Second Home Financing Options For many home purchasers an FHA-insured loan is a prime choice because these loans require a down payment of just 35. The minimum down payment for a second home purchase in Canada is 5.

Home Loan Downpayment Calculator

Home Loan Downpayment Calculator

Add both amounts together which gives you total of 35000.

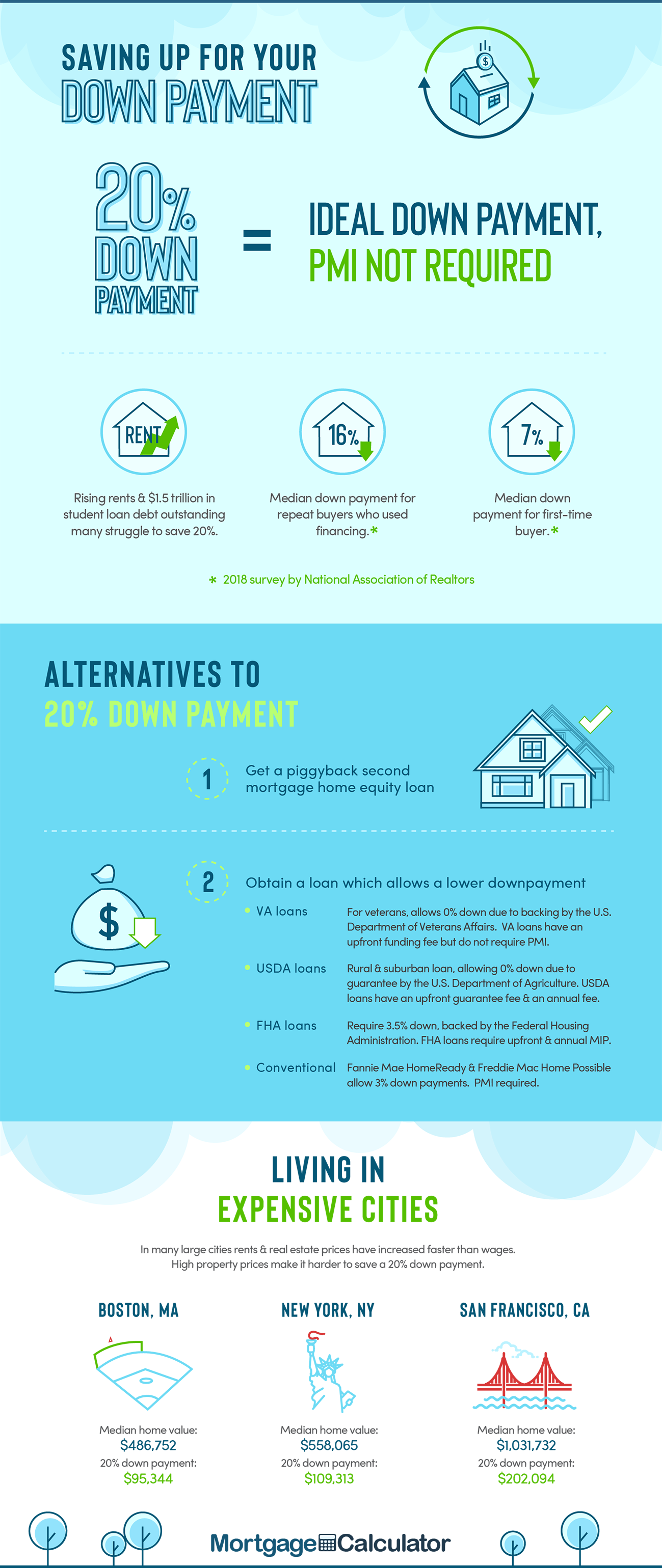

How much down payment for a second house. Learn how to buy a Vacation home or Second home with as little as a 5 down-payment. Keep in mind that restrictions on what is and isnt considered a second home may apply. That answer will depend on how much you can afford and how much is required by the loan program you use to purchase your next home.

