ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. INCOME TAX CALCULATOREstimate your 2020 tax refund.

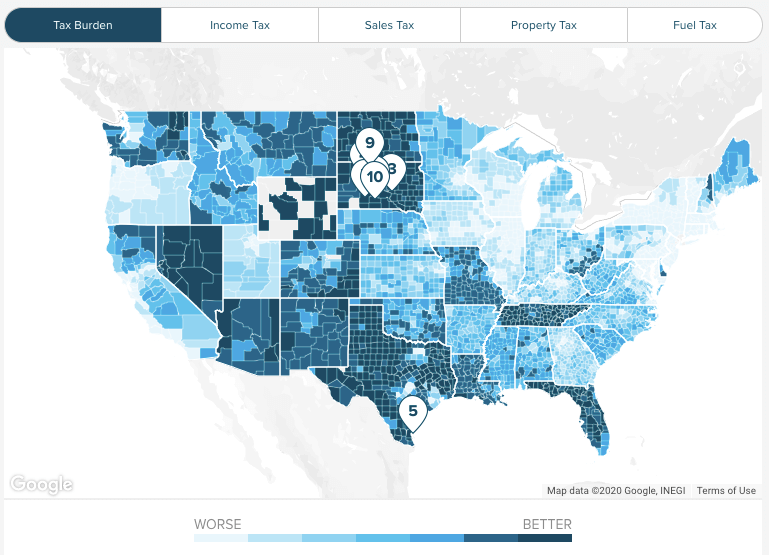

Free Income Tax Calculator Estimate Your Taxes Smartasset

Free Income Tax Calculator Estimate Your Taxes Smartasset

11 income tax and related need-to-knows.

Tax liability calculator 2020. 2020 federal income tax calculator. Taxes are unavoidable and without planning the annual tax liability can be very uncertain. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates.

Federal Income Tax Calculator - Estimate Your Tax Liability With This Calculator 2020 federal income tax calculator Taxes are unavoidable and without planning the annual tax liability can be very uncertain. Check your tax code - you may be owed 1000s. This interactive free tax calculator provides accurate insight into how much you may get back this year or what you may owe before you file.

The 2020 Tax Calculator uses the 2020 Federal Tax Tables and 2020 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Uniform tax rebate Up to 2000yr free per child to help with childcare costs. But before you start worrying about whats next at that income level you may not be required to file a federal return.

For the sake of simplicity lets assume youre a single filer whose taxable income is exactly 9000 and youre not taking any credits. Your 2020 tax rate. Calculate Total Assessable Income Taxable Income Tax Liability Student loan HECS Medicare Levy and Medicare Levy Surcharge if applicable for the taxpayer Susanne with the information below.

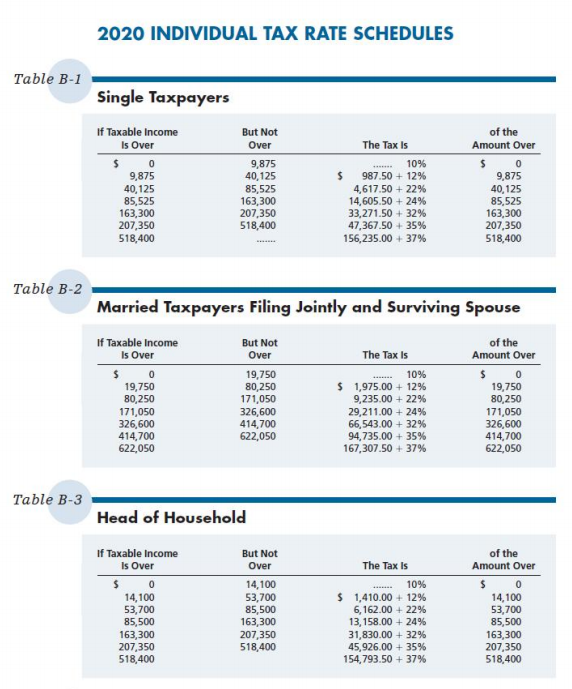

Above that level only the 29 self-employment Medicare. Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2020 to the federal income tax. Single Married Filing Jointly Married Filing Separately Head of Household Qualifying Widower.

