Fixed-dollar withdrawals involve taking the same amount of money out of your retirement account every year for a set period. How to Pay Less Tax on Retirement Account Withdrawals Withdraw What Keeps You in a Low Tax Bracket.

Taking A 401k Loan Or Withdrawal What You Should Know Fidelity

Taking A 401k Loan Or Withdrawal What You Should Know Fidelity

As with any taxable income the rate you pay depends on the amount of total taxable income you receive that year.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

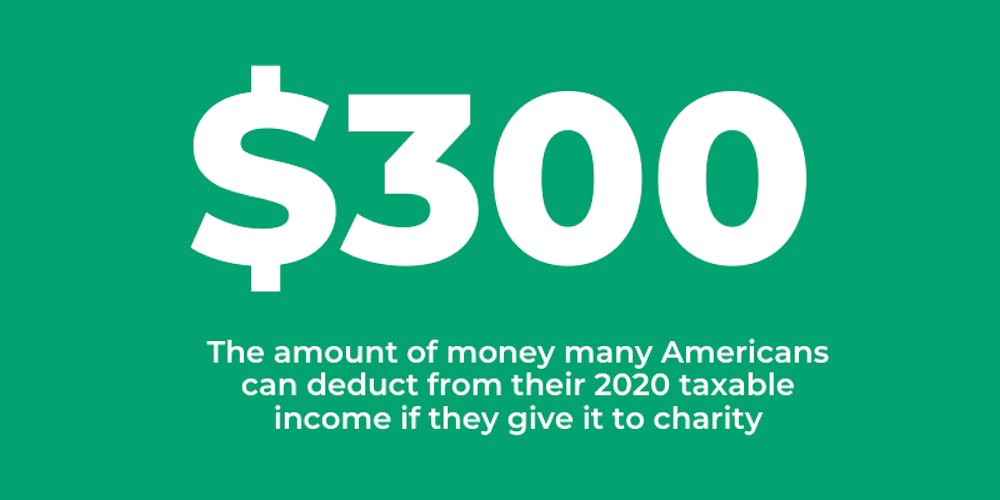

How to withdraw money from 401k. An early withdrawal from a 401k is subject to a 10 withdrawal tax penalty. There isnt a separate 401k withdrawal tax. Before taking your money out explore these penalty-free options.

Any money you withdraw from your 401k is considered income and will be taxed as such alongside other sources of taxable income you may receive. Next steps to consider. Normally a withdrawal from a 401k or IRA before age 59 12 would incur a 10 early withdrawal penalty but the CARES Act waived this penalty for 2020.

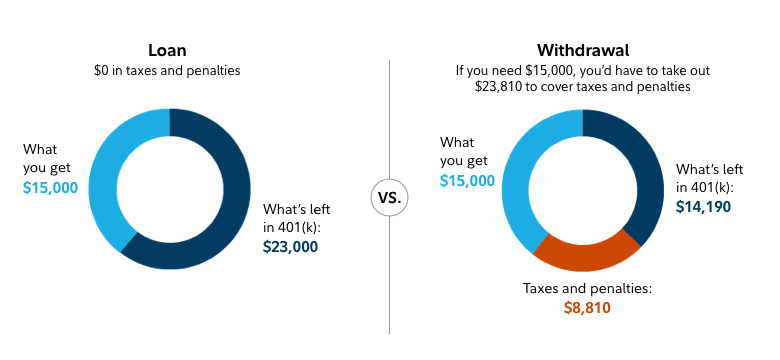

As such the tax code incentivizes saving by offering tax benefits for contributions and usually penalizing those who withdraw money before the age of 59½. As long as you can handle the payments yes you have to pay back this loan this is usually a less expensive option than a straight withdrawal. If youre under age 55 and you still work for the company that manages your 401 k plan youll have only two options assuming the options are made available by your employer.

Your loan can be up to 50000 or half the value of the account whichever is less. Withdrawing From Your 401 k Under Age 55. Youll simply need to contact your plan administrator or log into your account online and request a withdrawal.

How to Withdraw Money From Your 401 k or IRA After Retirement Continued Growth vs. Your 401 k plans rules The Balance 2018. However if you really need to access the money you can often do so with a loan or an early withdrawal from your 401k just remain mindful of the tax implications for doing so.

For example you may decide to withdraw 20000 annually for the first. Easily access your workplace benefits with Fidelity. Withdrawals from Roth IRAs and some other IRAs are generally preferable to taking money from a 401k.

By age 59½ and in some cases age 55 you will be eligible to begin withdrawing money from your 401k without having to pay a penalty tax. Remember that your retirement savings accounts dont grind to a halt when you begin. You can withdraw the money from one IRA or a combination.

Many financial advisers recommend the 4 rule when evaluating how much money you. However if you have money in a 401 k plan you must take a separate RMD from that. In addition to withdrawing money from a 401k plan many plans offer the option to take a loan from your 401k.

Borrowing from Your 401k. Ask yourself 4 questions to help prepare for the. A Quick Review of the 401k Rules A 401k account is earmarked to save for retirement.

Another option with a 401k is to take out a loan. Income tax is still due on the withdrawal. Sign up for Fidelity Viewpoints.

The best way to take money out of your 401 k plan depends on three things. Log in to NetBenefits. To tap 401 k funds youll need to either take a 401 k loan or a hardship withdrawal.

Whether you still work for the company that sponsors your 401 k plan. This can be a better alternative than the withdrawal. Between ages 59 12 and 72 you are allowed to withdraw money from retirement accounts without triggering the 10 early withdrawal penalty but are not yet required to take distributions from the account.