Basically you will need to keep records between three and seven years. Figuring out how long to keep tax records requires some research.

How Long To Keep Tax Records And Other Statements Brandongaille Com

How Long To Keep Tax Records And Other Statements Brandongaille Com

Youve likely heard that seven years is the perfect period to hold on to tax records including returns.

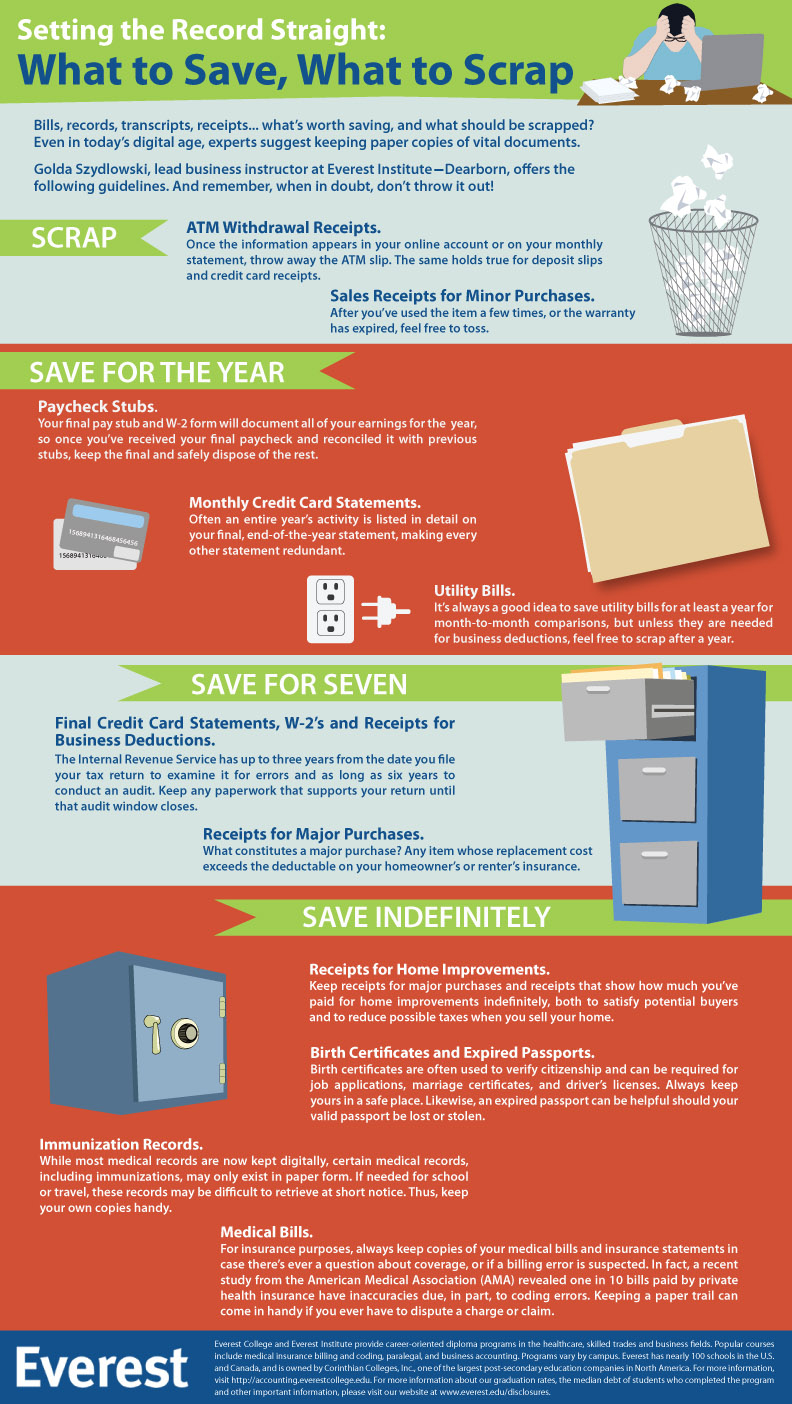

How long to save tax records. Keep employment tax records for at least 4 years after the date that the tax becomes due or is paid whichever is later. Keep business income tax returns and supporting documents for at least seven years from the tax year of the return. Keep for seven years.

Heres what they advise for several common records. Heres some information that. If you claimed a deduction for a given year you can change your mind within 10 years and claim a credit by filing an amended return.

