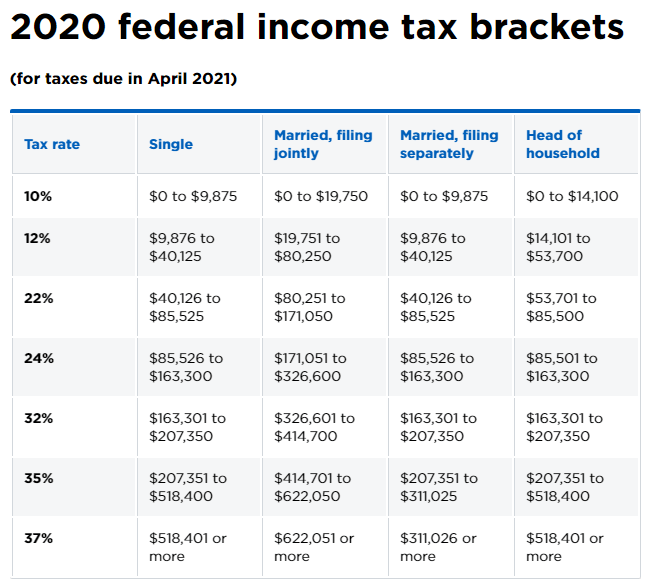

Cash donations include those made by check credit card or debit card. Its 24400 for married taxpayers who file joint returns and 18350 for those who qualify as head of household.

Cares Act Expands Tax Deductions For Charitable Giving Kiplinger

Cares Act Expands Tax Deductions For Charitable Giving Kiplinger

Thats a lot of appliances and kids jeans.

2020 charitable deductions. However taxpayers who dont itemize deductions may take a charitable deduction of up to 300 for cash contributions made in 2020 to qualifying organizations. In 2020 however you can deduct up to 100 on cash gifts. Charitable cash donations of up to 300 made to qualifying organizations before December 31 2020 are now deductible for individuals who choose to use the standard deduction rather than itemizing their deductions.

If you do not elect the 100 AGI limit your donations will fall under the typical limitations. We will eventually learn how many non-itemizers claimed the. But now taxpayers that do not itemize their deductions can claim up to 300 for cash contributions 600 for married couples filing jointly they made in 2020 to eligible organizations.

For 2019 the standard deduction for single filers is 12200. Heres how the CARES Act changes deducting charitable contributions made in 2020. In 2020 however you can deduct up to 100 on cash gifts.

Choosing the standard deduction effectively took the charitable deduction off the table. Under this new change individual taxpayers can claim an above-the-line deduction of up to 300 for cash donations made to charity during 2020. When you make a charitable contribution of cash to a qualifying public charity in 2021 under the Consolidated Appropriations Act 1 you can deduct up to 100 of your adjusted gross income.

A higher limit applies to certain qualified conservation contributions and qualified cash contributions for 2020. This means the deduction lowers both adjusted gross income and taxable income translating into tax savings for those making donations to qualifying tax-exempt organizations. Learn more about what you can donate.