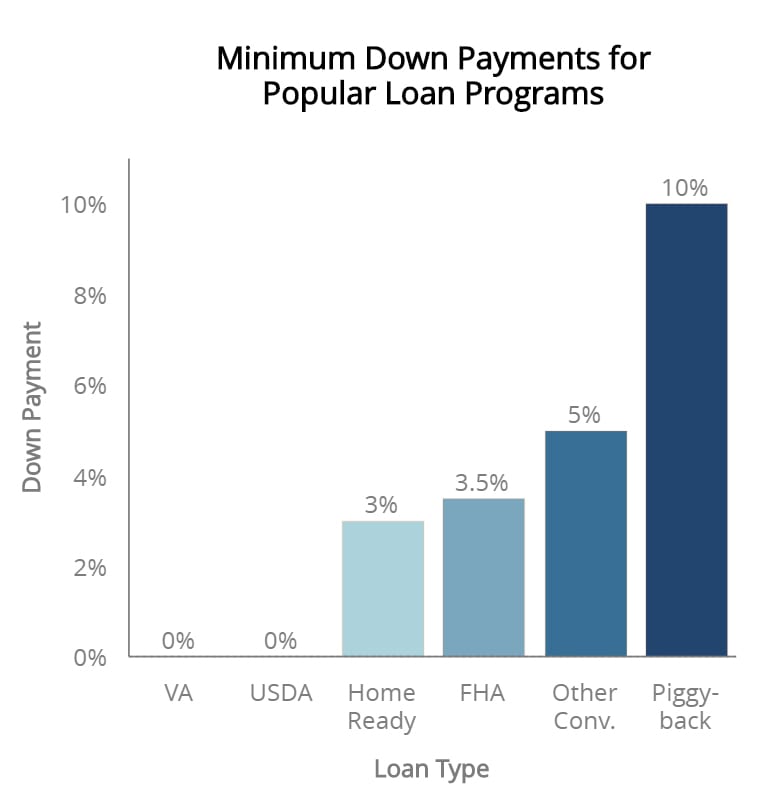

Interest rates are also going to be higher. Down payment for a second home You can buy a first home with just 3 down in many cases. What is the Minimum Down Payment for a Second Home.

These loans go up to 2 million at 5 down and 3 million at 10 down. But it takes at least 10 down to buy a vacation home. The quick answer is yes it is almost certain that you will need a down payment.