Marriage tax allowance Reduce tax if you wearwore a uniform. Income Tax Calculator 2020 Estimate your tax refund Quickly estimate your 2020 tax refund amount with TaxCaster the convenient tax return calculator thats always up-to-date on the latest tax laws. Your 2020 federal income tax liability would be 900 according to IRS tax tables.

Answer a few simple questions about your life income and expenses and our free tax refund calculator will give you an idea if you should expect a refund and how muchor if the opposite is true and youll owe the IRS when you file in 2021. 2020 5580 Your marginal federal income tax rate remained at 2200. 0 - 9875 9876 - 40125 40126 - 85525 85526 - 163300 163301 - 207350 207351 - 518400 518401.

Then we apply the appropriate tax bracket based on income and filing status to calculate tax liability. Click here for a 2020 Federal Tax Refund Estimator. Your effective federal income tax rate changed from 1000 to 981.

Calculate your 2020 federal taxes with Taxfyles tax return calculator. For recent developments see the tax year 2021 Publication 505 Tax Withholding and Estimated Tax and Electing To Apply a 2020 Return. Enter your income and filing status to estimate your tax refund for 2020.

Get details on the new tax deadlines and on coronavirus tax relief and Economic Impact Payments. Tax-free childcare Take home over 500mth. At the same time you may prefer to have less tax withheld up front so you receive more in your paychecks and get a smaller refund at tax time.

By Ryan Smith on February 7 2020 Your tax liability is just how much you owe in taxes. Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates.

While the deadlines to file and pay certain taxes have been extended to May 17 the first quarter estimated tax payments for individuals are still due on April 15. For individuals who are employed its usually a simple matter of consulting the tax tables for the year and calculating your income tax on Form 1040. Free tax code calculator Transfer unused allowance to your spouse.

Susanne is a single and an Australian resident plans to lodge a tax return for the tax year 2020 - 2021. Estimate your 2020 tax refund. When Should You Use the Estimator If you changed your withholding for 2019 the IRS reminds you to.

The full 153 tax only applies up to the wage base limit for Social Security which is 137700 in 2020. DisclaimerThe above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances. For those who are self-employed or run a.

Tax Withholding For Pensions And Social Security Sensible Money

Tax Withholding For Pensions And Social Security Sensible Money

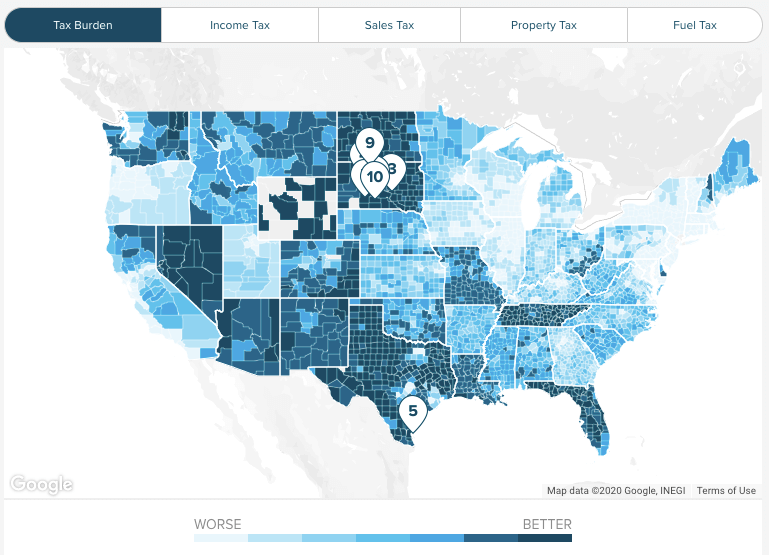

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Tax Calculator Estimate Your Income Tax For 2020 And 2021 Free