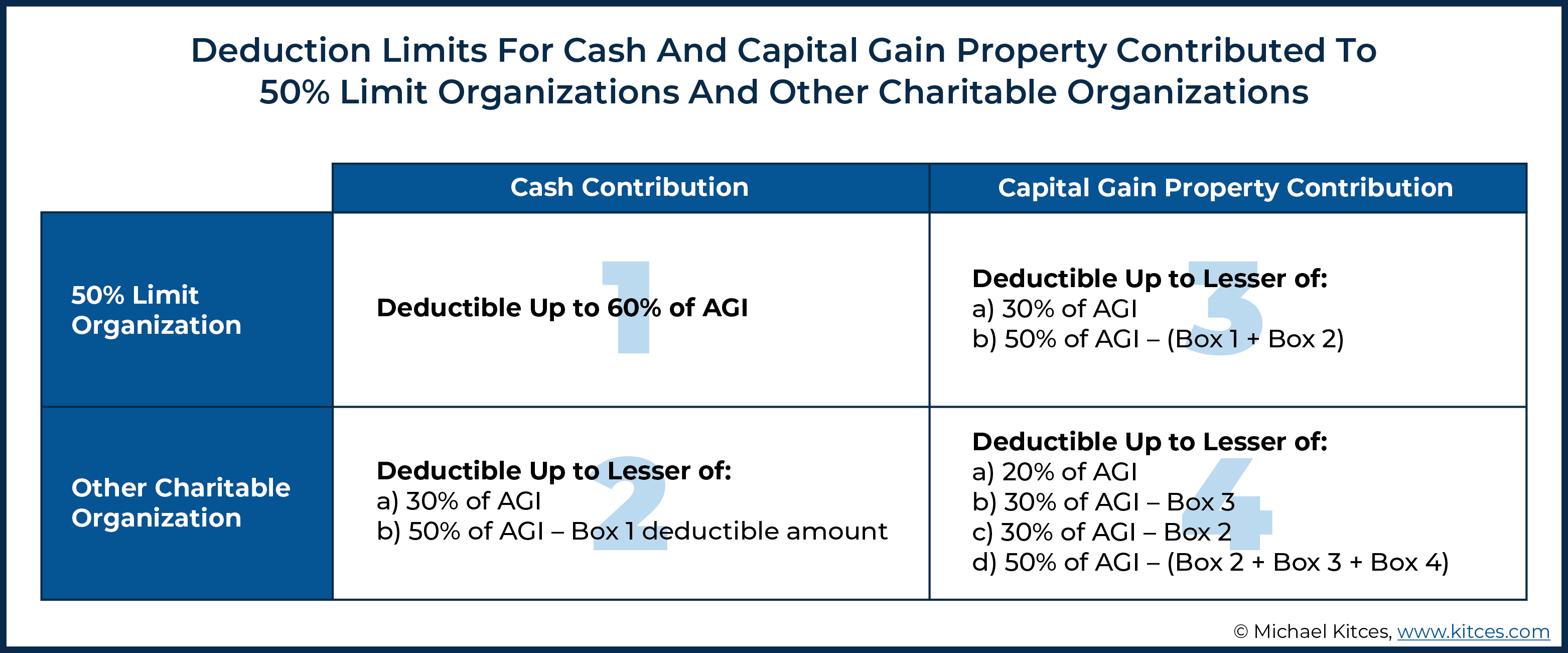

The IRS offers additional guidance on charitable contribution deduction changes for. For 2020 taxpayers who claim the standard deduction on their tax returns are entitled to deduct up to 300 of charitable contributions made in cash above-the-line that is in calculating their. Which maybe 50 of your AGI or 60 if you give cash.

For 2020 only taxpayers taking the standard deduction could claim a deduction for up to 300 in charitable contributions of cash. Previously charitable contributions could only be deducted if taxpayers itemized their deductions. The deduction which must be made by December 31 to count for tax year 2020 applies to tax filers who take the standard deduction on their federal.

Most people are aware that donations to charity are tax-deductible but did you know that charitable deductions are considered itemized Deductions. Typically you may deduct up to 60 of your adjusted gross income AGI through charitable donations. Typically you may deduct up to 60 of your adjusted gross income AGI through charitable donations.

If you do not elect the 100 AGI limit your donations will fall under the typical limitations. The election allows the taxpayer to limit the 2020 charitable deduction to an amount less than 100 of the charitable contribution base so that taxable income does not become negative due to nonbusiness itemized deductions. If you itemize your tax deductions you can still deduct charitable donations on your 2020 returns as well.

You cant both itemize and use the standard deduction as well. Which maybe 50 of your AGI or 60 if you give cash. Additionally there is a unique opportunity this year for clients with charitable contribution carryforwards to 2020.

