Can free up some of your cash for other home buying expenses. DPA programs are meant to make new homes affordable to moderate to low income.

/GettyImages-1147400722-0fcd8bf62511496aa49a732f1d25ab79.jpg) Down Payment Assistance Programs

Down Payment Assistance Programs

Bank of America 17500 Down Payment Grant Pros and Cons - What You Should Know.

Pros and cons of down payment assistance. In this video I discuss the basics of down payment assistance programs and what to expect. The Pros and Cons of a Down Payment Assistance Program Pros of Down Payment Assistance Programs. Pros and cons of down payment assistanceIs This Student Loan Settlement A Good DealGet life-changing financial advice Monday-Friday.

The Pros and Cons of a Low Down Payment. 3 Pros Cons of Down Payment Assistance There is help out there for people who want to own a home arent sure if they will qualify or have the funds needed. With the help of a down payment assistance program buyers need less cash up front and can typically buy a home quicker as it requires less time spent saving up.

The most common types of home. Silent Second Mortgage Homebuyer Grant. You know once the government gets involved they gotta start telling you.

Have you wondered about the pros and cons of Down Payment Assistance DPA programs. Pros of Down Payment Assistance Programs. Normally you need 5 for Conventional 35 down for FHA or 3 if you utilize a special Conventional loan plus the closing costs you need.

Here are some pros and cons to consider. Down payment assistance covers the gap between the down payment plus closing costs and the cash you have. DPAs are intended to make new homes affordable for low to middle-income buyers some income limits are quite high now extending to 92984 or higher.

There are many potential buyers out there who have excellent credit and a great job history but dont have a ton of money. For many the dream to purchase a home is far fetched because of the lack of cash for down payment and closing costs. Pros and Cons Bank of Americas 17500 Down Payment Assistance Program - YouTube.

There are a variety of programs for people who are looking to buy a home. The primary benefit of DPAs is that they can allow lower- and middle-income buyers to more easily afford a home. 900 am - 700 pm all.

Money for a down payment. Households that opt for a. These are a great option for some buyers.

If youre a homebuyer struggling to save the recommended 20 down payment amount you may choose to investigate a down payment assistance program. If youre a homebuyer struggling to save the recommended 2. Clarence a lending mortgage specialist explains what a DPA or Down Payment Assistance program is how it works.

When you participate in a down payment assistance program your mortgage financing options change. Earlier this year Down Payment Resource conducted an analysis weighing the pros and cons of lower down payments. Money for down paymentof course.

One of the major reasons why lenders allow buyers to purchase a home with a small down payment or even a zero down payment aside from the lender getting the mortgage and the subsequent money theyll make on it is because some buyers dont have boatloads of money saved. Find out more information on the pros and cons to downpayment assistance below. Considered a higher risk mortgage these programs come with high long-term costs.

Down Payment Assistance DPA programs help low to moderate INCOME. Helping Homeowners Potential Homeowners for over 30 YearsTo Get Pre-approved or See if Refinancing makes sense. Down payment assistance programs provide would-be homebuyers with money to cover some or all of a down payment and some programs offer help.

It can take years for a household to save 20 percent for a down payment. If you have any questions feel free to comment belowInterested in learning. Assistance programs are also available thru state city and county government departments.

I know as a first-time homebuyer I didnt have a 20 down payment saved up. If you qualify for a down payment assistance or first time home buyer program these are the advantages. Cons of Down Payment Assistance Programs.

These are a great option for some buyers. Im Hilda Hensley Branch Manager and Senior Mortgage Loan Originator with Benchmark Mortgage. Home buyer assistance comes in several forms.

They found that a major benefit of a low down payment is that it can get potential home buyers off the sidelines and into homeownership faster. There are several programs in Georgia that assist buyers with funds to purchase their first home.

