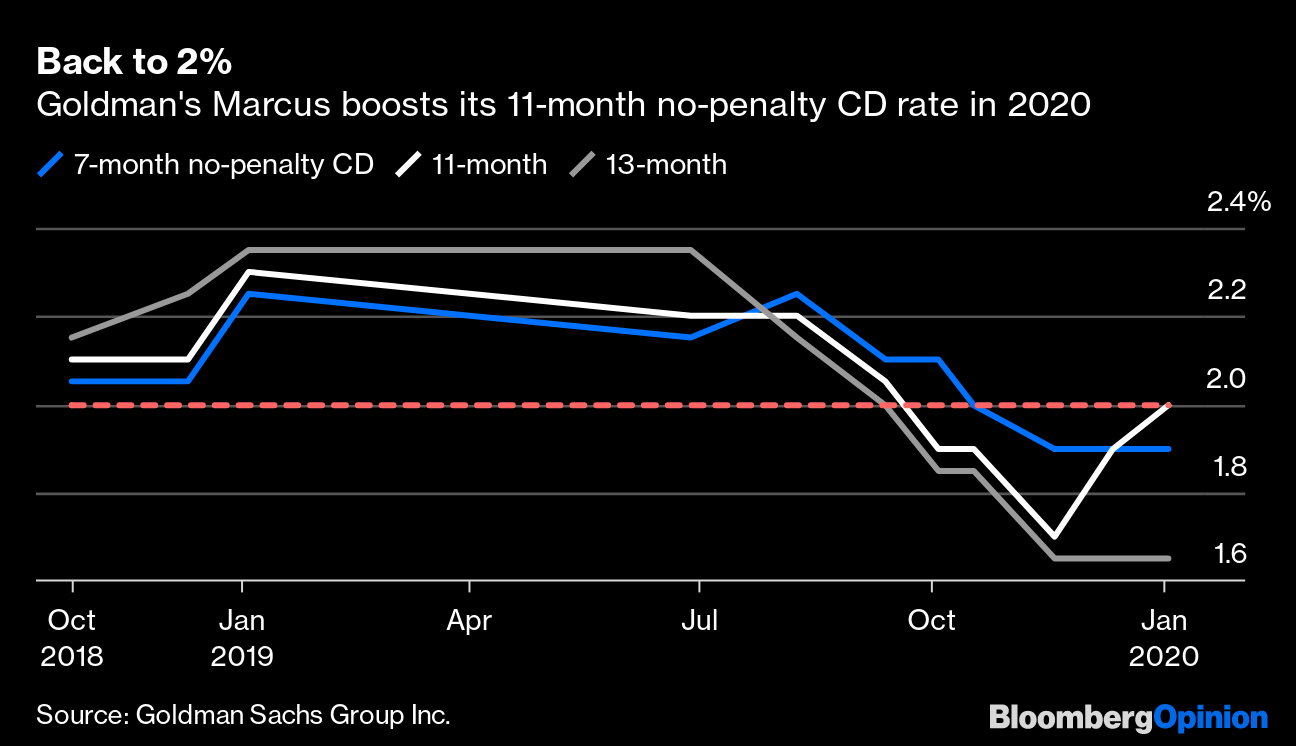

Goldman S Marcus Woos Mom And Pop With A 2 Magic Number Bloomberg

Goldman S Marcus Woos Mom And Pop With A 2 Magic Number Bloomberg

Withdrawals permitted starting seven days after the funding date.

Goldman sachs no penalty cd. Youll have the flexibility to withdraw your full balance online beginning 7 days after funding with no penalty. Rates are guaranteed fixed and do not fluctuate if the account maintains the minimum balance of 500. Maximum balance limits apply.

Terms tend to be around. 500 minimum to earn stated APY for No-Penalty CD. Marcus by Goldman Sachs is an online division of the bank offering no-fee loans high-yield savings accounts and certificates of deposit.

As long as its seven days from the date the account is funded. A no-penalty certificate of deposit is a type of CD that charges no fee for withdrawing money before the term expires. Marcus by Goldman Sachs presents.

Marcus by Goldman Sachs is a brand of Goldman Sachs Bank USA. A no-penalty CD is another option for consumers who want the benefits of a CD with the flexibility to access their money at any time. You can usually withdraw money beginning seven days after the day the CD was funded you dont have to wait for the term to end A high-yield savings account earns a higher interest rate than a traditional savings.