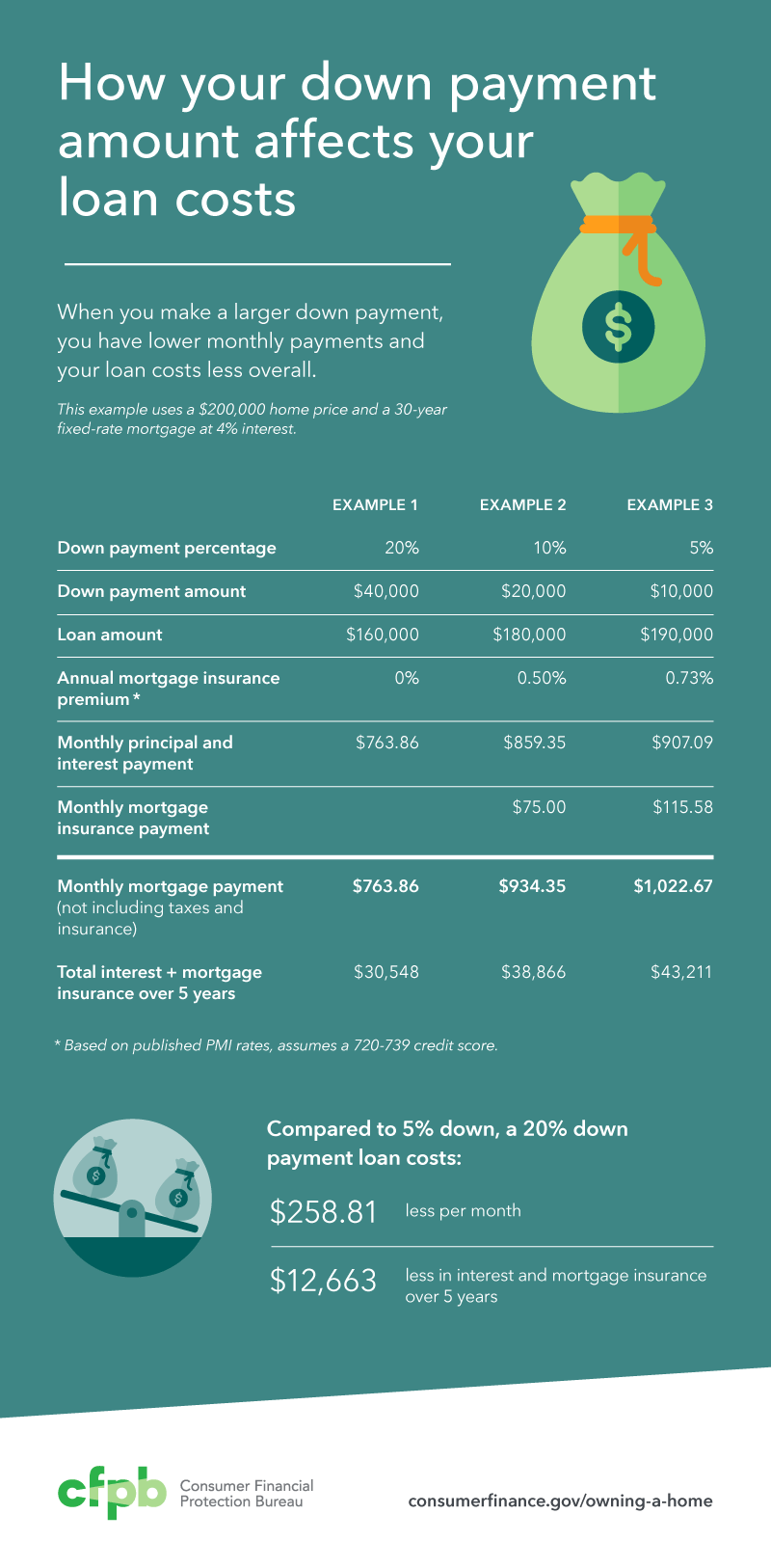

If you plan to strictly use the home as an investment property the minimum down payment required is usually 15. If you love your second home all of the mortgage payments will be worth it in the end as long as you can make it work financially. Beyond lender requirements it can be financially beneficial to increase your down payment to reduce the amount of your monthly mortgage payment.

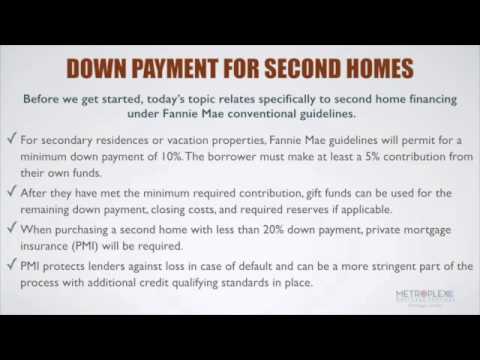

Investment properties are not eligible for high ratio default insurance-a down payment of at least 20 is required. If the loan amount is 75 or less of the price then the seller may pay 9 towards costs. To qualify for a loan on a second home youll need a down payment of at least 10.

Most home loans require at least 3 of the price of the home as a down payment. Do Second-Time Homebuyers Need a Down Payment. The second amount is 10 of the remaining balance of 100000 which is equal to 10000.

Offers with larger down payments can be more appealing to home sellers who are looking. Its a good idea to choose your new property wisely. When buying a second home and financing between 7501 90 of the price the seller is allowed to pay 6 of the sales towards the buyers closing costs and pre-paids.