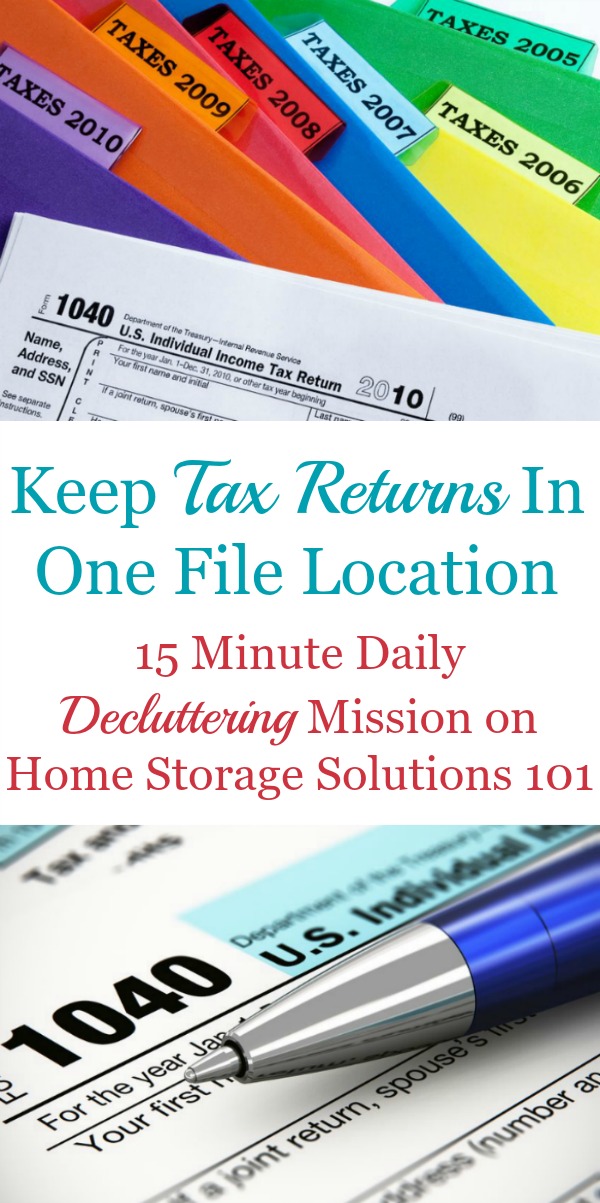

Keep records for three years from the date you filed your original return or two years from the date you paid the tax whichever is later if you file a claim for credit or refund after you file. To put it more plainly you will need to keep your tax records between three and seven years. Some states can look back further than the IRS.

To be on the safe side without needing to recall the fine print just remember to keep your tax records for seven years. How long should you keep your income tax records. Purchase invoicespayables all invoices.

