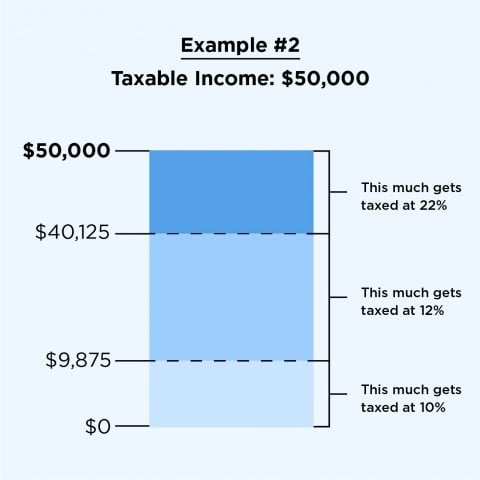

The tax rate of your total income applies only to the income earned in that bracket. While there are seven brackets total there isnt just one single tax bracket chart.

What Are The Income Tax Brackets For 2019 Vs 2018 Kiplinger

What Are The Income Tax Brackets For 2019 Vs 2018 Kiplinger

85526 163300 24.

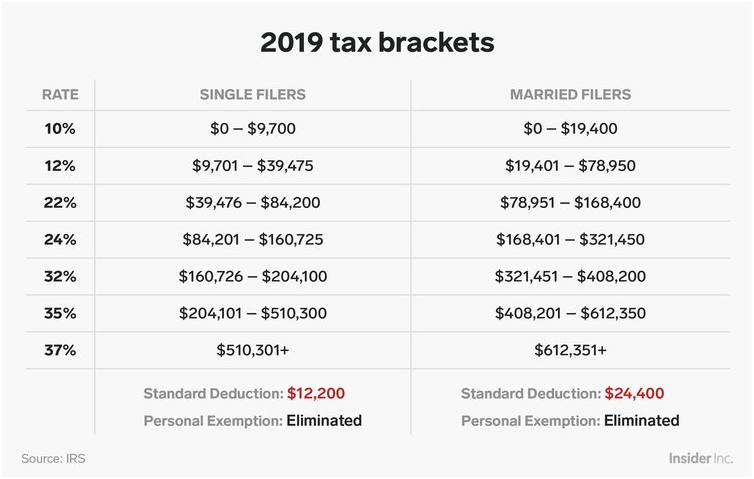

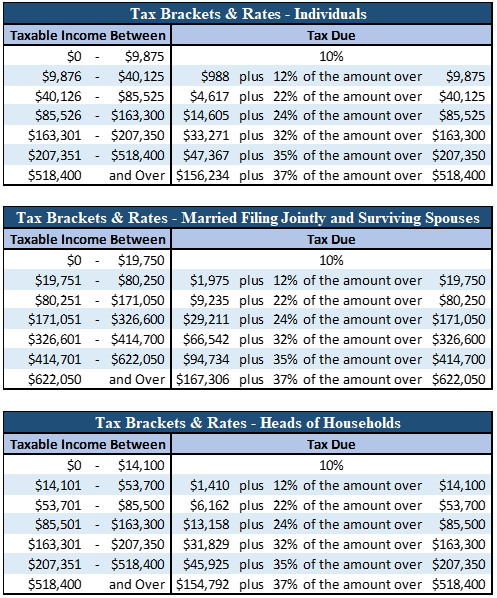

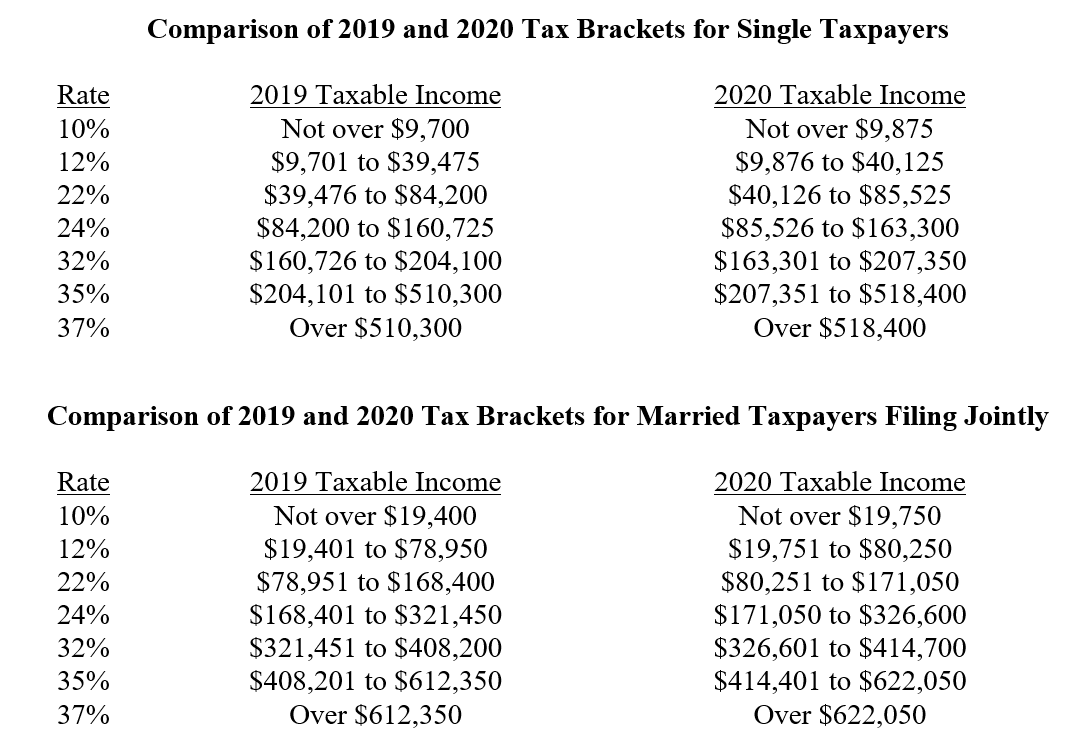

Tax brackets 2019 2020. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518400 and higher for single filers and 622050 and higher for married couples filing jointly. 2020 Income Bracket 2019 Rate. 10 12 22 24 32 35 and 37.