What you need to know A high ratio mortgage is available if you or family members plan to live in the home on a rent-free basis. Although its a myth that a 20 down payment is required to obtain a loan keep in mind that the higher your down payment the lower your monthly payment. Taxes insurance and a maintenance budget.

CMHC allows Canadians to own up to two high ratio insured properties. For example you can only rent the home for up to 180 days a year. There may be unit limitations of.

You cannot use an. A second home can be the ultimate. You will need to check with the lender first since mortgage rates and policies will be different for second homes opposed to primary residences.

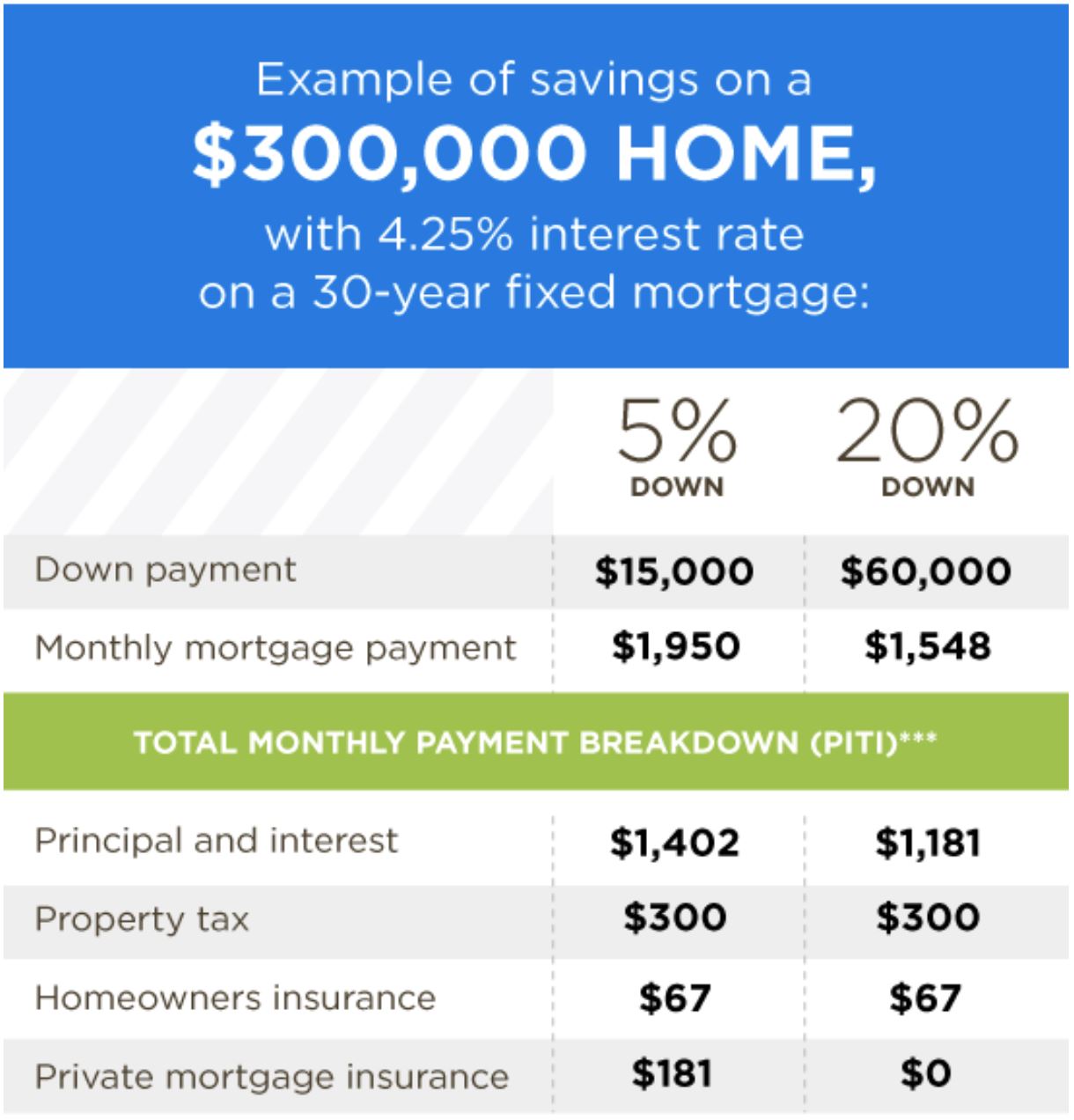

Some loans like VA loans and some USDA loans allow zero down. How much do you have to put down on a second home. The 20 down payment is 60000 and the 30-year fixed interest rate on the 240000 balance is 4.

In order to qualify to buy a second home youll need at least a 10 down payment. If you plan to strictly use the home as an investment property the minimum down payment required is usually 15. The first amount is 5 of the first 500000 which is equal to 25000.

In some cases second mortgage down payments can be as low as the normal 20 but others particularly jumbo loans can call for down payments of 30 or higher. The standard down payment for a second home is 20 of the purchase price. How much youre required to put down on a house is determined by the type of loan you get but it generally ranges from 3 to 20 of the purchase price of the home.

You may need only 10 if you have a stellar financial profile income credit rating debt-to-income ratio and total savings. Down payment requirements for a second home can vary from one lender to another but in general expect to put down a minimum of 10. You can expect on average interest rates a quarter of a point to a half a point higher than the rate on your primary home.

Down payments on conventional loans for primary residences can be as low as 3 but some lenders require 20 or more for second homes. To be eligible for a second home property purchase with a 5 down payment borrowers must intend to occupy the property either themselves or have it occupied by an immediate family member. There are a few options that allow 10 down based on your finances but they are rare.

