Permanent policies accrue cash value that can be used for. The premium for life insurance can either be paid in lump sum or periodic intervals usually quarterly.

Life Insurance Consulting Advice Los Angeles

Life Insurance Consulting Advice Los Angeles

Qualified annuities fund with pre-tax dollars while nonqualified annuities fund with post-tax dollars.

Life insurance differences. If the policyholder passes away during that specified period your beneficiary will receive the payout. On the contrary health insurance provides treatment and medical benefits in case of illness or accident. Variable Universal life insurance is similar to regular universal life insurance coverage except in this case the policyholder is allowed to invest the cash in their policy into different types of investments such as mutual funds.

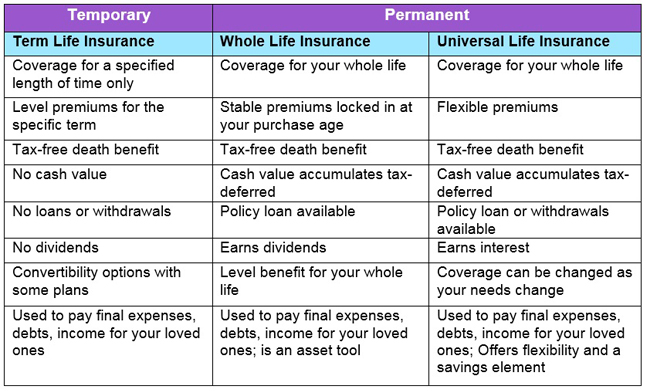

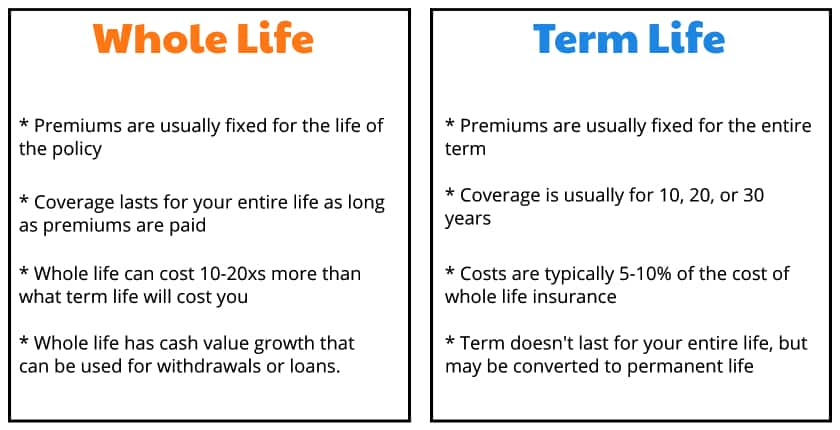

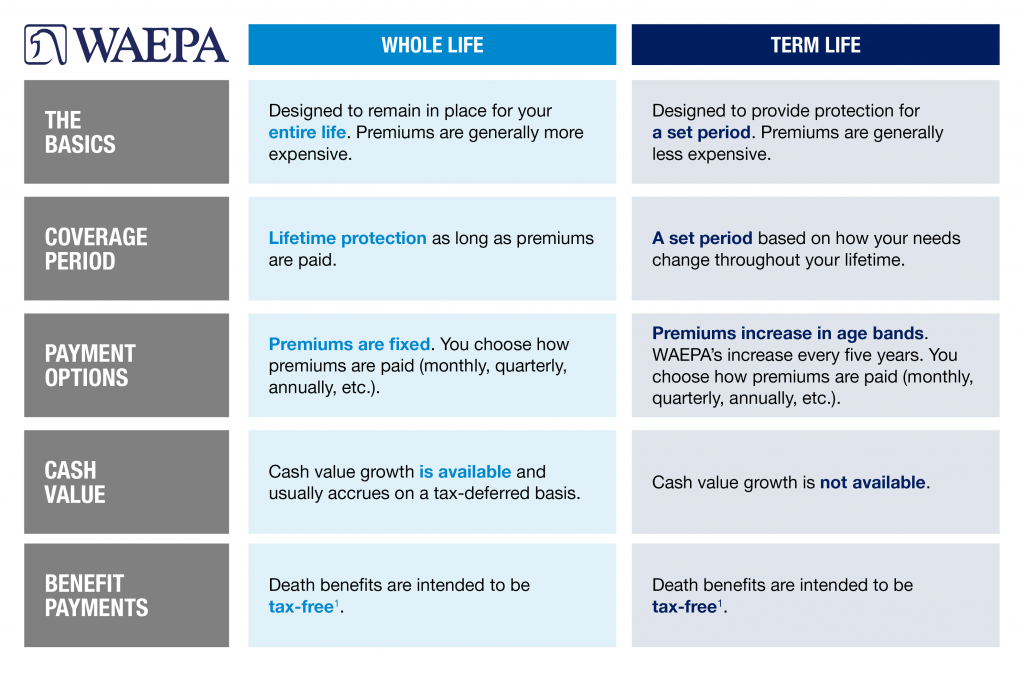

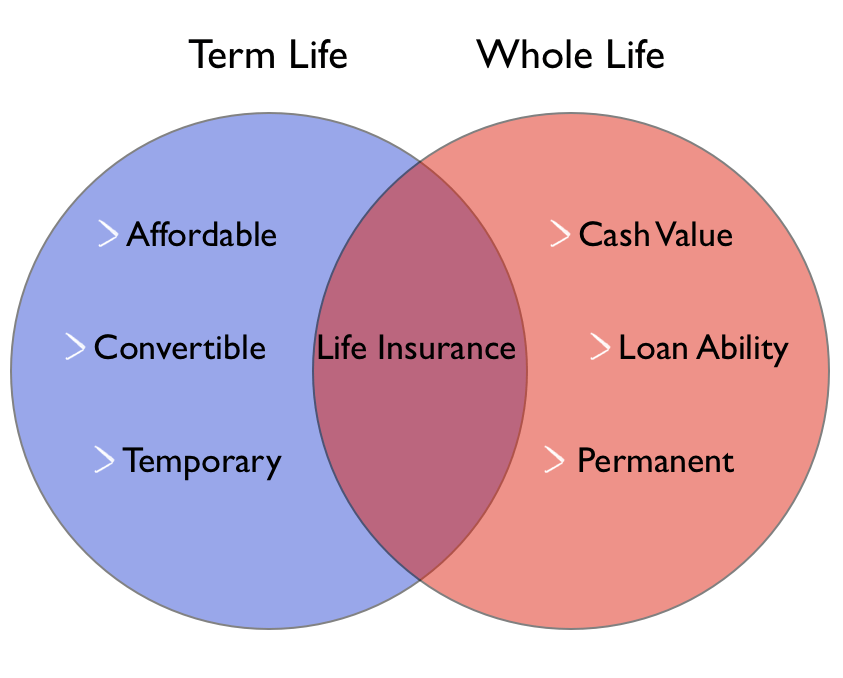

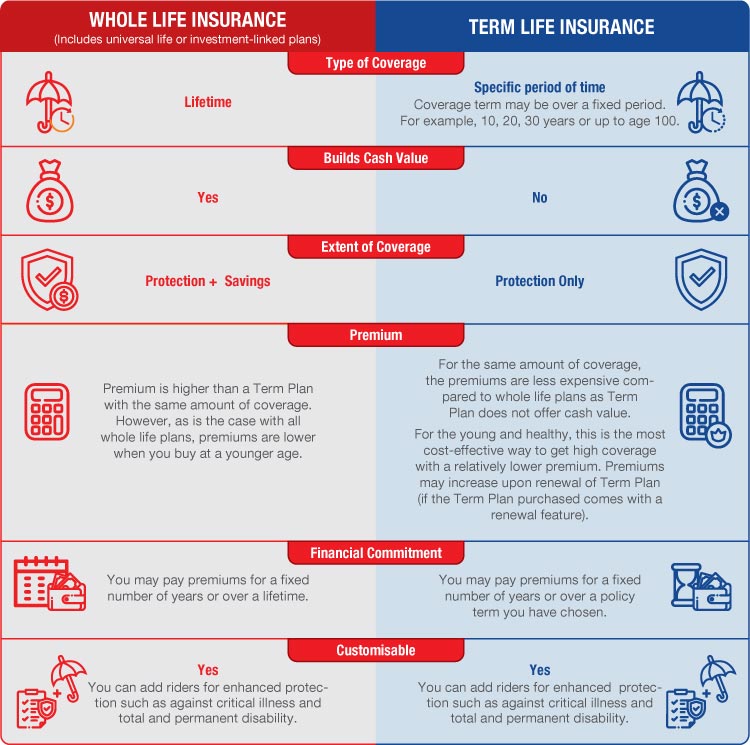

9 rânduri The difference between whole life insurance and universal life insurance is that universal. Also there will be no guaranteed minimum cash value in this type of policy. When deciding between term or whole life insurance there are crucial differences to take note of.