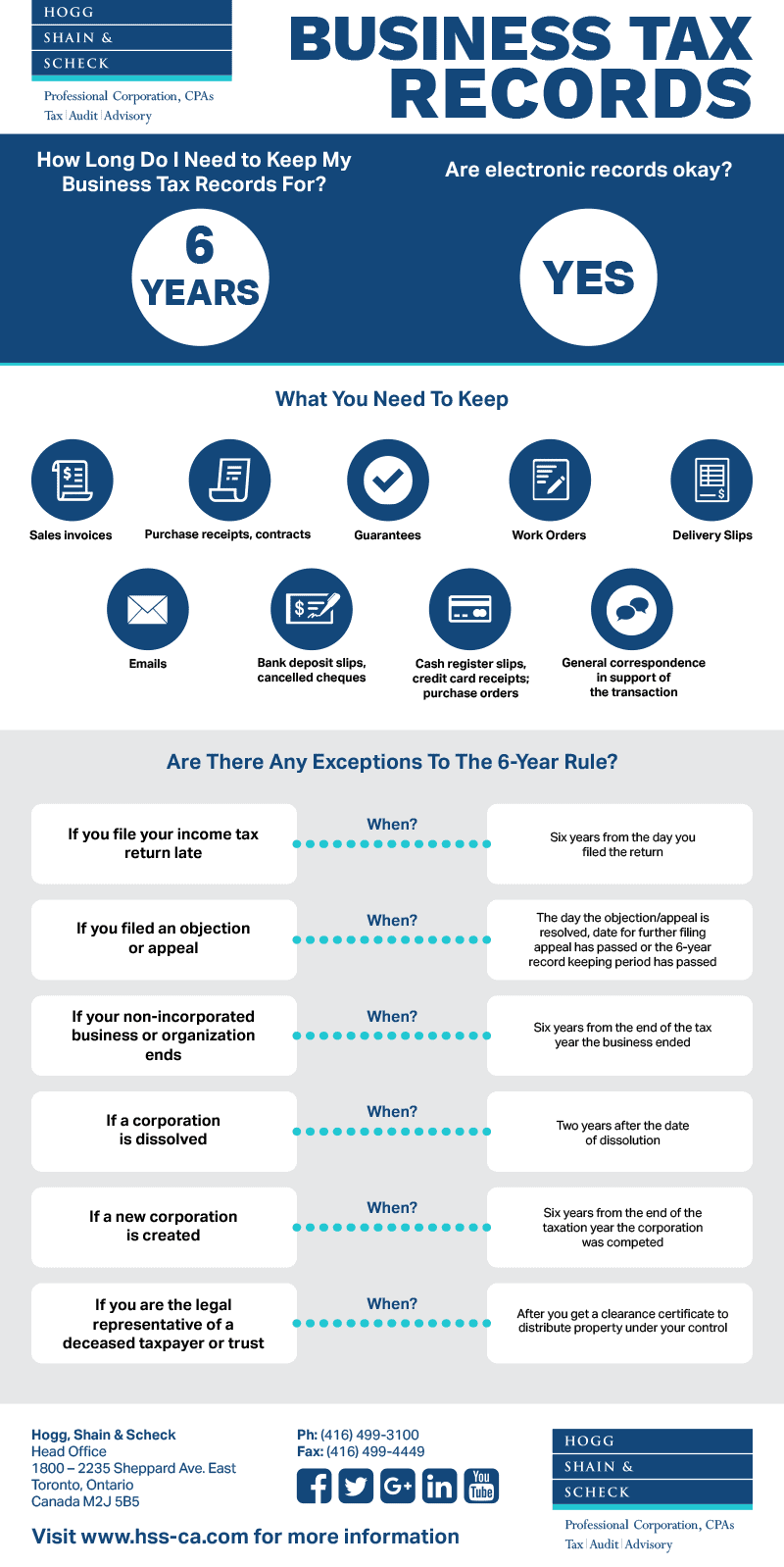

Keep records indefinitely if you do not file a return. Keep records indefinitely if you file a fraudulent return. If you fail to report all of your gross income on your tax returns the government has six years to collect the tax or start legal proceedings.

Even if you do not have to attach certain supporting documents to your return or if you are filing your return electronically keep your supporting documents for six years in case the CRA selects your return for review. To be on the safe side McBride. Keep proof of payment of deductible expenses such as cancelled.

The IRS recommends keeping records three to seven years after filing your taxes but some experts say that might not be long enough in some situations. How long to keep it. In general this means you need to keep your tax records for three years from the date the return was filed or from the due date of the tax return whichever is later.

You also have 10 years. The following questions should be applied to each record as you decide whether to keep a document or throw it away. You could be in for a host of problems if you dont have accurate records.

But Montana wants you to keep them for five years. Regular statements pay stubs. Lets say you filed your 2017 tax return two months ahead of the deadline on February 10 2018.

California and Arizona for example have a four-year statute of limitations. What Tax Records Should I Keep. Check with your state about state income tax records.

The actual time to keep records isnt that simple according to Steven Packer CPA in the Tax Accounting Group at Duane Morris. How Long To Keep Tax Returns In most cases you should plan on keeping tax returns along with any supporting documents for a period of at least three years following the date you filed or the due date of your tax return whichever is later. To be on the safe side without needing to recall the fine print just remember to.

Most states make you keep them as long as the federal government does three years. 3 Store 1 year. Knowing that a good rule of thumb is to save any document that verifies information on your tax returnincluding Forms W2 and 1099 bank and brokerage statements tuition payments and charitable donation receiptsfor three to seven years.

You should keep every tax return and supporting forms. The CRA may ask for documents other than official receipts such as cancelled. Keep proof of income and expenses for the same time you keep the tax return.

Sales receipts electronic or paper. If youre paying state income taxes the time you need to keep records will depend on state law. And Ohio recommends you hang on to them 10 years.

How Long Should You Keep Business Tax Records. Sales and use tax returns. The IRS can audit your return and you can amend your return to claim additional credits for a period that varies from three to seven years from the date you first filed.

Montana has a five-year statute. What happens if your records arent accurate. The general rule is to keep your tax records for three years but there are several important exceptions for when you might need to keep your tax records for a longer period as a taxpayer.

How Long to Save a Deceased Parents Tax Returns Proof of Income and Expenses.

/how-long-to-keep-state-tax-records-3193344-V22-3972fe8732794cc596ab2cac3cd979c3.png) How Long Does Your State Have To Audit Your Tax Return

How Long Does Your State Have To Audit Your Tax Return

How Long To Keep Tax Records Plus How To Organize Old Tax Returns In Your Home Filing System

How Long To Keep Tax Records Plus How To Organize Old Tax Returns In Your Home Filing System

How Long To Keep Records Digitech Systems Llc

How Long To Keep Records Digitech Systems Llc

How Long Should I Keep My Bills Personal Finance Money Stack Exchange

How Long Should I Keep My Bills Personal Finance Money Stack Exchange

What Documents To Keep And What To Toss John And Tracey Tindall

Record Retention Policy How Long To Keep Business Tax Record

Record Retention Policy How Long To Keep Business Tax Record

How Long Do I Have To Keep My Business Tax Records Hogg Shain Scheck

How Long Do I Have To Keep My Business Tax Records Hogg Shain Scheck

Here S How Long To Keep All Your Important Financial Documents

How Long To Keep Important Financial Documents

How Long To Keep Important Financial Documents

How Long To Keep Tax Records And Other Statements Brandongaille Com

How Long To Keep Tax Records And Other Statements Brandongaille Com

How Long Should You Keep Your Records And Tax Return The Wealthy Accountant

How Long Should You Keep Your Records And Tax Return The Wealthy Accountant

Here S How Long To Keep All Your Important Financial Documents

How Long Should You Keep Financial Documents

How Long Should You Keep Financial Documents

How Long To Keep Tax Records And Receipts For Tax Deductions

How Long To Keep Tax Records And Receipts For Tax Deductions

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.