Generally though you will need at least 20 of the purchase price. You can calculate your minimum down payment by adding 2 amounts.

What Is The Minimum Down Payment Needed To Purchase A Second Home Youtube

What Is The Minimum Down Payment Needed To Purchase A Second Home Youtube

How To Buy A House With 0 Down In 2021 First Time Buyer

How To Buy A House With 0 Down In 2021 First Time Buyer

Here S How To Buy A Second Home With No Down Payment Clever Real Estate

Here S How To Buy A Second Home With No Down Payment Clever Real Estate

Mortgages For Second Home Vacation And Second Home Down Payment

Mortgages For Second Home Vacation And Second Home Down Payment

How Much Do I Need For A Second Home Down Payment In Canada Sterling Homes Edmonton

How Much Do I Need For A Second Home Down Payment In Canada Sterling Homes Edmonton

What Is The Minimum Down Payment To Buy A Home

What Is The Minimum Down Payment To Buy A Home

What S The Minimum Down Payment For A Second Home Clever Real Estate

What S The Minimum Down Payment For A Second Home Clever Real Estate

Using Home Equity For Down Payment On A Second Home Rca Wealth Management In Jacksonville Florida

Using Home Equity For Down Payment On A Second Home Rca Wealth Management In Jacksonville Florida

How To Decide How Much To Spend On Your Down Payment Consumer Financial Protection Bureau

How To Decide How Much To Spend On Your Down Payment Consumer Financial Protection Bureau

How I Used A Home Equity Loan To Buy A Second Home Business Insider

How I Used A Home Equity Loan To Buy A Second Home Business Insider

House Downpayment Savings Goal Calculator How Long Will It Take To Save Up To Buy A Home

How Much Do I Need For A Second Home Down Payment In Canada Sterling Homes Edmonton

How Much Do I Need For A Second Home Down Payment In Canada Sterling Homes Edmonton

How To Buy A Second Home And Rent The First Psecu

How To Buy A Second Home And Rent The First Psecu

How Much Is A Down Payment On A House Zillow

How Much Is A Down Payment On A House Zillow

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.