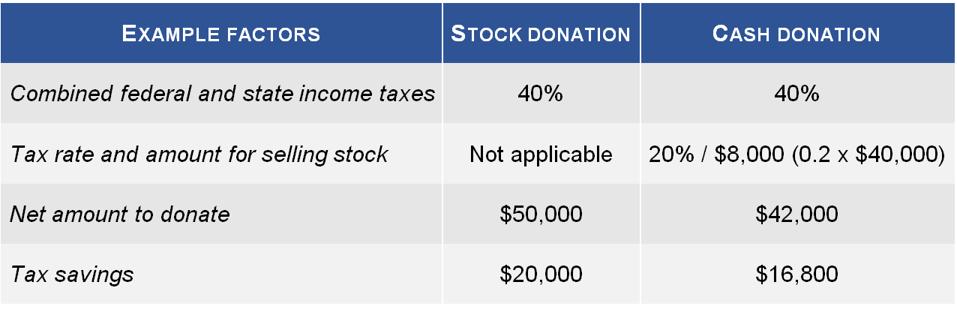

Cash Contributions for Itemizers Under the CARES Act that was enacted in March 2020 the 60 deduction limit on cash contributions to most charities was suspended for 2020 thus allowing larger cash contributions during the COVID crisispotentially up to 100 of the AGI. New 300 Charitable Deduction for Non-Itemizers The Coronavirus Aid Relief and Economic Security Act or CARES Act created several incentives for people to help charities right away including a. Your deduction may be further limited to 50 30 or 20 of your AGI depending on the type of property you give and the type of organization you give it to.

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

Grow Your 2020 Charitable Giving Increased Deductions Under The Cares Act Shutts Bowen Llp

Grow Your 2020 Charitable Giving Increased Deductions Under The Cares Act Shutts Bowen Llp

Cares Act Added A 300 Charitable Contribution Deduction Here S How It Works

Cares Act Added A 300 Charitable Contribution Deduction Here S How It Works

Why To Avoid 100 Of Agi Qualified Charitable Contributions

Why To Avoid 100 Of Agi Qualified Charitable Contributions

Covid 19 Stimulus Cares Act Includes Incentive For Donors United Way Of North Central Ohio

Covid 19 Stimulus Cares Act Includes Incentive For Donors United Way Of North Central Ohio

How To Let Donors Know New Cares Act Offers Deduction Opportunities

How To Let Donors Know New Cares Act Offers Deduction Opportunities

What You Can Expect For Your 2020 Taxes Charitable Deductions And Cares Act

What You Can Expect For Your 2020 Taxes Charitable Deductions And Cares Act

A 300 Charitable Deduction Explained

A 300 Charitable Deduction Explained

How Large Are Individual Income Tax Incentives For Charitable Giving Tax Policy Center

How Large Are Individual Income Tax Incentives For Charitable Giving Tax Policy Center

2020 Year End Tax Planning 300 Charitable Contribution Deductions C Brian Streig Cpa

2020 Year End Tax Planning 300 Charitable Contribution Deductions C Brian Streig Cpa

Indian Muslim Relief On Twitter Don T Miss Out Deduct Your Entire Agi Pay No Taxes In 2020 Other Tips For Year End Charitable Giving Read More Here Https T Co 4j4bny5r1n Https T Co Aggaqcp418

Indian Muslim Relief On Twitter Don T Miss Out Deduct Your Entire Agi Pay No Taxes In 2020 Other Tips For Year End Charitable Giving Read More Here Https T Co 4j4bny5r1n Https T Co Aggaqcp418

Stock Donations 7 Essentials To Maximize Your Charitable Giving Tax Deduction

Stock Donations 7 Essentials To Maximize Your Charitable Giving Tax Deduction

Why 2020 Is An Especially Good Year To Give Schwab Charitable Donor Advised Fund Schwab Charitable

Why 2020 Is An Especially Good Year To Give Schwab Charitable Donor Advised Fund Schwab Charitable

Charitable Intentions Methods To Maximize Your Impact And Minimize Taxes Fi3 Advisors

Charitable Intentions Methods To Maximize Your Impact And Minimize Taxes Fi3 Advisors

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.