Federal Income Tax Calculator 2020 Credit Karma

Federal Income Tax Calculator 2020 Credit Karma

Calculate The Federal Income Tax Liability Margin Chegg Com

Calculate The Federal Income Tax Liability Margin Chegg Com

Free Tax Calculator Tax Return Estimator Liberty Tax

Free Tax Calculator Tax Return Estimator Liberty Tax

Calculate Your Income Tax For The Financial Year 2020 2021 And Assessment Year 2021 2022 As Per Budget 2020 Tax Guru Indian

Calculate Your Income Tax For The Financial Year 2020 2021 And Assessment Year 2021 2022 As Per Budget 2020 Tax Guru Indian

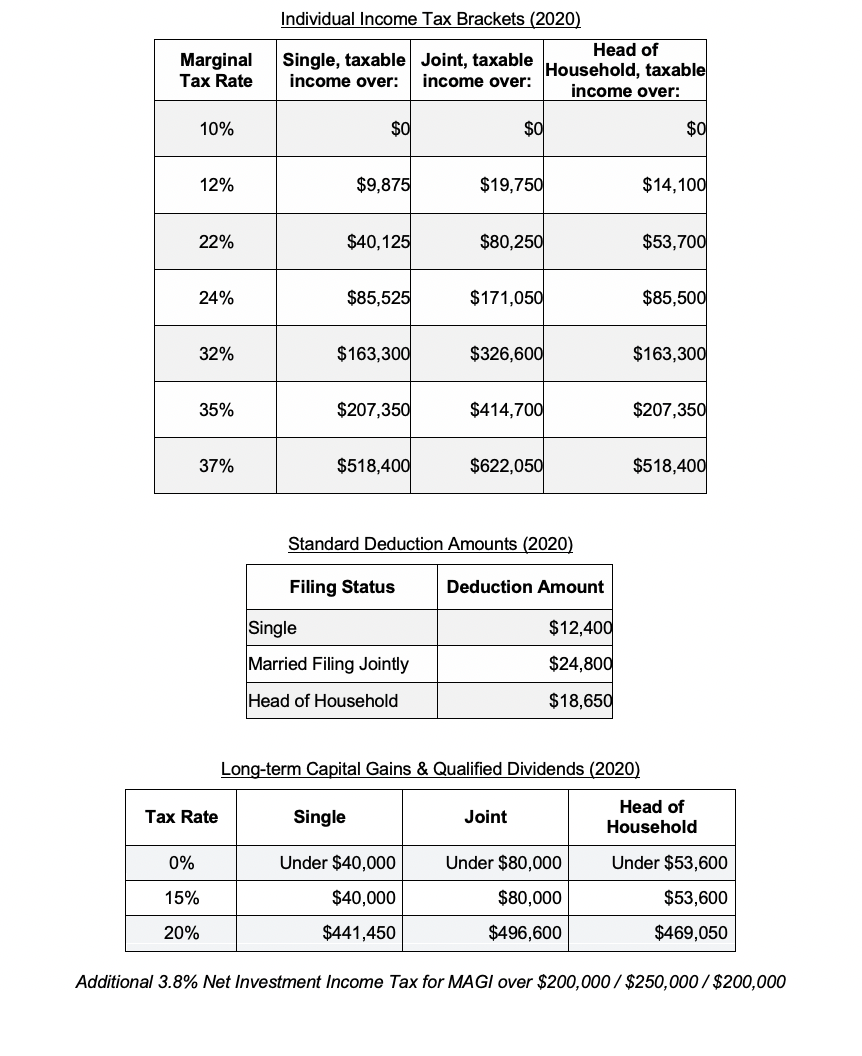

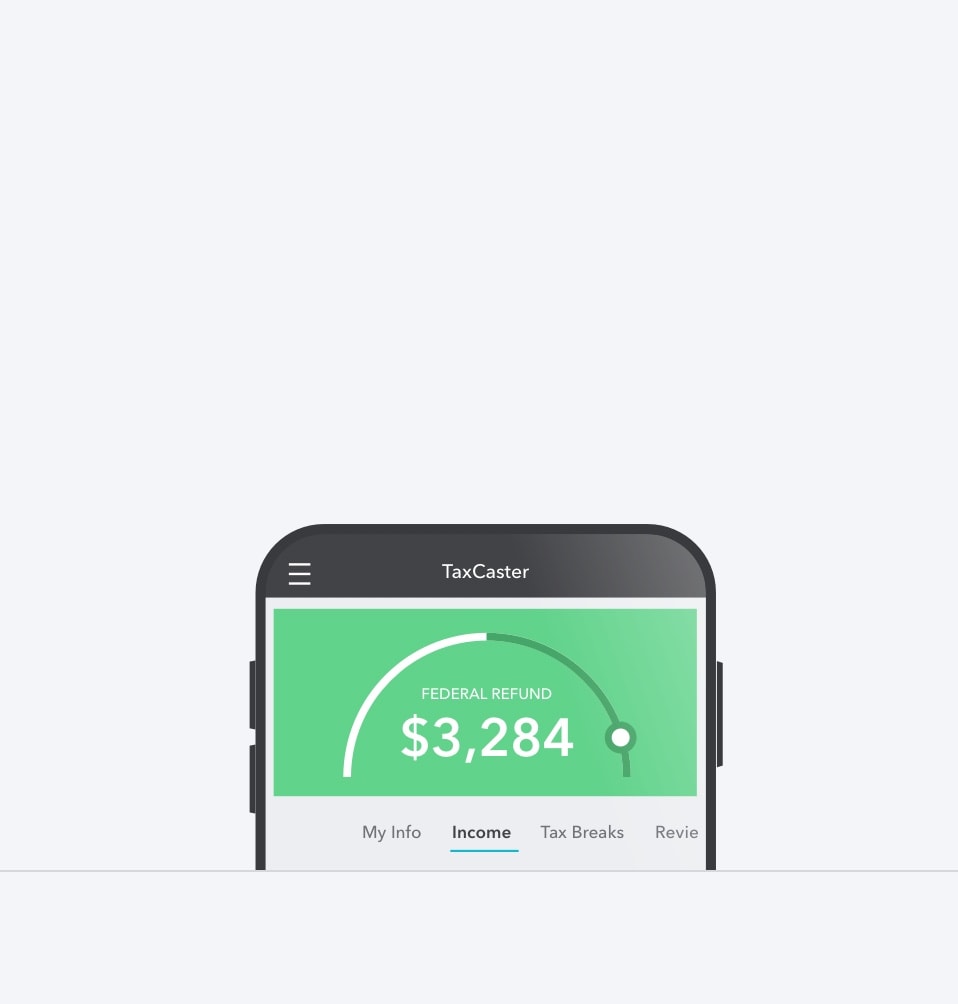

Tax Calculator And Refund Estimator 2020 2021 Turbotax Official

Tax Calculator And Refund Estimator 2020 2021 Turbotax Official

Solved Calculating Tax Liability Lo 5 Refer To The Tax Chegg Com

Solved Calculating Tax Liability Lo 5 Refer To The Tax Chegg Com

How To Calculate Your Federal Income Tax Liability Personal Finance Series Youtube

How To Calculate Your Federal Income Tax Liability Personal Finance Series Youtube

1099 Taxes Calculator Estimate Your Self Employment Taxes

1099 Taxes Calculator Estimate Your Self Employment Taxes

Tax Liability What It Is And How To Calculate It Bench Accounting

Tax Liability What It Is And How To Calculate It Bench Accounting

Federal Income Tax Calculator For Estimated Taxes

Federal Income Tax Calculator For Estimated Taxes

Excel Formula Income Tax Bracket Calculation Exceljet

Excel Formula Income Tax Bracket Calculation Exceljet

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.