Down Payment Assistance How To Get Help Buying A House Nerdwallet

Down Payment Assistance How To Get Help Buying A House Nerdwallet

Down Payment Assistance Pros And Cons Down Payment Assistance In Arizona

Down Payment Assistance Pros And Cons Down Payment Assistance In Arizona

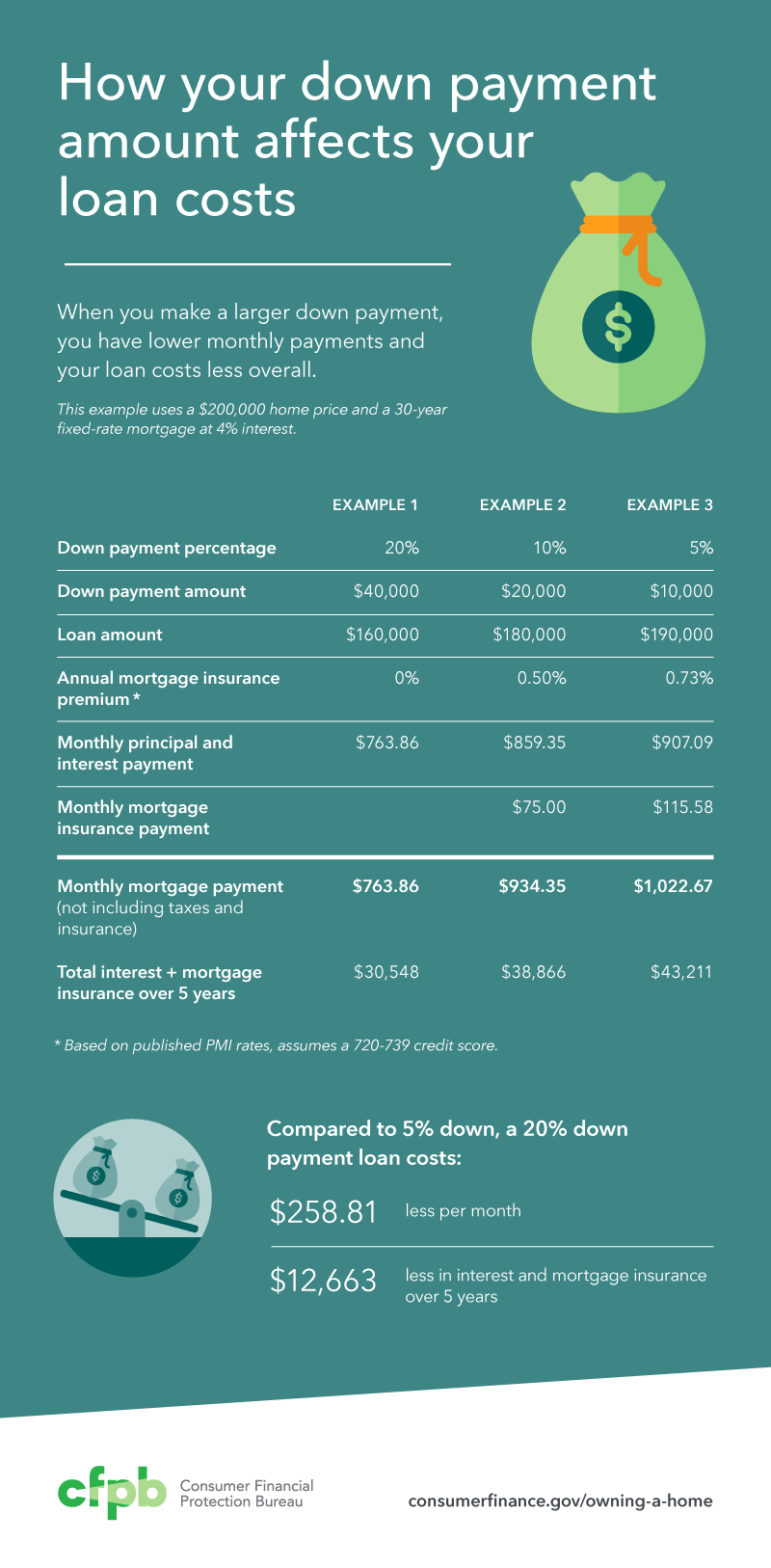

/choosing-a-down-payment-315602-Final-21f6f43a49084466afd65a24f1d288b9.png) Down Payments How They Work How Much To Pay

Down Payments How They Work How Much To Pay

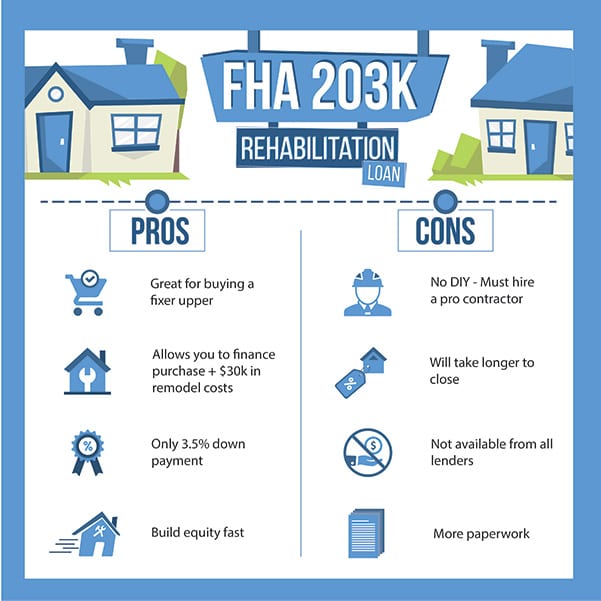

How Does A 203k Loan Work Fha 203k Requirements 2021

How Does A 203k Loan Work Fha 203k Requirements 2021

Reasons To Use A Piggyback Loan 80 10 10 Loan Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Reasons To Use A Piggyback Loan 80 10 10 Loan Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Down Payment Assistance Pros And Cons Buy Now Or Save For Down Payment Wynn Eagan Team At Citywide Home Loans

Down Payment Assistance Pros And Cons Buy Now Or Save For Down Payment Wynn Eagan Team At Citywide Home Loans

Down Payment Assistance Programs Are Not A Wise Financial Choice For Home Buyers Texaslending Com

Down Payment Assistance Programs Are Not A Wise Financial Choice For Home Buyers Texaslending Com

Down Payment Assist Loans Pros Cons

Down Payment Assist Loans Pros Cons

Fha Vs Conventional Loans Pros Cons To Both

The Average Down Payment On A House When To Put Down More Or Less Money Mortgage Rates Mortgage News And Strategy The Mortgage Reports

The Average Down Payment On A House When To Put Down More Or Less Money Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How To Get Down Payment Assistance For A Mortgage Us News

How To Get Down Payment Assistance For A Mortgage Us News

Pros And Cons Of Buying A Home With A Small Down Payment

Pros And Cons Of Buying A Home With A Small Down Payment

Pros And Cons Of A Large Down Payment On A House

Pros And Cons Of A Large Down Payment On A House

Pros Cons Of Down Payment Assistance Coach S Corner

Pros Cons Of Down Payment Assistance Coach S Corner

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.