With our No-Penalty CD you get the power to earn a competitive fixed rate plus the flexibility to withdraw your full balance if you need it beginning 7 days after funding. If you want to avoid the risk of early withdrawal penalties while still earning a high APY the Marcus No-Penalty CD is a good option. The online bank Marcus by Goldman Sachs offers some of the highest rates for certificates of deposit among online banks and a low minimum opening requirement of 500.

Marcus offers a variety of CDs three no-penalty CD. Marcus by Goldman Sachs Bank does assess an early withdrawal penalty if you crack into your CD ahead of time. A 500 minimum deposit is required to open a CD account and earn stated APY.

The bank also offers no-penalty CDs. Penalties that may reduce account earnings will apply to a withdrawal of principal prior to maturity. Marcus by Goldman Sachs 060 APY 500 minimum deposit.

It also has competitive yields. Guaranteed Rate of Return on an Exclusive 8-Month Term Members can open an 8-month No-Penalty CD online in minutes with no fees and lock in a higher interest rate than whats available with a Marcus Online Savings Account. Marcus by Goldman Sachs is a brand of Goldman Sachs Bank USA.

Even if you withdraw money before your term is up you wont pay a fee you. This penalty is calculated based. Marcus offers a variety of CDs.

Say an emergency comes up. APY may change at any time without notice before a CD account is opened and funded. What You Need To Know About Marcus No-Penalty CDs.

Marcus by Goldman Sachs Fees and Penalties. Marcus by Goldman Sachs CDs permit account holders to withdraw monthly earned interest without penalty. Theres no checking account so youll have to transfer funds externally to access.

In addition to high-yield CDs Marcus offers a no-penalty option which aims to provide more flexibility than a typical CD account while still earning a. Marcus by Goldman Sachs offers three terms of no-penalty CDs. These CDs allow account holders to withdraw their money.

No-Penalty CD terms of. Those who choose to withdraw more will pay a fee depending on their individual term. Marcus by Goldman Sachs Member FDIC is an online-only bank that offers a savings account and more.

Marcus No-Penalty CDs are like traditional CDs except Marcus does not charge you a fee if you need to withdraw your money before the term ends. Whether you want to save for a financial goal or simply lock in a competitive rate consider a No-Penalty CD. Seven months 11 months and 13 months.

A no-penalty CD is a certificate of deposit that includes a bit of freedom. Annual Percentage Yield APY may change before NPCD is opened and funded.

No Penalty Cd Marcus By Goldman Sachs

No Penalty Cds Vs Online Savings Accounts Marcus By Goldman Sachs

No Penalty Cds Vs Online Savings Accounts Marcus By Goldman Sachs

Marcus No Penalty Cd Product Review Moneyrates

Marcus No Penalty Cd Product Review Moneyrates

Marcus By Goldman Sachs On Twitter Learn The Ins And Outs Of Online Savings Accounts And No Penalty Cds And How Each One Can Impact Your Savings Strategy At Https T Co Qnpiapygxp Https T Co Cpuhvi7ii2

Marcus By Goldman Sachs On Twitter Learn The Ins And Outs Of Online Savings Accounts And No Penalty Cds And How Each One Can Impact Your Savings Strategy At Https T Co Qnpiapygxp Https T Co Cpuhvi7ii2

What Is A No Penalty Cd And How Does It Work Marcus By Goldman Sachs

What Is A No Penalty Cd And How Does It Work Marcus By Goldman Sachs

Marcus By Goldman Sachs Cds Review April 2021 Finder Com

Marcus By Goldman Sachs Cds Review April 2021 Finder Com

No Penalty Cd Vs Savings Account Which Is Better Nerdwallet

No Penalty Cd Vs Savings Account Which Is Better Nerdwallet

Marcus Bank By Goldman Sachs Online Savings 0 50 Apy 0 60 Apy Cds

Marcus Bank By Goldman Sachs Online Savings 0 50 Apy 0 60 Apy Cds

No Penalty Cd How Does It Work

No Penalty Cd How Does It Work

Marcus Bank Review High Apys No Monthly Fees

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.