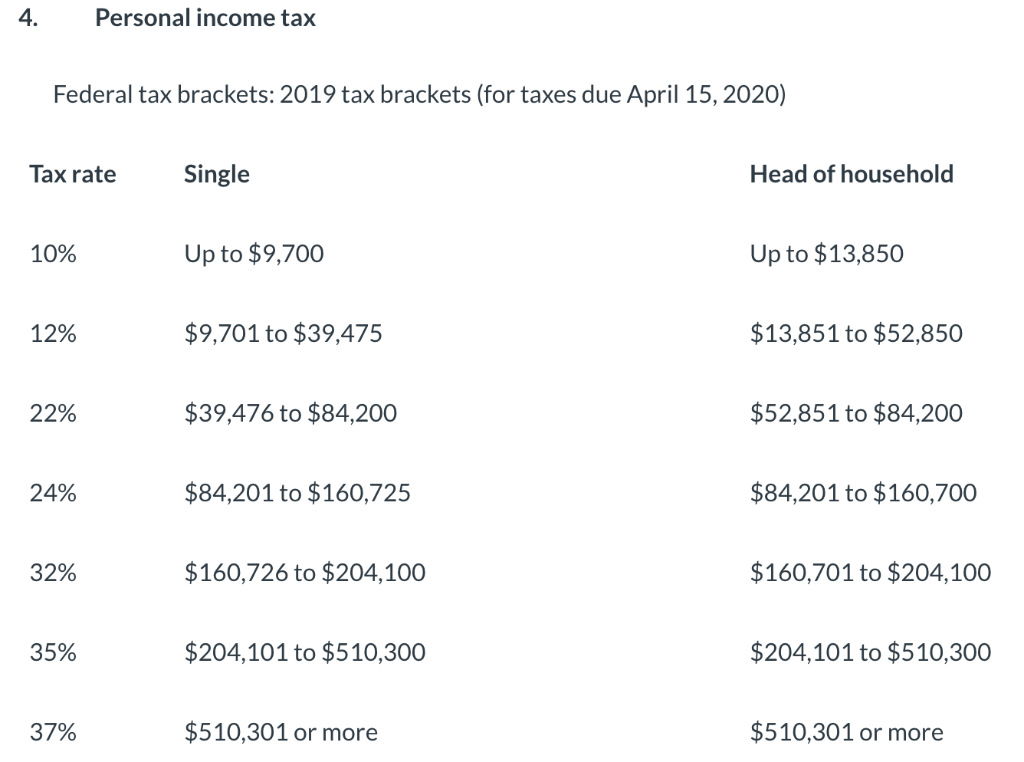

Your total tax bill would be 14744. As youll see below the income range in each bracket differs depending on whether youre single or married or the head of household. There are seven federal tax brackets for the 2020 tax year.

The 2020 tax rate ranges from 10 to 37. Well look into income tax slabs for FY 2018-19 income tax slabs for FY 2019-20 income tax slabs for FY 2020-21 and income tax rates. Single Married Filing Jointly Married Filing Separately Head of Household Qualifying Widower.

Putting It All Together. Here is a list of our partners and heres how we make money. The tax rates for 2020 are.

Calculating Your Tax Bill. There are currently the seven tax brackets for the 2020 tax year which youll file in 2021. 2020 Tax Rate.

Use this tax bracket calculator to discover which bracket you fall in. Remember that the tax rates are marginal. Your 2020 tax rate.

Being in a higher tax bracket doesnt mean all. Let us help you understand. Youngsters with accounts that earn more than 1100 in dividends and interest in 2020 will be liable for taxes according to the rates applied to trusts and estates quickly escalating brackets that range from 10 up to 2600 to 37 more than 12950.

For instance if your taxable income is 300000 in 2020 only the income you earn past 207351 will be taxed at the rate of 35 shown on the corresponding federal income tax chart above. Unsure what an income tax slab means or which one applies to you. Divide that by your earnings of 70000 and you get an effective tax rate of 21 percent which is lower than the 22 percent bracket youre in.

The income brackets though are adjusted slightly for inflation. 0 - 9875 9876 - 40125 40126 - 85525 85526 - 163300 163301 - 207350 207351 - 518400 518401. Federal Income Tax Brackets for Tax Years 2019 and 2020 The federal income tax rates remain unchanged for the 2019 and 2020 tax years.

10 12 22 24 32 35 and 37. 2020 Individual Income Tax Brackets The federal tax brackets are broken down into seven 7 taxable income groups based on your filing status. Up to 9875 10.

10 12 22 24 32 35 and 37. In 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

2020 2021 Federal Tax Brackets And Rates Bankrate

2020 2021 Federal Tax Brackets And Rates Bankrate

What Are The 2019 Tax Brackets

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

New Tax Brackets Tax Years 2019 And 2020 Levesque Associates

What You Need To Know About 2020 Taxes Advisors Management Group

What You Need To Know About 2020 Taxes Advisors Management Group

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Preview Carlile Patchen Murphy

2020 Tax Preview Carlile Patchen Murphy

Solved Suppose You Are Single And Your Personal Taxable I Chegg Com

Solved Suppose You Are Single And Your Personal Taxable I Chegg Com

Understanding The Tax Code Usgopo Com

Understanding The Tax Code Usgopo Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.