Survivorship Life Insurance Coverage. Permanent life insurance products like universal life insurance and whole life insurance are more complex have many features and are more expensive. Term life insurance is cheaper than whole life insurance.

This type of cover insures assets against theft or damage due to fires natural calamities accidents man-made disasters like riots or terrorist attacks etc. Life insurance in contrast can be structured so that its outside of clients estates producing not only an income tax-free benefit to their heirs but also one that is not subject to estate. Life is uncertain it is better to protect yourself and your loved ones before its too late.

Different types of life insurance are designed to suit the needs of different individuals at their unique stages of life. Before we break down the important differences between the different types of life. Types of life insurance Life insurance terms review.

While life insurance covers the life of a person general insurance provides cover to other aspects and assets in a persons life for example health car travel home etc. 8 rânduri Term insurance vs life insurance. As annuities there are few types of life insurance policies too.

Health insurance gets your medical affairs covered and Life insurance gets your family covered in your absence. Life and Health Insurance is for everyone who is worried about the future for family and for the ones who care. Now that you have understood the basic meaning of both.

Like it sounds term life insurance provides coverage for a set term or specific amount of time. Differences Between Life Insurance Property Insurance. However your term life insurance policy may expire before you die.

Conversely general insurance is a short term contract which needs to be renewed every year. Life insurance falls into two categories. In life insurance the sum assured is paid either on the happening of the event or the on the maturity of the term.

Pay the premiums in a timely manner and you wont risk losing the. Term life insurance lasts for a number of years before it expires. Whole life insurance on the other hand will provide you with coverage for the remainder of your life.

Another thing is that both of the pensions and life insurance policies bend more towards hefty fees. Life insurance and property insurance are both common types of coverage but operate in different ways and are purchased for different reasons. In fact 90 of term life insurance plans never a pay a death benefit because of the term limits.

Life insurance is a long-term contract which runs over a number of years. For most families term life insurance is the best option because its the most affordable and its straight-forward. With a term policy all youre.

In life insurance both survival and death benefits are provided to the policyholder. Term life policies provide coverage for a specified period while permanent life insurance offers extended protection. For instance a lender typically requires that a borrower purchase some type of homeowners insurance.

Permanent life insurance provides death benefit coverage for the life of the insured. If you die before the term is. The key differences in the two types of life insurance are the period of coverage the payout and protection provided.

They usually vary between 10 and 30 years long. Both types of coverage have advantages and disadvantages but each is tailored to meet the needs of a diverse range of policyholders.

Econnect Woman S Life Insurance Society

Econnect Woman S Life Insurance Society

Term Life Insurance Advice From Dave Ramsey Get His 1 Tip Here

Term Life Insurance Advice From Dave Ramsey Get His 1 Tip Here

Life Insurance Term Versus Whole Waepa

Life Insurance Term Versus Whole Waepa

Personal Life Insurance Explained Https Www Insurechance Com

Personal Life Insurance Explained Https Www Insurechance Com

Learning English In Ohio Term Vs Whole Life Insurance

Learning English In Ohio Term Vs Whole Life Insurance

5 Reasons Dave Ramsey And Suze Orman Are Right Term Is Best

5 Reasons Dave Ramsey And Suze Orman Are Right Term Is Best

Term Life Vs Whole Life Insurance Understanding The Difference Clark Howard

Term Life Vs Whole Life Insurance Understanding The Difference Clark Howard

Term Life Insurance Vs Whole Life Insurance Johnson Associates Insurance

Term Life Insurance Vs Whole Life Insurance Johnson Associates Insurance

Term Vs Whole Life Insurance Policygenius

Term Vs Whole Life Insurance Policygenius

Premium For A Healthy Life Business News

Premium For A Healthy Life Business News

Whole Life Or Term Life Insurance Great Eastern Singapore

Whole Life Or Term Life Insurance Great Eastern Singapore

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.